NASDAQ futures are coming into the first trading day of May gap up after an overnight session featuring elevated range on normal volume. Price was balanced overnight, balancing along the mid-point of last Friday’s range. As we approach cash open price is hovering about +15 above the Friday mid.

On the economic calendar today we have ISM manufacturing and construction spending at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

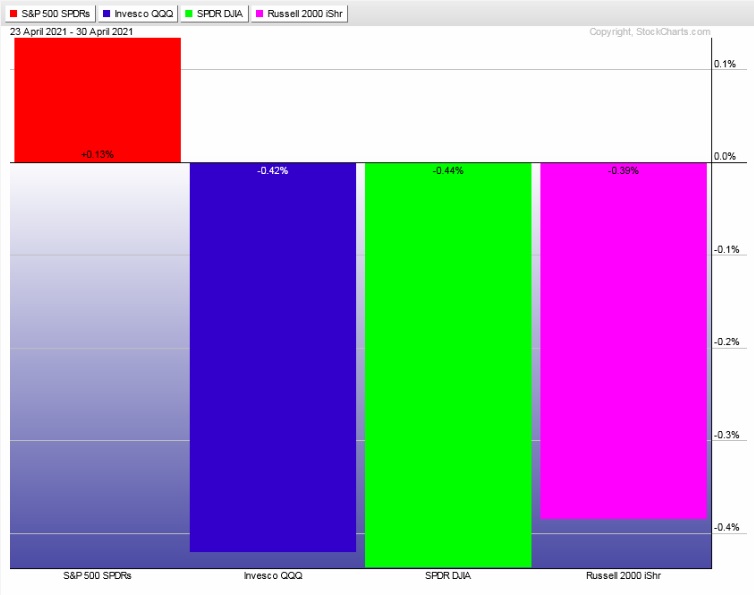

Last week we essentially marked time. There was a small rally in the beginning of the week, a sell-off mid week, and then a small fade upward to end the week. The last week performance of each major index is shown below:

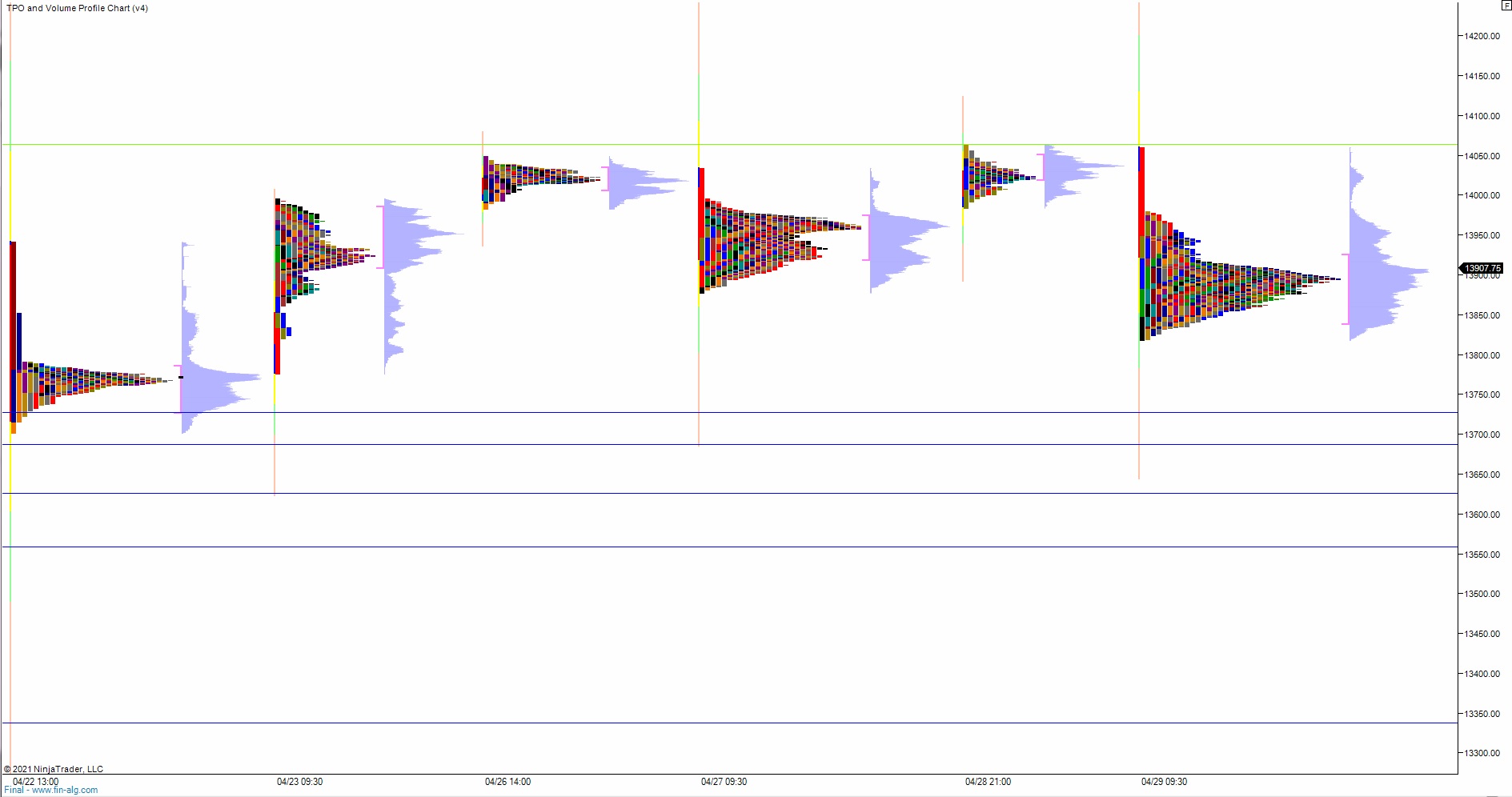

On Friday the NASDAQ printed a neutral day. The session began with a gap down in range that was quickly resolved via an open-drive-up. Buyers made an early range extension up just a few points beyond the gap fill before price abruptly fell back to the midpoint. There was a battle along the mid for several hours before a mid-afternoon push to a new low of day and into the neutral print. Said sellers were unable to take out the Thursday low. Instead price chopped along the lower quadrant of range into the weekend close.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 13,867.25. From there sellers continue lower, down through overnight low 13,844.50. Look for buyers at 13,800 and for two way trade to ensue.

Hypo 2 stronger sellers trade down to close the 04/22 gap down at 13,756 before two way trade ensues.

Hypo 3 gap-and-go higher, trading up to 14,000 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: