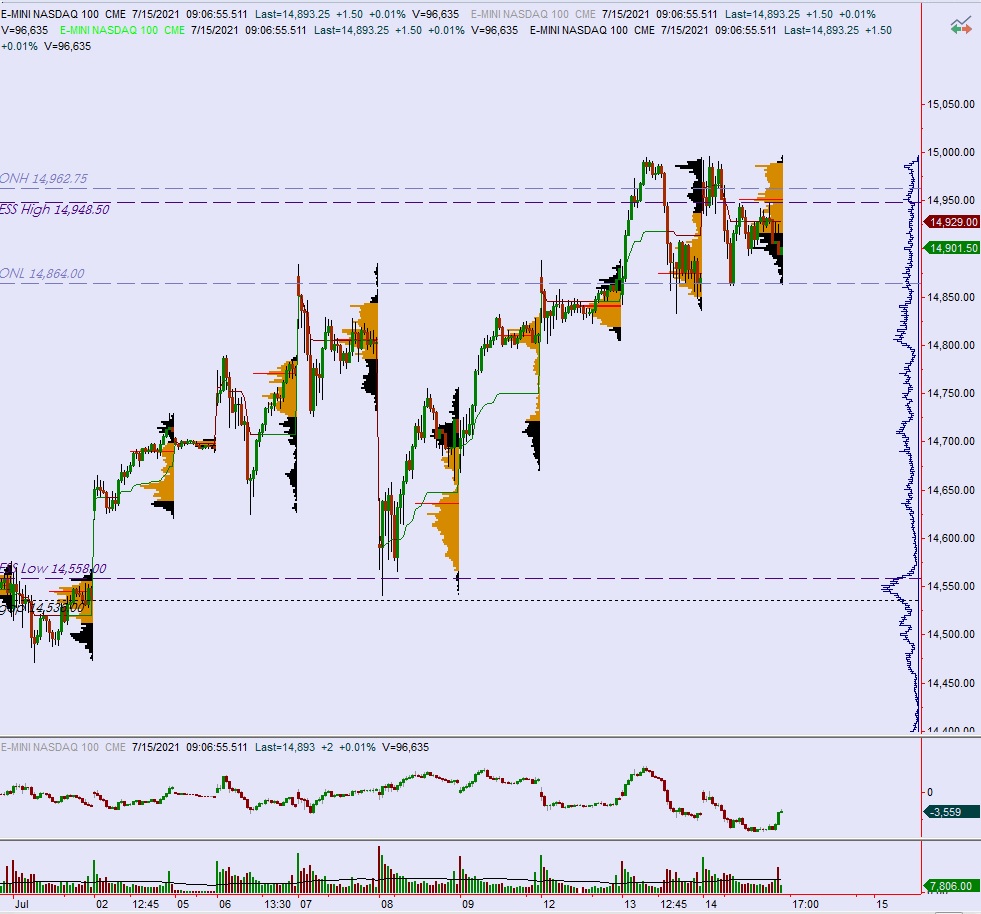

NASDAQ futures are coming into Thursday with a slight gap down after an overnight session featuring extreme range and volume. Price was balanced overnight, balancing inside of Wednesday’s range. Price nearly took out the Wednesday low around 7:45am New York but was bid higher before it could do so. At 8:30am jobless claims data came out slightly better than expected and we approach cash open price is hovering about 30 points above the Wednesday low.

Also on the economic calendar today we have industrial production at 9:15am followed by Fed Chairman Powell set to speak at 9:30am. Then we have 4- and 8-week T-bill auctions at 11:30am.

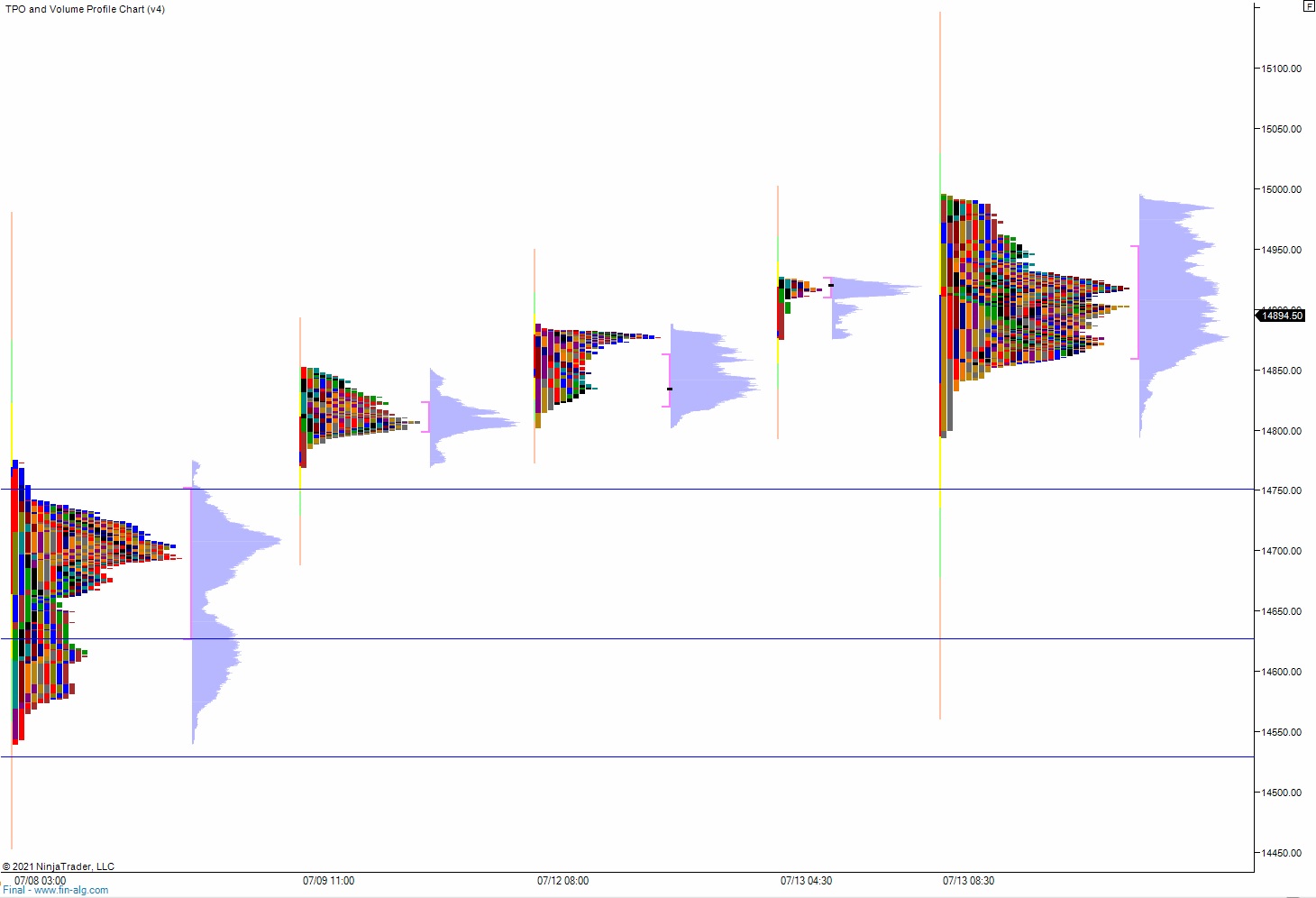

Yesterday we printed a normal variation down. The day began with a gap up in range and after an open-two-way auction buyers stepped in and worked price up to a new all-time high. The auction failed at this point, and after chopping back to the mid a few times sellers became initiative and worked us into a range extension down. This selling was met with sharp responsive bids right around the Tuesday volume point of control. Said buyers formed a sharp, excess low and sent price back up through the mid. Sellers held mid twice though, and we ended the session chopping along the bottom-side of the mid.

Heading into today my primary expectation is for buyers to work up through overnight high 14,962.75 setting up another tag of 15,000.

Hypo 2 sellers press down through overnight low 14,864 setting up a probe below Tuesday low 14,833.50.

Hypo 3 stronger sellers tag 14,751.75.

Levels:

Volume profiles, gaps and measured moves: