NASDAQ futures are coming into the final week of September gap down about -120 after an overnight session featuring extreme range and volume. Price was stable Sunday evening, steadily rising up through last week’s high and holding these levels until about 3:30am. From 3:30am price has gone unidirectionally lower, effectively erasing the Sunday rally and more. At 8:30am durable goods orders came out stronger than expected (in line ex-auto). As we approach cash open price is hovering along the Friday low.

Also on the economic calendar today we have 6-month T-bills and 2-year notes for auction at 11:30am followed by 3-month bills and 5-year notes at 1pm.

Last week featured a major gap down Monday across the board. The rest of the week saw price steadily claw back the weekend losses and the week concluded on a high note, with price at the weekly highs.

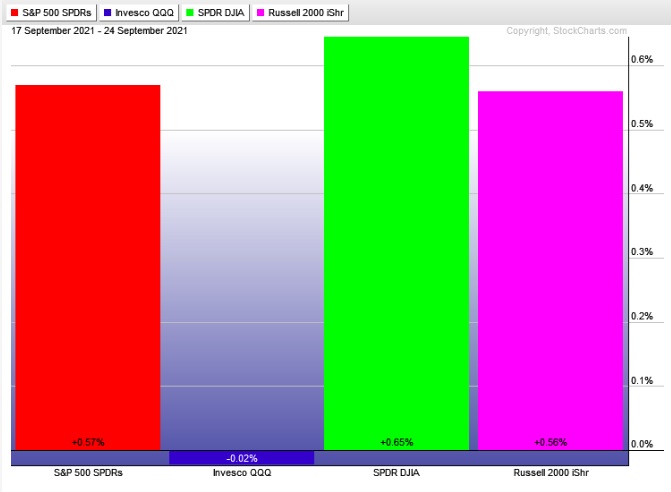

The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation up. The day began with a gap down in range. There was an open two-way auction and then a tight, choppy range all morning. Then halfway through the New York lunch hour buyers pressed into a range extension up and began to campaign for the gap fill. They met a bit of resistance ahead of the gap around 1:45pm, then after a shallow pullback resumed their campaign, effectively closing the gap and continuing higher to tag the Thursday value point-of-control [VPOC].

Of note. The Friday VPOC never shifted off the lower distribution, suggesting a lack of participating on the late-Friday upside move.

Heading into today my primary expectation is for sellers to press down to 15,115-15,100 before two way trade ensues.

Hypo 2 stronger sellers tag the 15,000 century mark before two way trade ensues.

Hypo 3 buyers work into the overnight inventory, closing the overnight gap 15,316.50 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: