NASDAQ futures are coming into the week with a slight gap down after an overnight session featuring extreme range and volume. Price briefly exceeded the Friday high Sunday evening before beginning a steady rotation lower. Said rotation worked price down through the Friday midpoint for a bit. Since then price has recovered the mid and as we approach cash open price is hovering about 50 points above it.

On the economic calendar today we have factory orders at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

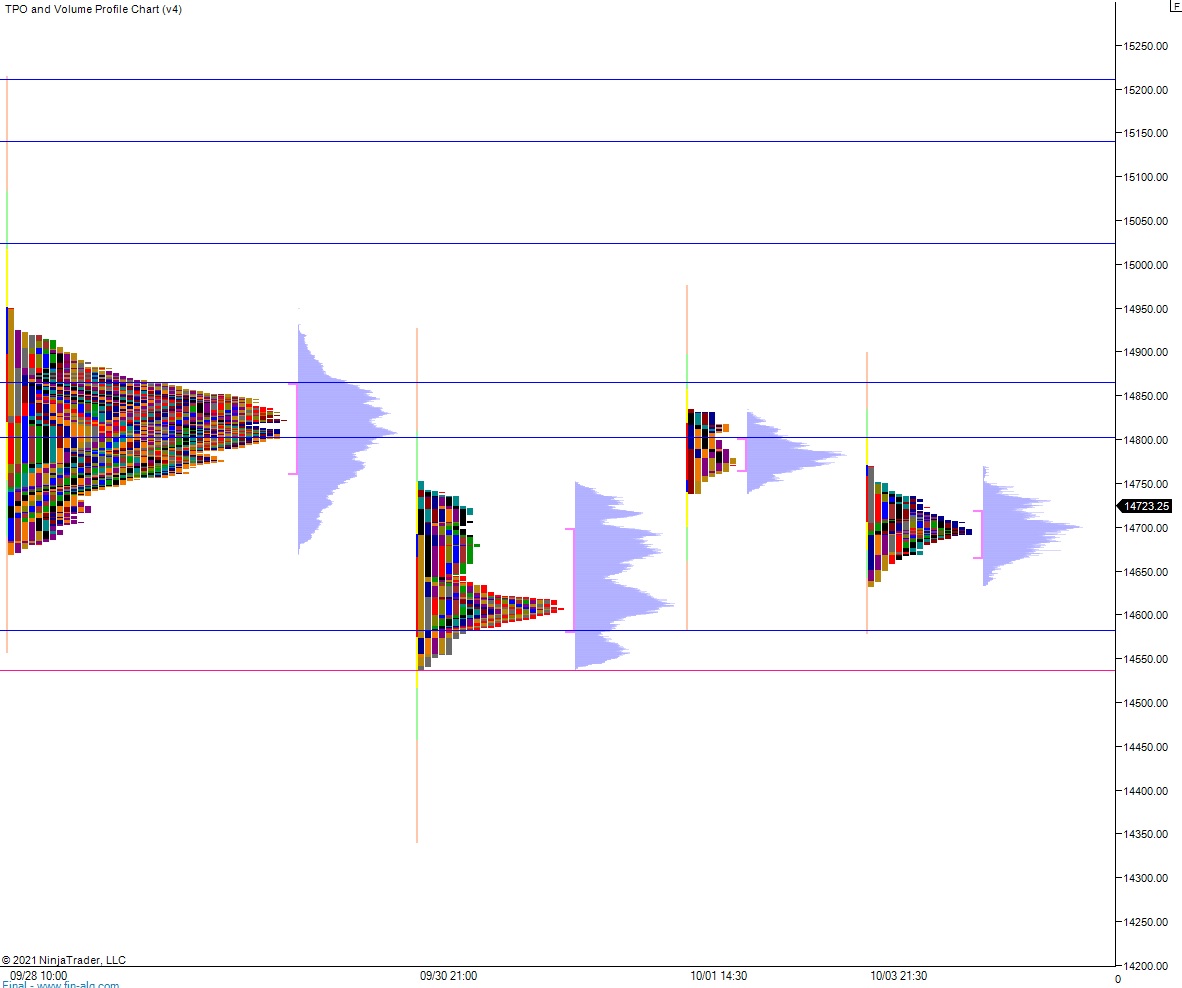

Last week featured balance/consolidation Monday. Then there was a pro gap down and drive lower Tuesday. That selling continued through early Friday. Then mid-morning on Friday a sharp reversal higher took hold and rallied prices into the weekend. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation up. The day began with The day began with a slight gap up inside range. After a brief open two-way auction sellers stepped in and drove down through the Thursday low, trading down into levels unseen since July 20th before buyers stepped in and reversed the auction. The rest of the day was spent steadily campaigning higher. There was a brief pause above the midpoint before the accumulation continued through the afternoon, eventually tagging the Thursday volume point of control.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 14,766. From here buyers continue up through overnight high 14,835. Look for sellers up at 14,865.50 and for two way trade to ensue.

Hypo 2 sellers take out overnight low 14,633.50 and tag 14,600.

Hypo 3 stronger sellers probe the lows and tag 14,500.

Levels:

Volume profiles, gaps and measured moves: