NASDAQ futures are floating around the unchanged line heading into Monday after an overnight session featuring extreme range on elevated volume. Price worked lower overnight, trading down near last Friday’s midpoint before discovering a responsive bid around 8am New York. At 8:30am durable goods orders came out in-line ex-transportation but well below expectations if we include transports. Since then price has worked about 50 handles up, and as we approach cash open price is hovering in the upper quadrant of last Friday’s range.

Also on the economic calendar today we have a 6-month bill and 2-year note auctions at 11:30am followed by 3-month bill and 5-year note auctions at 1pm.

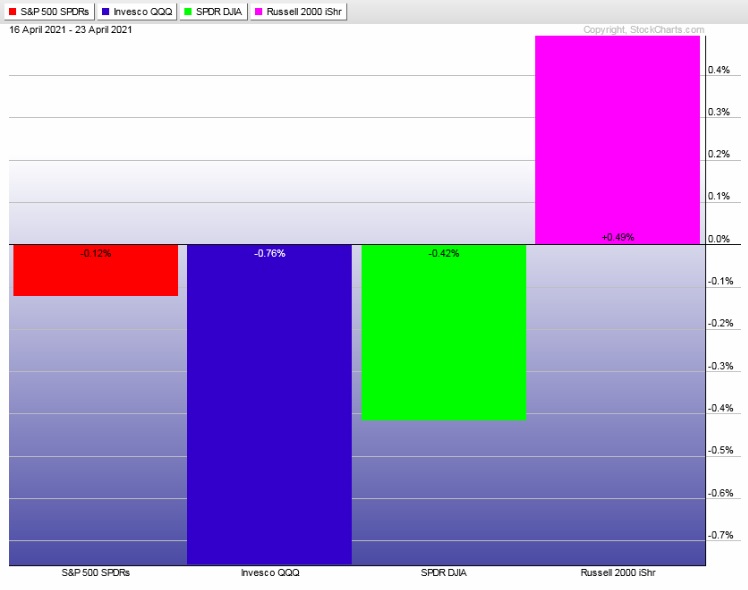

Last week had some big choppy price action. There was weakness early in the week and eventually strength into the weekend. Russell was bullish divergent throughout the week, suggesting risk tolerance remains elevated.

The last week performance of each major index is shown below:

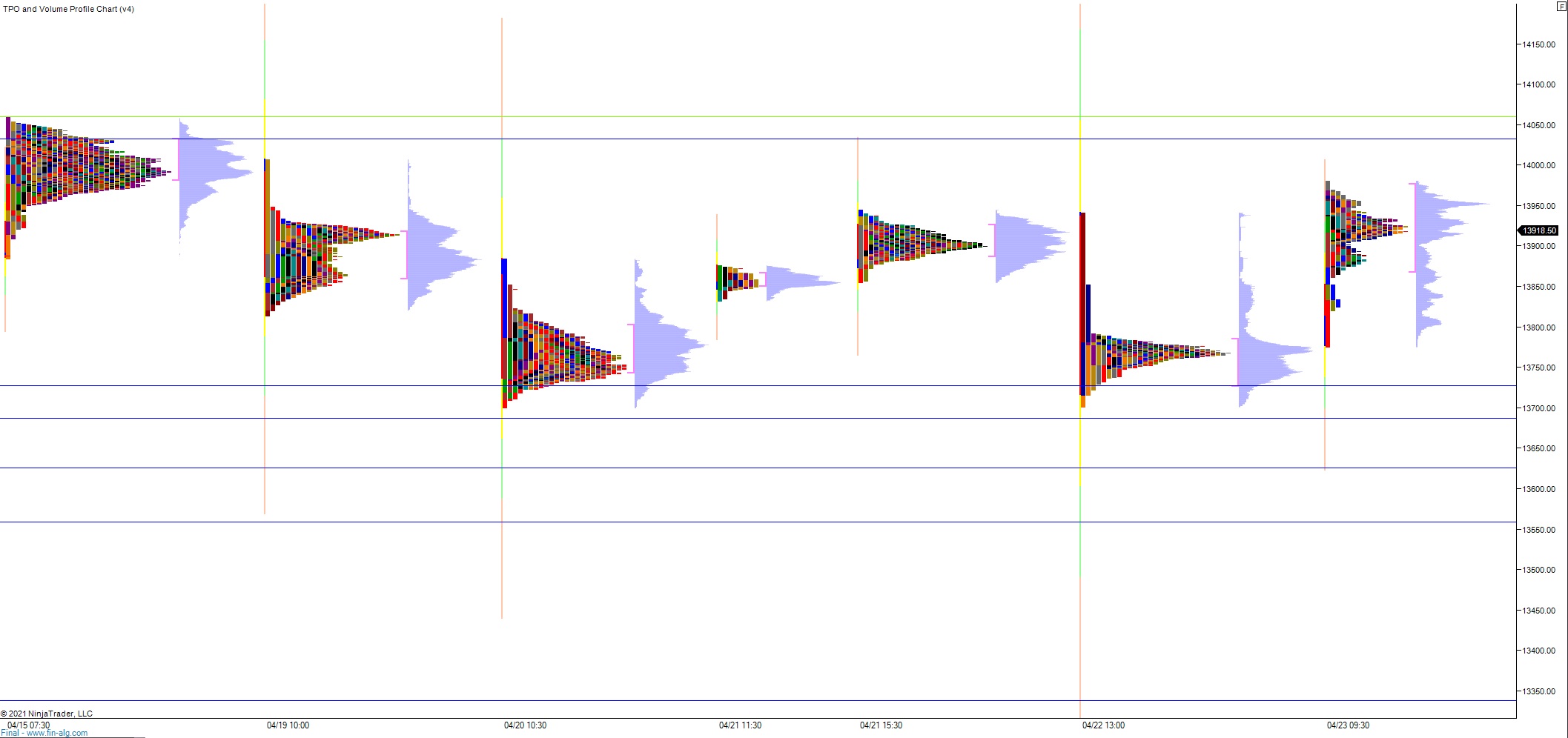

On Friday the NASDAQ printed a double distribution trend up. The day began with a gap up in range and then an open drive higher. Early buyers steadily campaigned price higher, effectively making short work of returning price “to the scene of the crime” where the initial reaction to new of a capital gains tax increase hit the wires. Price shot clean through beyond that level and eventually took out Thursday high before flagging along the highs for a few hours. Price then dropped a bit during settlement period.

Heading into today my primary expectation is for sellers to press into the overnight inventory and trade down to 13,845 before two way trade ensues.

Hypo 2 buyers press up through overnight high 13,944.25 setting up a move up through last Friday high 13,981 on the way to tagging 14,000.

Hypo 3 stronger sellers trade down through 13,845 early on and sustain trade below it seeting up a move to 13,800.

Levels:

Volume profiles, gaps and measured moves: