NASDAQ futures are coming into the final week of July with a slight gap down after an overnight session featuring elevated range and volume. Price was balanced overnight, balancing along the upper quadrant of Friday’s range after briefly exceeding it around 8:30pm Sunday evening. As we approach cash open price is hovering in the upper quad of Friday’s range.

On the economic calendar today we have new home sales at 10am followed by 3- and 6-month T-bill auctions at 11:30am and a 2-year note auction at 1pm.

Major NASDAQ component Tesla is set to report earnings after the bell.

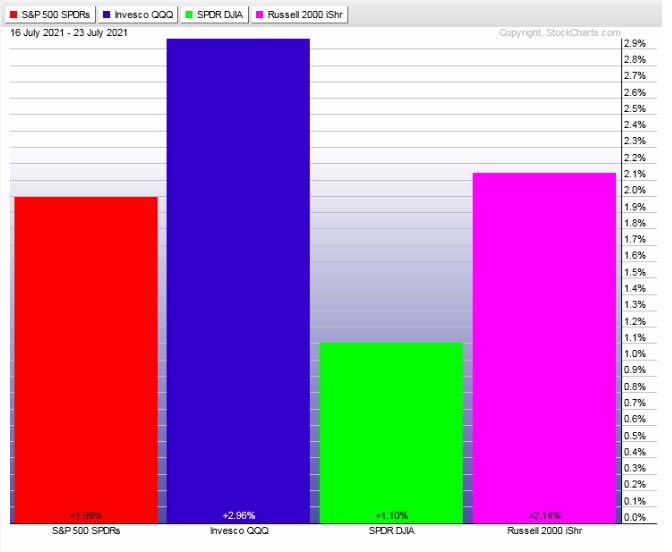

Last week kicked off with a pro gap down across the entire equity complex followed by a choppy weak Monday. Then buyers printed a conviction day Tuesday, effectively closing the weekend gaps and setting up a week long rally. We closed out the week on the highs. The last week performance of each major index is shown below:

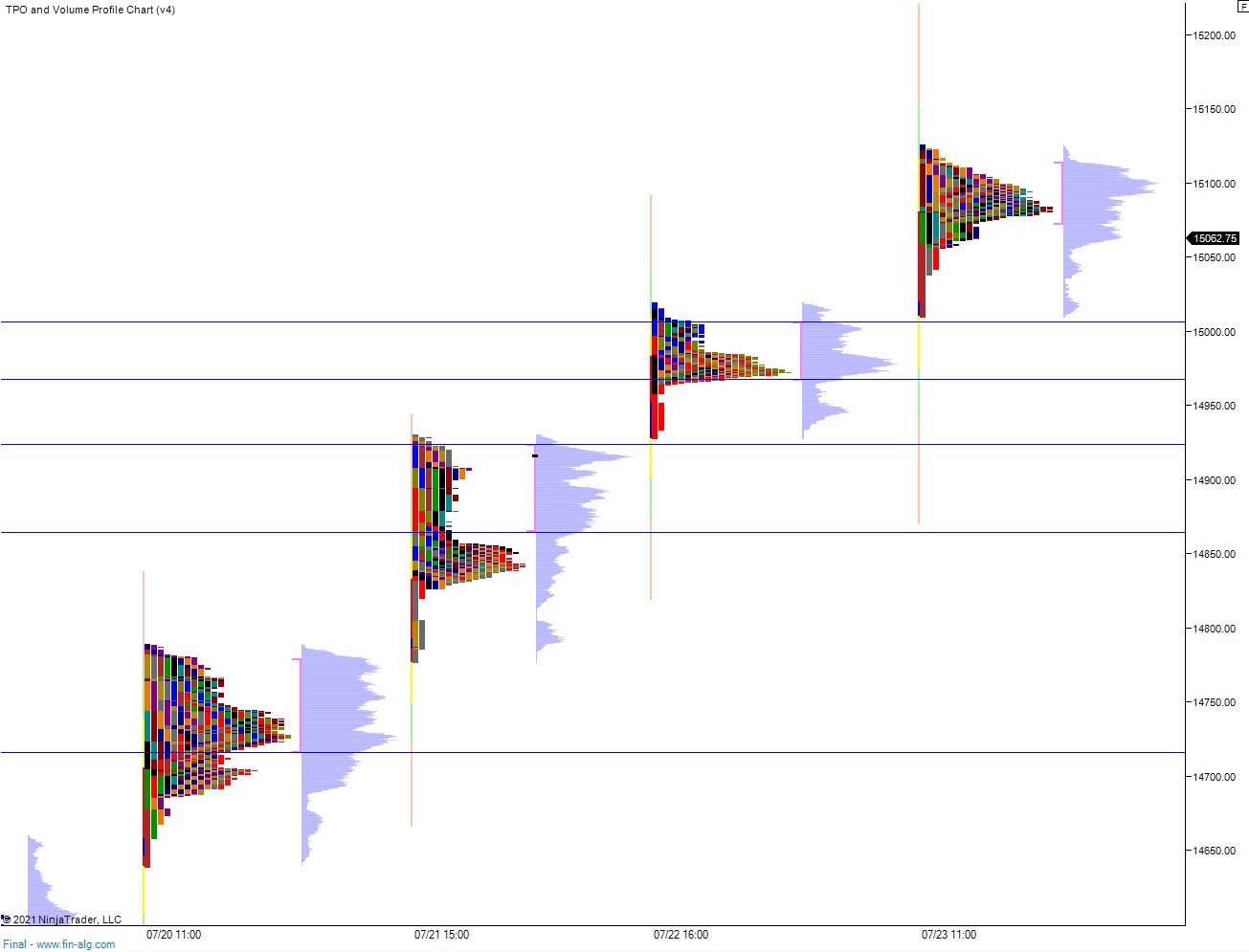

On Friday the NASDAQ printed a double distribution trend up. The day began with a gap up out of range. Sellers managed to resolved the overnight gap with a drive down off the open. This would be the end of the seller’s control on the day. Buyers rejected a move back into the Thursday range setting up a strong rally to new all-time highs. We ended the day flagging long the 15,100 century mark.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 15,095.50. Buyers continue higher, taking out overnight high 15,126.25 before two way trade ensues.

Hypo 2 stronger buyers tag 15,200 before two way trade ensues.

Hypo 3 sellers press down through overnight low 15,038.75 setting up a tag of 15,000 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: