Part of what I love about futures trading and farming is that you’re regularly forced to think three months ahead. All sorts of effort is spent these days to ground oneself in the present and I am here for it. That stated, I love when a good plan comes together.

Right now everyone is hot on corn. When was the farmer hot on corn? In May. I have corn coming out of my ears boys. This week I’m setting up a small farm stand on a moderately busy corner in the city to sell corn. The hustle is alive.

But if you think unmedicated hyperactivity disorder RAUL is going to just sit behind a table all day waiting to sell corn I dunno man maybe you’re unfamiliar with my style.

I have about 200 pumpkin plants here at Mothership that I will be transplanting in the coming days. The plan is simple:

Load the diesel truck with about 175 gallons of water, table, umbrella, corn and as many pumpkin plants as’ll fit. Stop at bank on way for 50 fiat american singles. Mosey on down to the farm. Set up table then go to work planting punkin. Stopping as needed to hustle corn.

Here’s the thing. I think sometimes we become so very out of touch with reality when we deal in the financial markets. It is very liberating to grow something from the ground that sustains you physically and financially. I doubt I would have been able to spend 700 fiat american per penguin jpeg if I didn’t also work the land. The dichotomy helps me.

So does pulling weeds. Working the land will humble even the most hyperactive lunatic. It will break the spirit and the body. Then the only choice is to go on the mend and plan your next campaign. On-and-on until this musty old meat sack called home finally kicks the bucket.

And that day comes closer with each moment.

There is one shot at immortality. Build great structures out of steel and properly graded cimento. Document the journey. Perhaps then man can achieve footnote status is some bibliography nobody reads.

“All I want to do is have some fun before I die.”

I believe that was Sheryl Crow.

That’s it for now. Top stock pick going into year-end is Twitter. Top crypto: ether. Top produce: corn baby.

Raul Santos, August 15th 2021

And now for the 351st edition of Strategy Session. Enjoy:

Stocklabs Strategy Session: 08/16/21 – 08/20/21

I. Executive Summary

Raul’s bias score 3.50, medium bull*. Calm drift, perhaps with a slight upward bias. Watch earnings of out Walmart Tuesday morning along with Powell comments in the afternoon to introduce a bit of direction to the tape. Then watch for a potential acceleration or pivot Wednesday afternoon once we hear earnings out of NVIDIA.

*extreme Rose Colored Sunglasses [RCS] bullish bias triggered, see Section IV

II. RECAP OF THE ACTION

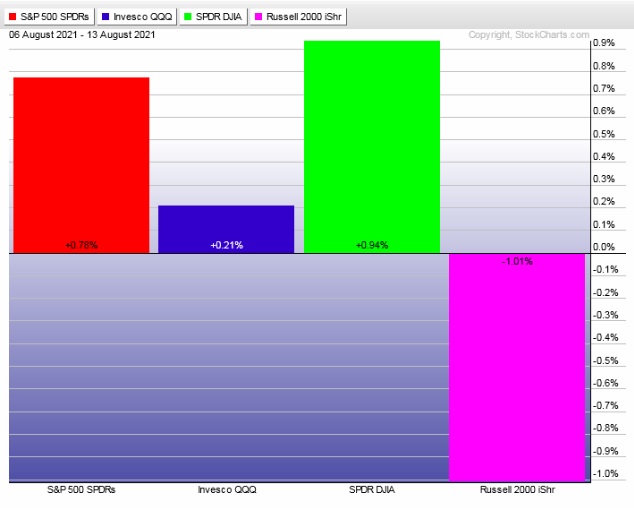

Steady, week-long rally in the Dow and S&P while the NASDAQ and Russell marked time.

The last week performance of each major index is shown below:

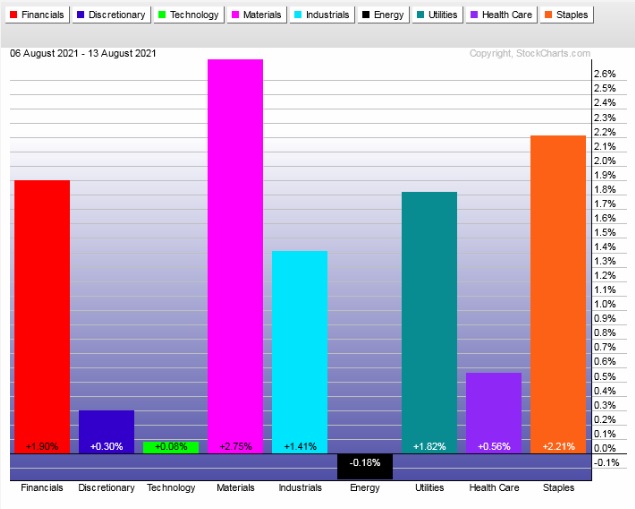

Rotational Report:

Second consecutive week of leadership in all the wrong sectors. Tech still [barely] positive.

neutral

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Ledger skewed slightly negative this time after being slightly positive on the prior report. Still we have not seen anything big enough to negate the major selling we saw five weeks back.

neutral

Here are this week’s results:

III. Stocklabs ACADEMY

Building context

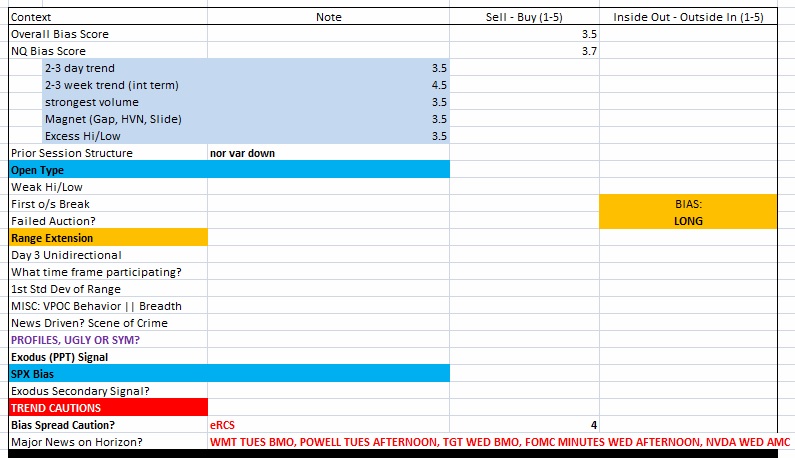

One of the biggest challenges I had early in my trading was wrapping context into my actions. Context is a big word which encapsulates everything. Everything. Seasons, celestial alignments, policy, sentiment, news, industry, culture and more.

I codify it as best as possible. Ranking these type of things from 1-to-5, one being extremely bearish, five extremely bullish. Then over the years I made slight tweaks to the data, giving more weight to things that appear to be more important to stock market behavior.

This is not a perfect system, but it is the best way for me to consistently add a layer of context to my trades. I do this in excel. Here is a screenshot of the switchboard I build for trading the NASDAQ:

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Calm drift, perhaps with a slight upward bias. Watch earnings of out Walmart Tuesday morning along with Powell comments in the afternoon to introduce a bit of direction to the tape. Then watch for a potential acceleration or pivot Wednesday afternoon once we hear earnings out of NVIDIA.

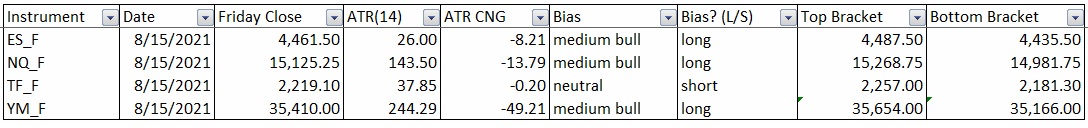

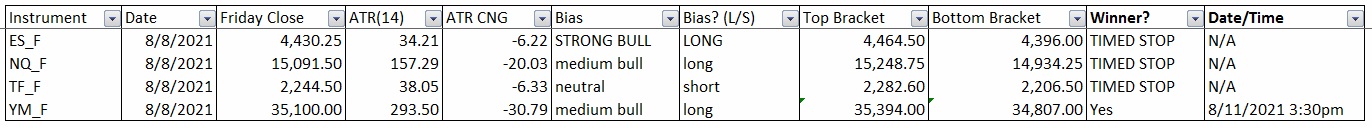

Bias Book:

Here are the bias trades and price levels for this week:

Here are last week’s bias trade results:

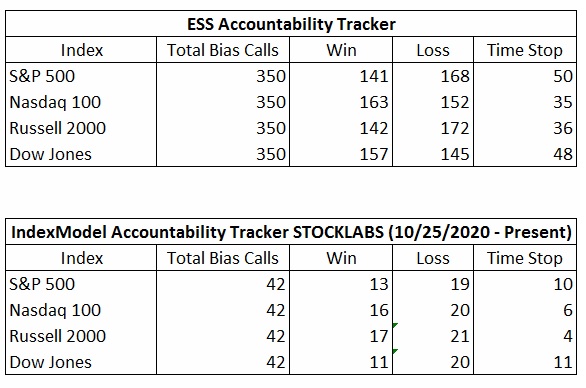

Bias Book Performance [11/17/2014-Present]:

Semiconductors are the big context in the upcoming week

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports broke free from discovery down for the first time since the trend began back on June 1st. Watch for buyers to defend their conviction buying day. If not we could see a major liquidation.

See below:

Semiconductors made that new high and have been consolidating since then. We are heading into the week with the PHLX resting atop prior resistance. Primary expectation is for buyers to defend this region setting up a new leg higher. If not, a quick move down through range. NVIDIA earnings due out Wednesday afternoon may decide the fate of this setup.

See below:

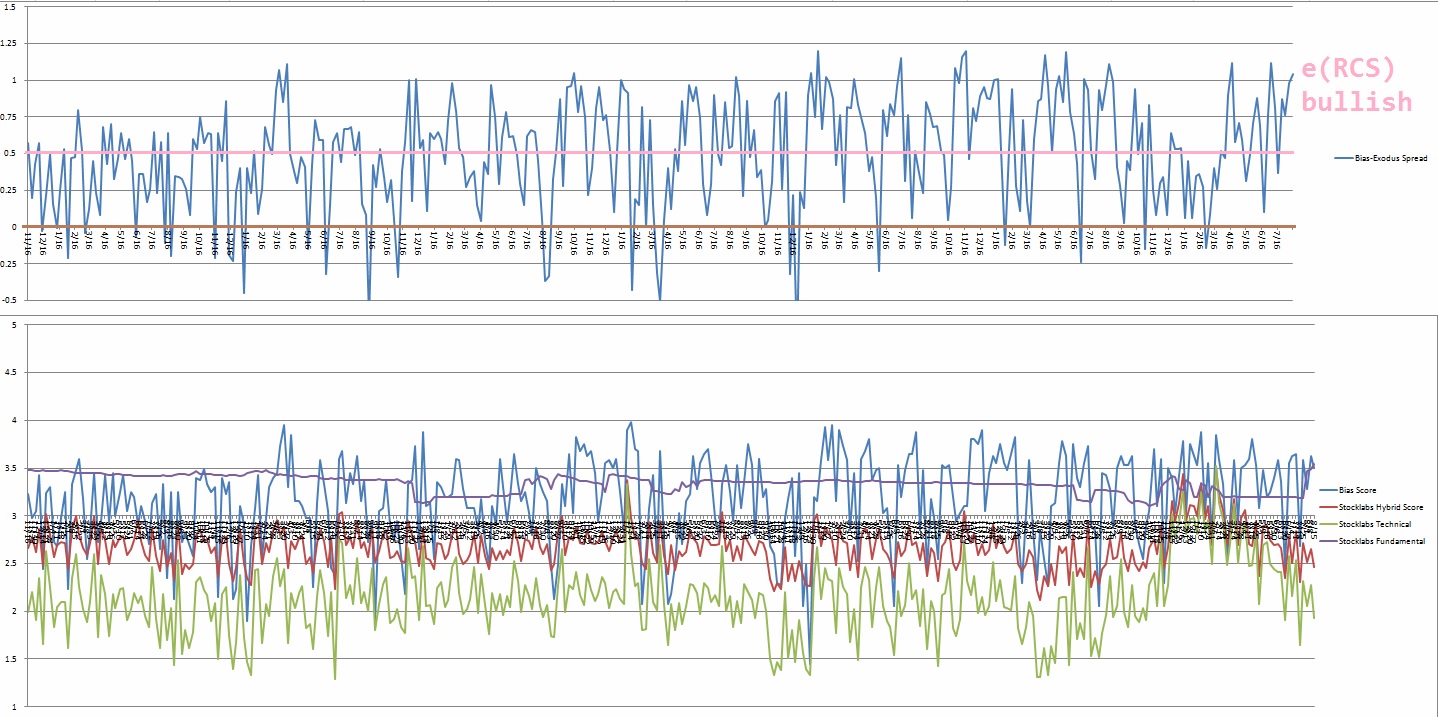

V. INDEX MODEL

Bias model is extreme Rose Colored Sunglasses bullish for a second consecutive week after being Rose Colored Sunglasses bearish two weeks back after being extreme Rose Colored Sunglasses bullish three weeks back after being neutral four weeks back after being extreme rose colored sunglasses bullish for the three weeks prior to that. Bias model was neutral eight weeks back after being extreme Rose Colored Sunglasses bullish bias for the three consecutive weeks prior after being neutral for the two weeks prior to that after being e[RCS] bullish fourteen weeks ago and RCS bearish fifteen weeks ago.

We had a Bunker Buster twenty-four weeks ago.

Extreme Rose Colored Sunglasses is a bullish bias that calls for a calm drift, perhaps with a slight upward bias.

Here is the current spread:

VI. QUOTE OF THE WEEK:

“If the world were a logical place, men would ride sidesaddle.” – Rita Mae Brown

Trade simple, accept irrationality

If you enjoy the content at iBankCoin, please follow us on Twitter