NASDAQ futures are coming into the second full week of April with a small gap down after an overnight session featuring elevated volume on normal range. Price was balanced overnight, balancing along the upper quadrant of Friday’s range. As we approach cash open, price hovers in this upper quad.

On the economic calendar today we have 6-mont t-bills and 3-year notes up for auction at 11:30am, 3-month t-bills and 10-year notes auctioning at 1pm and a Treasury statement at 2pm.

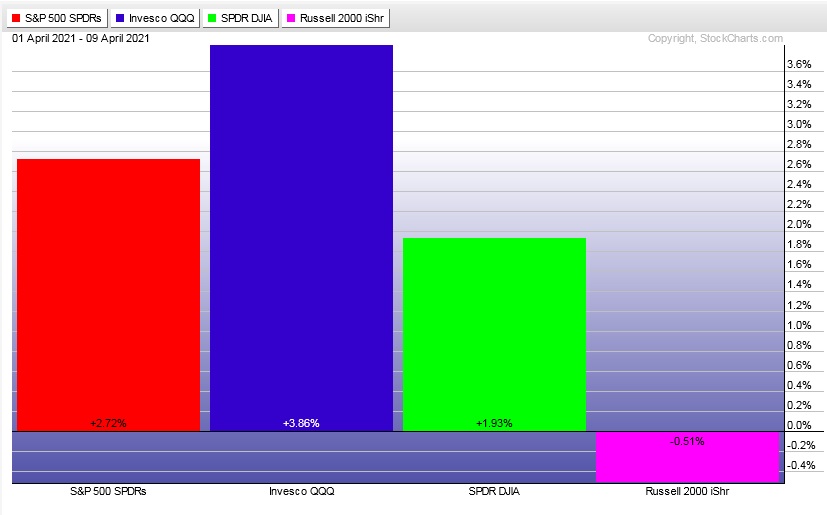

Last week featured a strong rally Monday. Then a consolidation of the gains through Wednesday. A gap higher Thursday and continuation rally through Friday and into the weekend. Russell 2000 lagged. Here is the last week performance of each major index:

On Friday the NASDAQ printed a double distribution trend up. The day began with a gap down in range. Sellers made an early attempt lower, probing below the Thursday range briefly before a sharp,excess low formed. Price shot back through the mid, checked back to it, then rallied to close the overnight gap and make a new high on the week. Price flagged along the high for several hours before ramping higher into the weekend.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 13,809.50. From there buyers continue higher, up to probe beyond all-time high 13,878.25 before two way trade ensues.

higher, up to probe beyond all-time high 13,878.25 before two way trade ensues.

Hypo 2 sellers press down through overnight low 13,767.75 and tag 13,753 before two way trade ensues.

Hypo 3 stronger sellers trade down to 13,700 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves:

If you enjoy the content at iBankCoin, please follow us on Twitter