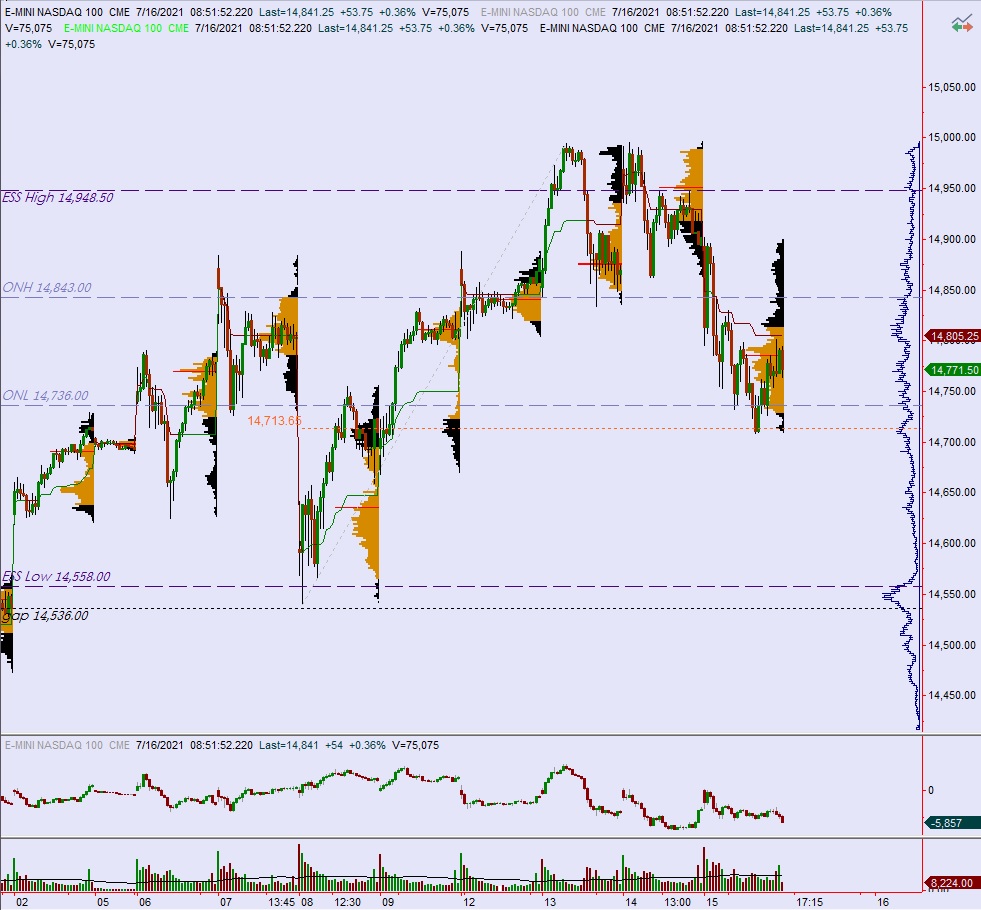

NASDAQ futures are heading into option expiration day up about +70 after an overnight session featuring extreme range and volume. Price was balanced overnight, balancing along the lower half of Thursday’s range until about 8:30am when retail sales data came out stronger than expected and introduced buyers to the tape. Since then price has worked up through the Thursday midpoint and as we approach cash open price is hovering about +40 handles above the Thursday mid.

Also on the economic calendar today we have retail sales data at 8:30am followed by business inventories at consumer sentiment at 10am.

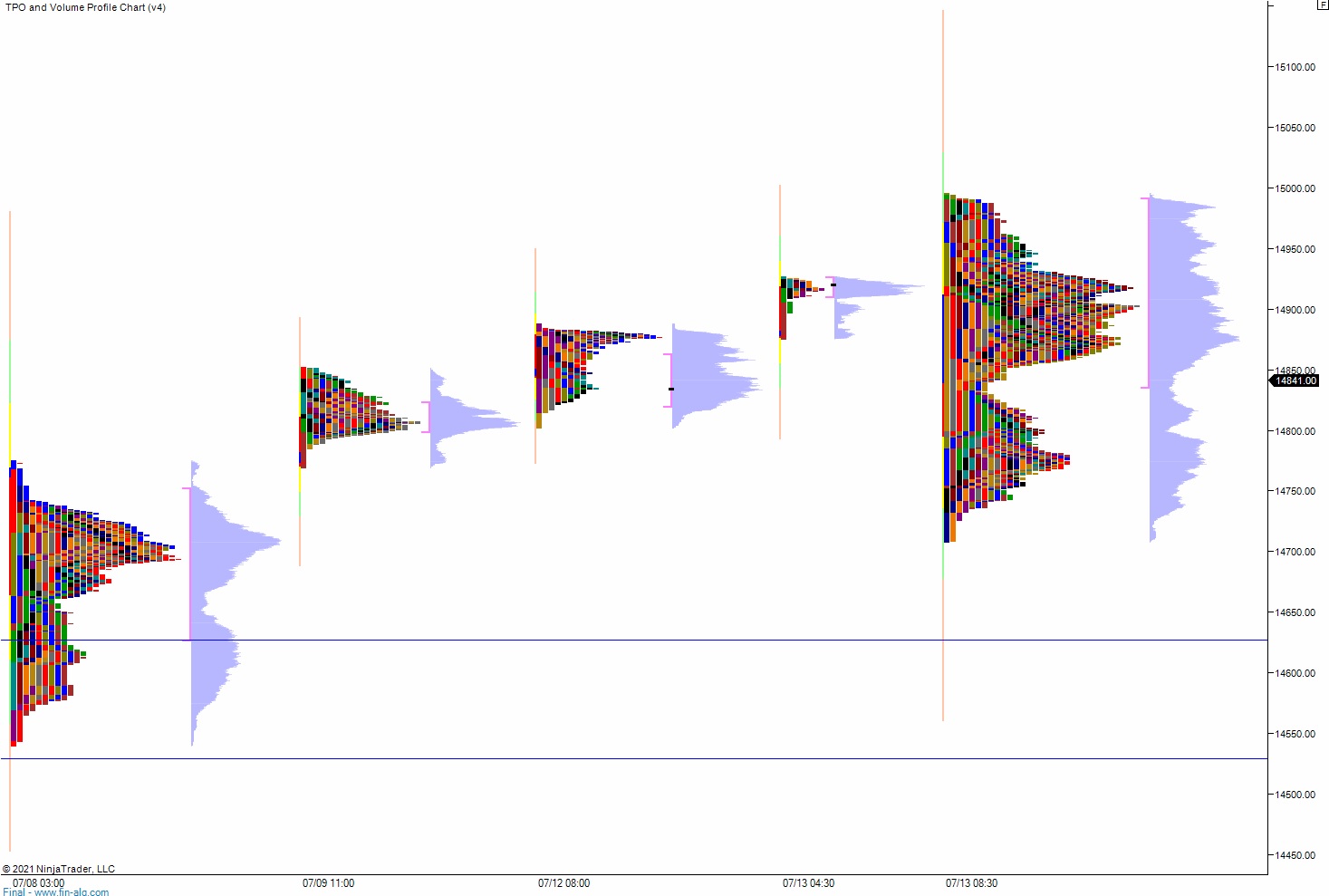

Yesterday we printed a double distribution trend down. The day began with a slight gap down. Sellers drove lower off the open, taking out the weekly low within the first few minutes of trade before finding a sharp responsive bid (very sharp) that quickly negated the selling. Sellers then made a second sharp move lower, pushing an early range extension lower, then we methodically rotated lower for for several hours. Around 2pm New York the auction reversed and steadily campaigned back up to the midpoint. We ended the day below the mid.

Heading into today my primary expectation is for sellers to work into the overnight inventory and trade down to 14,800 before two way trade ensues.

Hypo 2 stronger sellers work a full gap fill down to 14,771.50 then take out overnight low 14,736 setting up a move down to 14,700.

Hypo 3 buyers gap-and-go higher, trading up to 14,900.

Levels:

Volume profiles, gaps and measured moves: