NASDAQ future are heading into OPEX Tuesday with a slight gap up after an overnight session featuring elevated volume on extreme range. Price drove higher overnight, working up beyond the Monday high and briefly exceeded last Friday’s high before discovering responsive sellers. Since then price has retraced lower a bit. At 8:30am housing starts/permits data came out mixed, and as we approach cash open price is hovering above the Monday high.

Walmart is up +3.25% in pre-market trade after reporting earnings.

Also on the economic calendar today we have 52-week T-bill auction at 11:30am.

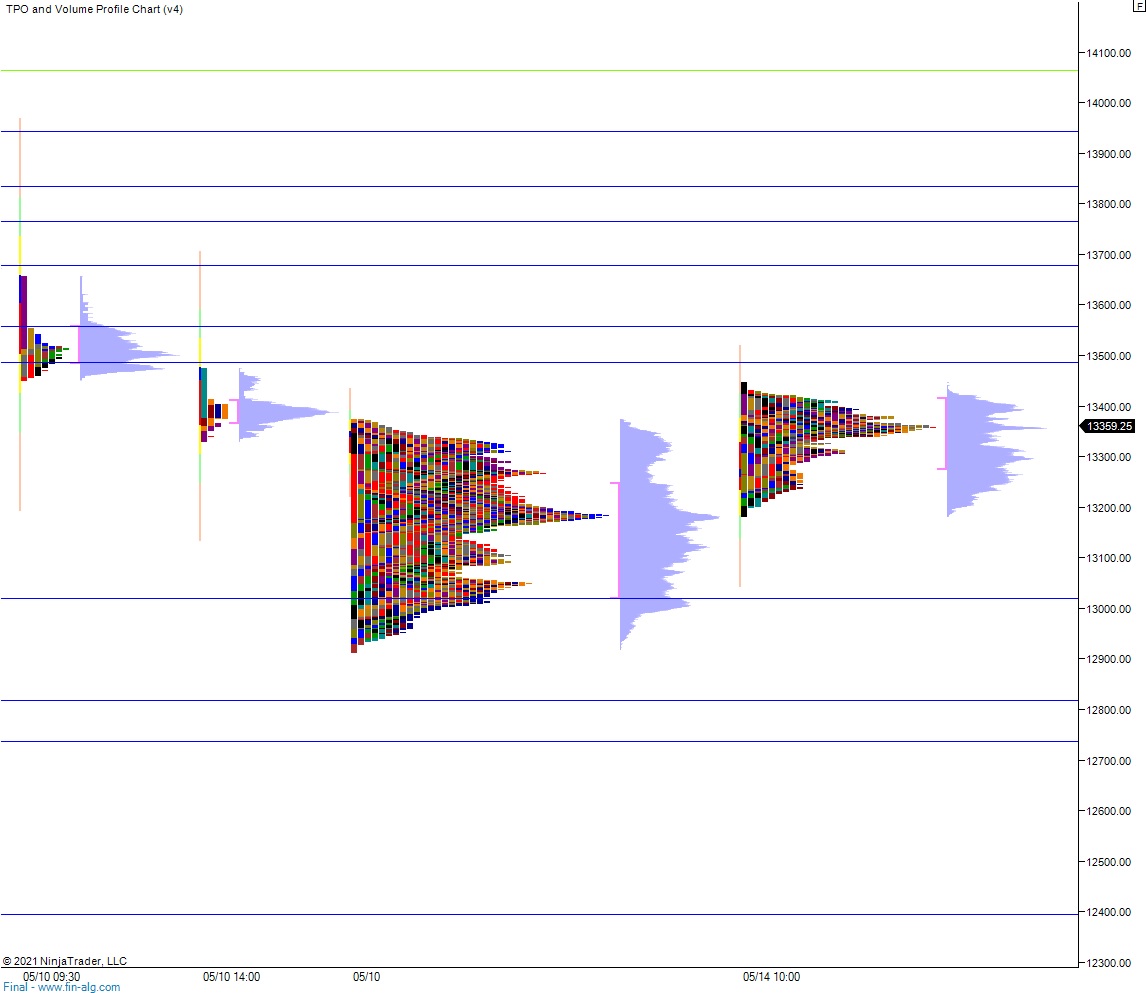

Yesterday we printed a normal variation down. The day began with a gap down in range, right along the midpoint of last Friday’s range. There was a big/choppy open two-way auction which ultimately gave way to selling. Sellers worked an early range extension down after chopping along the mid for a bit and eventually took out last Friday’s low by a few points before a responsive bid stepped in late in the afternoon and ramped price back up through the mid.

Heading into today my primary expectation is for buyers to reject a move back into Monday high 13,343 setting up a move to 13,486 before two way trade ensues.

Hypo 2 stronger buyers tag 13,500.

Hypo 3 sellers press back into Monday high 13,343 and sustain trade below it, setting up a move down through overnight low 13,290 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: