NASDAQ futures are heading into the first day of the third quarter down a touch after an overnight session featuring extreme range and volume. Price was balanced overnight, first pressing higher and making a new record high then traversing the entire Wednesday range and taking out the lows. At 8:30am jobless claims data came out a bit better than forecasts. No move in price really. Likely investors are more keen on hearing the NFP data tomorrow morning. As we approach cash open price is hovering just below the Wednesday midpoint.

Also on the economic calendar today we have PMI manufacturing at 9:45am, ISM manufacturing and construction spending at 10am and then 4- and 8-week T-bill auctions at 11:30am.

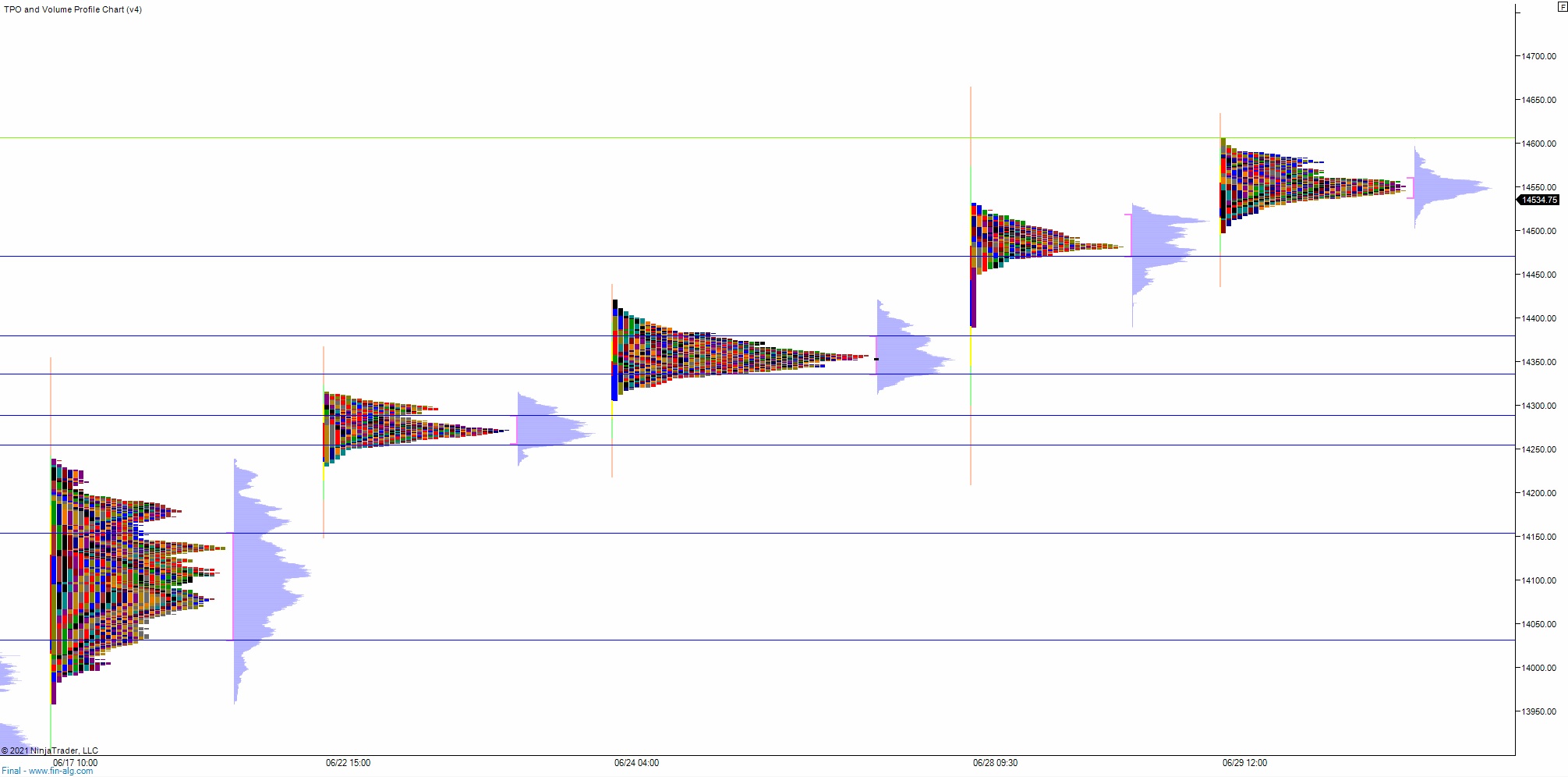

Yesterday we printed a normal variation up. The day began with a slight gap down in range. A slow open two-way auction accomplished very little. Eventually we made a range extension up late in the morning but never managed to close the overnight gap. Instead price probed below overnight low a bit and found a responsive bid then essentially marked time, walking all over the midpoint in an apparent local-to-local chop.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up at 14,553 then continue higher, up through overnight high 14,606.25 before two way trade ensues.

Hypo 2 sellers press down through overnight low 14,498.25 setting up a tag of 14,470.75 before two way trade ensues.

Hypo 3 stronger sellers trade down to 14,400 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: