NASDAQ futures are coming into the final day of June with a slight gap down after an overnight session featuring elevated range and volume. Price was balanced overnight, balancing along the upper quadrant of Tuesday’s range. Price was balanced above the Tuesday range until about 2am New York when sellers reclaimed the range. At 8:15am ADP employment data came out slightly better than expected, and as we approach cash open price is hovering up near the Tuesday high.

Also on the economic calendar today we have pending home sales at 10am, crude oil inventories at 10:30am and farm prices at 3pm.

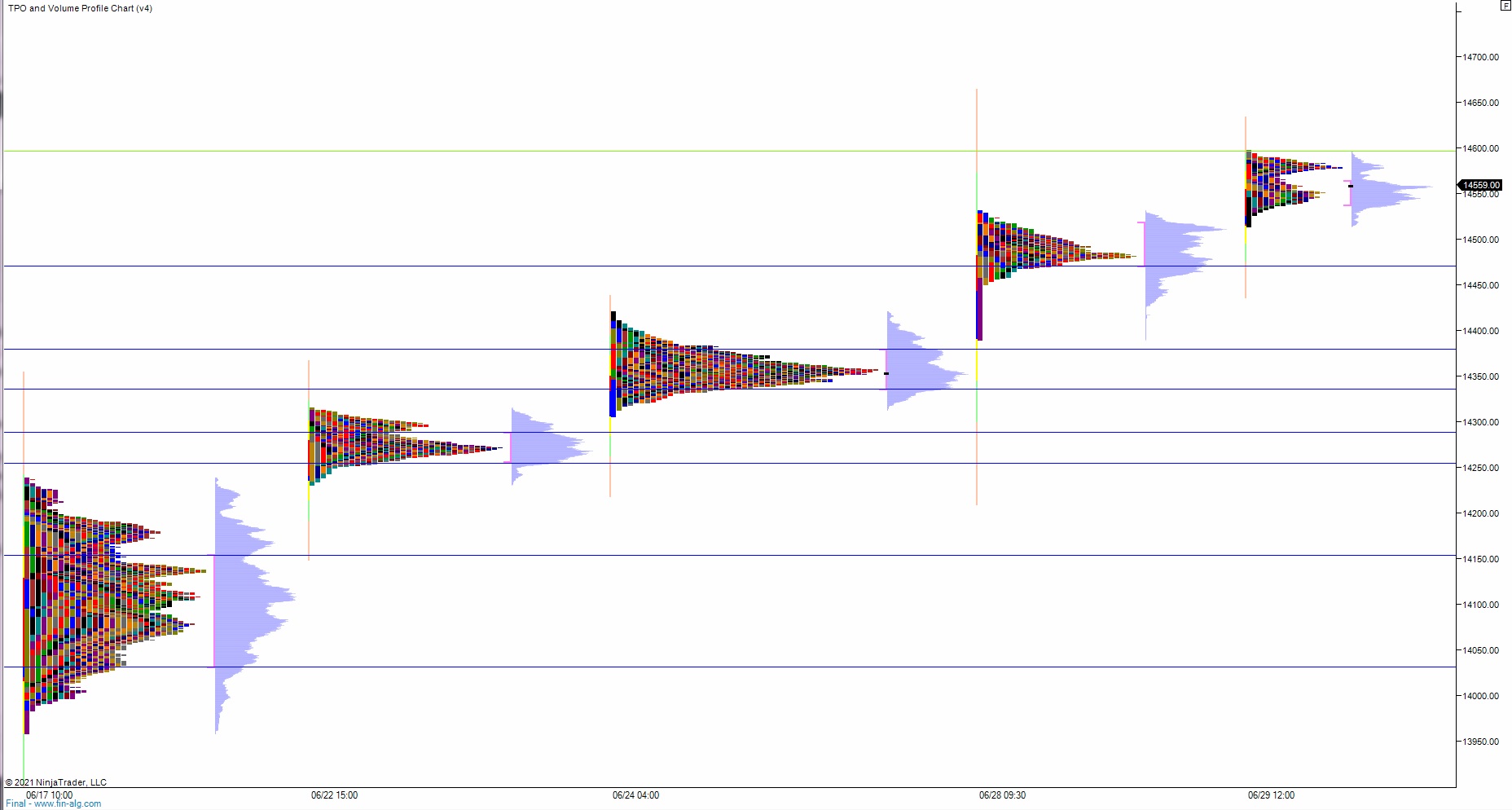

Yesterday we printed a double distribution trend up, the second consecutive print of this day-type. The cash session began with a slight gap down. Buyers resolved the gap and took out overnight high during a brief open two-way auction in range. Then there was a battle along the daily midpoint for a few hours which eventually gave way to a rally during the lunch hour. Said rally continued, grinding to new heights right up into settlement and spiking a bit higher into settlement.

Heading into today my primary expectation is for buyers to work up through overnight high 14,598.50 before two way trade ensues.

Hypo 2 sellers press down through overnight low 14,527 setting up a tag of 14,500.

Hypo 3 stronger sellers tag 14,470.50 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: