NASDAQ futures are set to gap up into the week with prices trading up above last Friday’s midpoint and over +100 from last week’s close. Price was balanced overnight until about 3:30am New York when it began to probe beyond the mini balance. Price has been on a steady campaign higher since then and as we approach cash open price is hovering near the upper quadrant of last Friday’s range.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

Last week was choppy through Tuesday then there was some late Tuesday selling. Pro gaps down across the board Wednesday that were bid into resulting in an all-day rally. Rally carried into Thursday. Then we essentially marked time Friday.

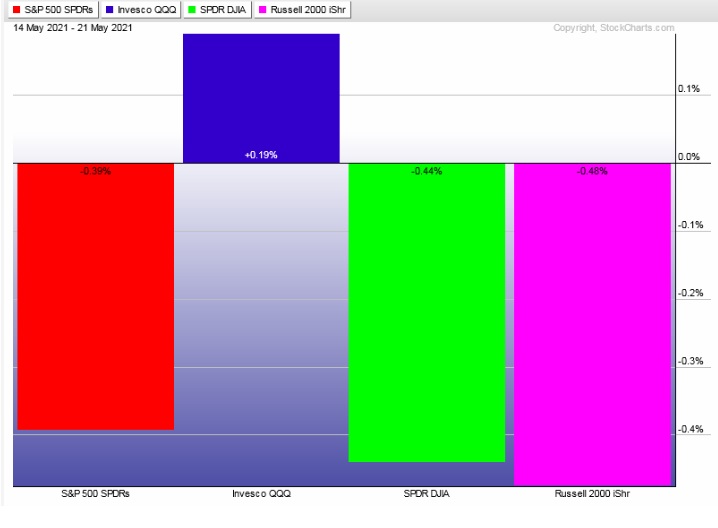

The last week performance of each major index is shown below:

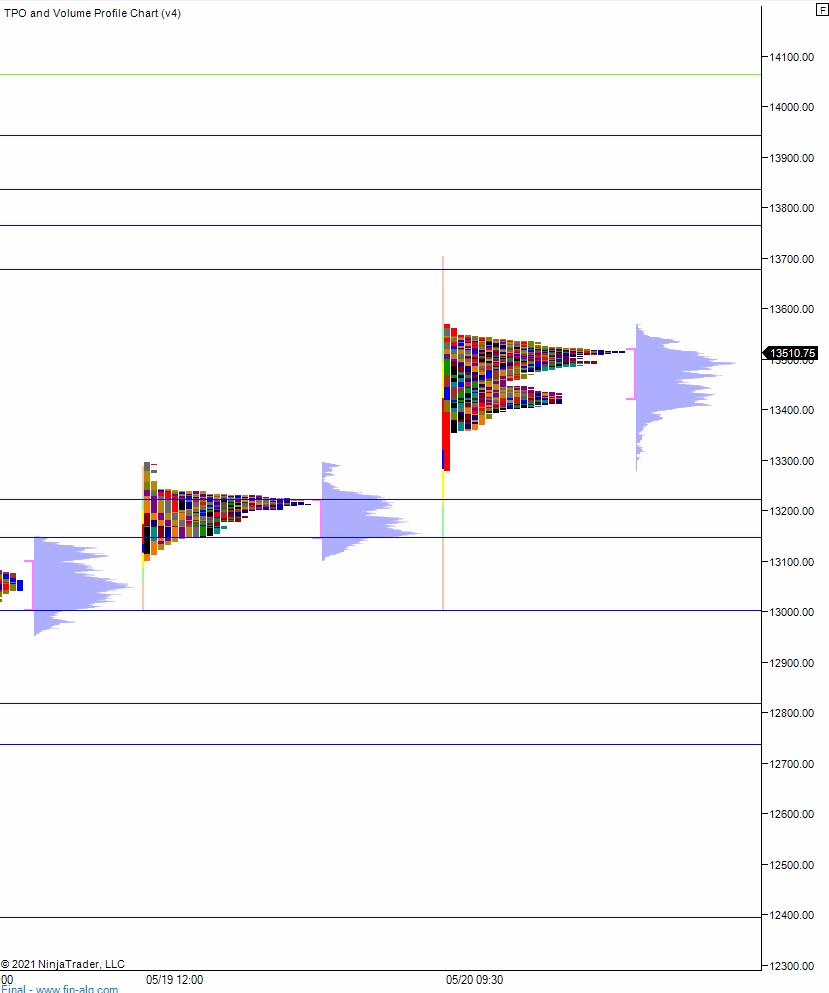

On Friday the NASDAQ printed a normal variation down. The day began with a gap up slightly above Thursday range. Sellers resolved the gap with an open-drive-down, driving down into the gap fill rapidly and then finding a responsive bid there. Said bidders could not take out the opening swing high. Instead sellers reasserted themselves and pushed an early range extension down. The selling continued until about noon, rotating price down to Thursday’s midpoint where we then bounced and marked time for the rest of the session.

Heading into today my primary expectation is for buyers to gap and go higher, probing above Friday high 13,570 and tagging 13,600 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the gap down to 13,410.50. Look for buyers ahead of 13,410 and for two way trade ensue.

Hypo 3 stronger sellers tag 13,300 before two way trade ensues.

Levels:

V0lume profiles, gaps and measured moves: