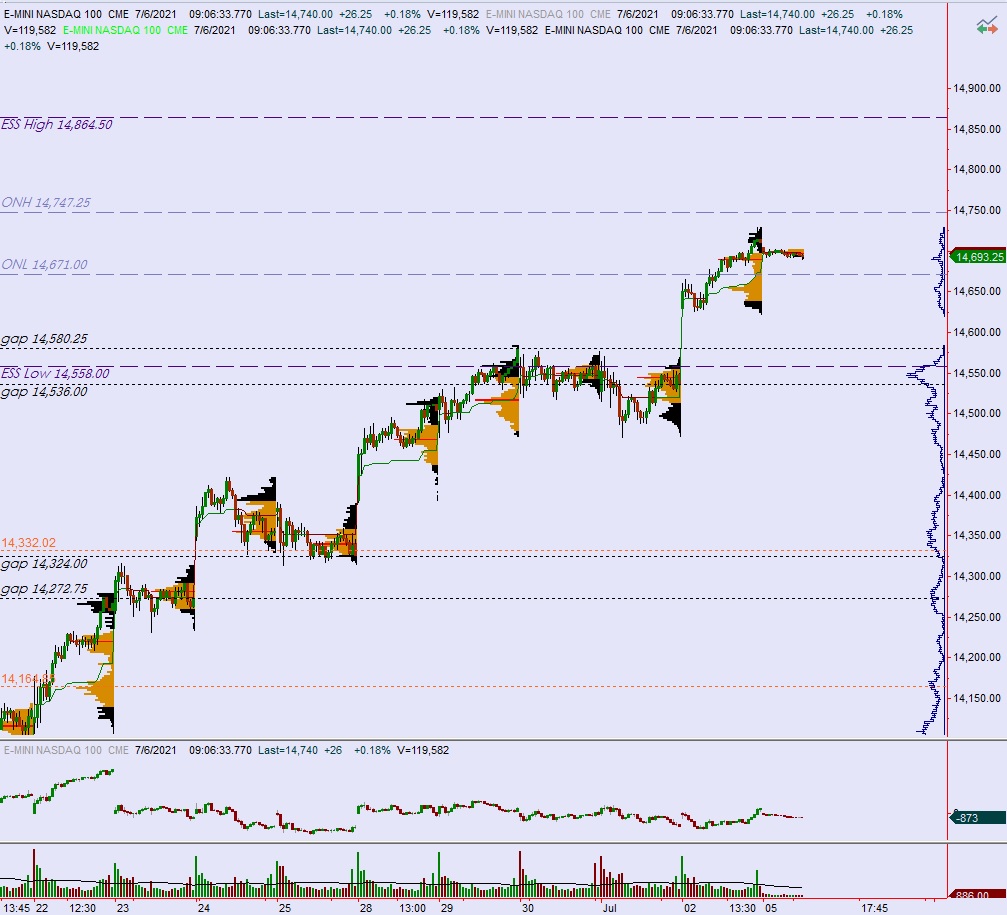

NASDAQ futures are coming into the holiday-shortened week gap up after an overnight session featuring extreme volume on elevated range. Price was balanced for the extended Globex session, which began Sunday evening and extended through Monday. Around 6am Tuesday price drifted up and away from the balance and as we approach cash open price is hovering up near all-time highs.

On the economic calendar today we have ISM services index at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

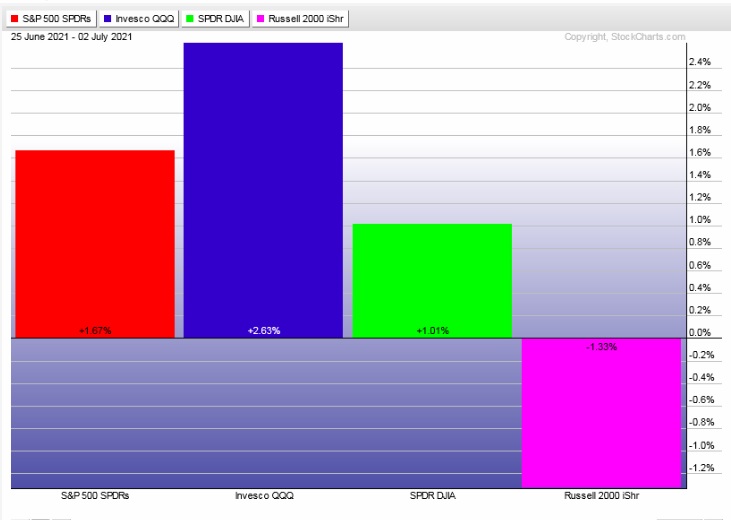

Last week featured strong buyers early Monday who squeezed prices higher, then we drifted for much of the week before accenting with a rally Friday. All week the Russell 2000 lagged.

The last week performance of each major index is shown below:

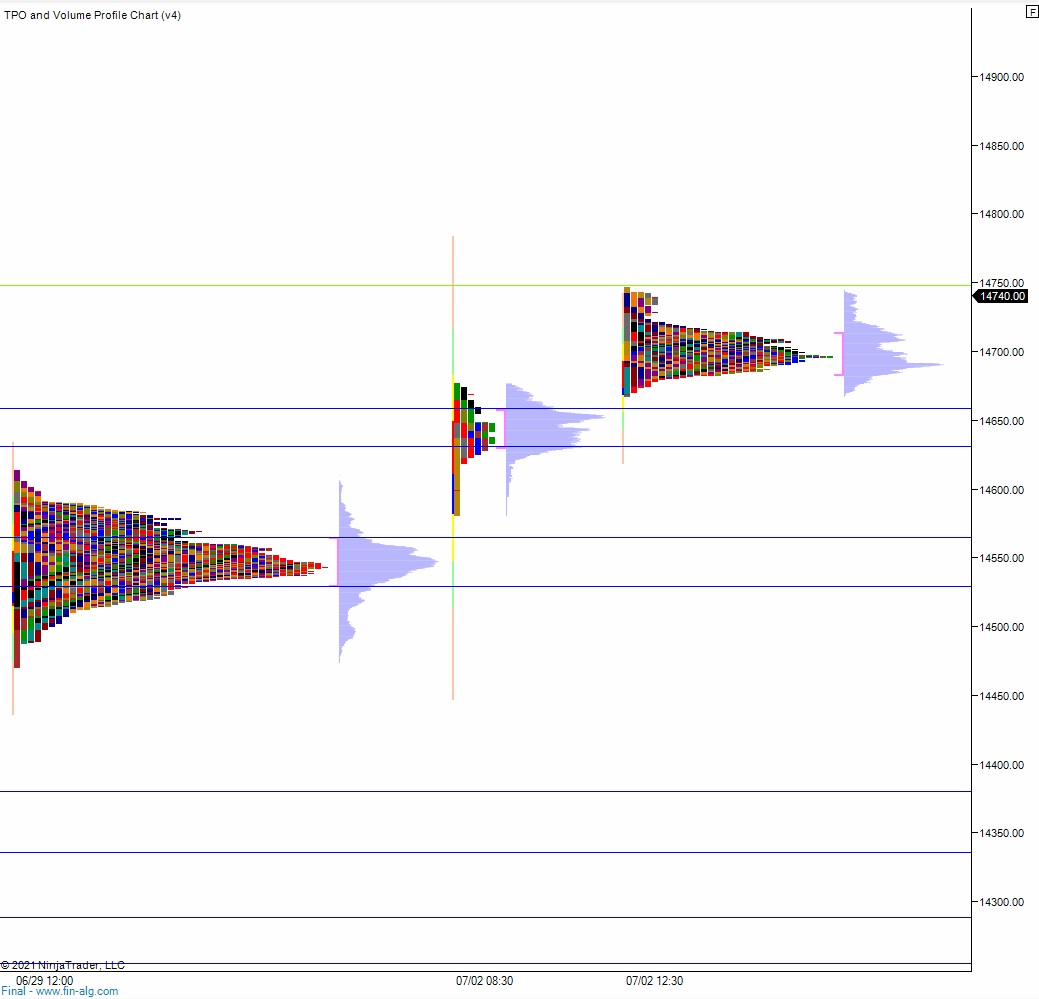

On Friday the NASDAQ printed a double distribution trend up. The day began with a pro gap up and a small open drive higher. Responsive sellers faded the early drive but were unable to take out overnight low. Instead buyers stepped in and worked the market into a range extension up before noon and we spend the rest of the afternoon rallying, eventually closing along the high.

Heading into today my primary expectation is for buyers to buyers to gap-and-go up to 14,800.

Hypo 2 stronger buyers tag 14,864.50 before two way trade ensues.

Hypo 3 sellers work into the overnight inventory and close the gap down to 14,711 then take out overnight low 14,671 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: