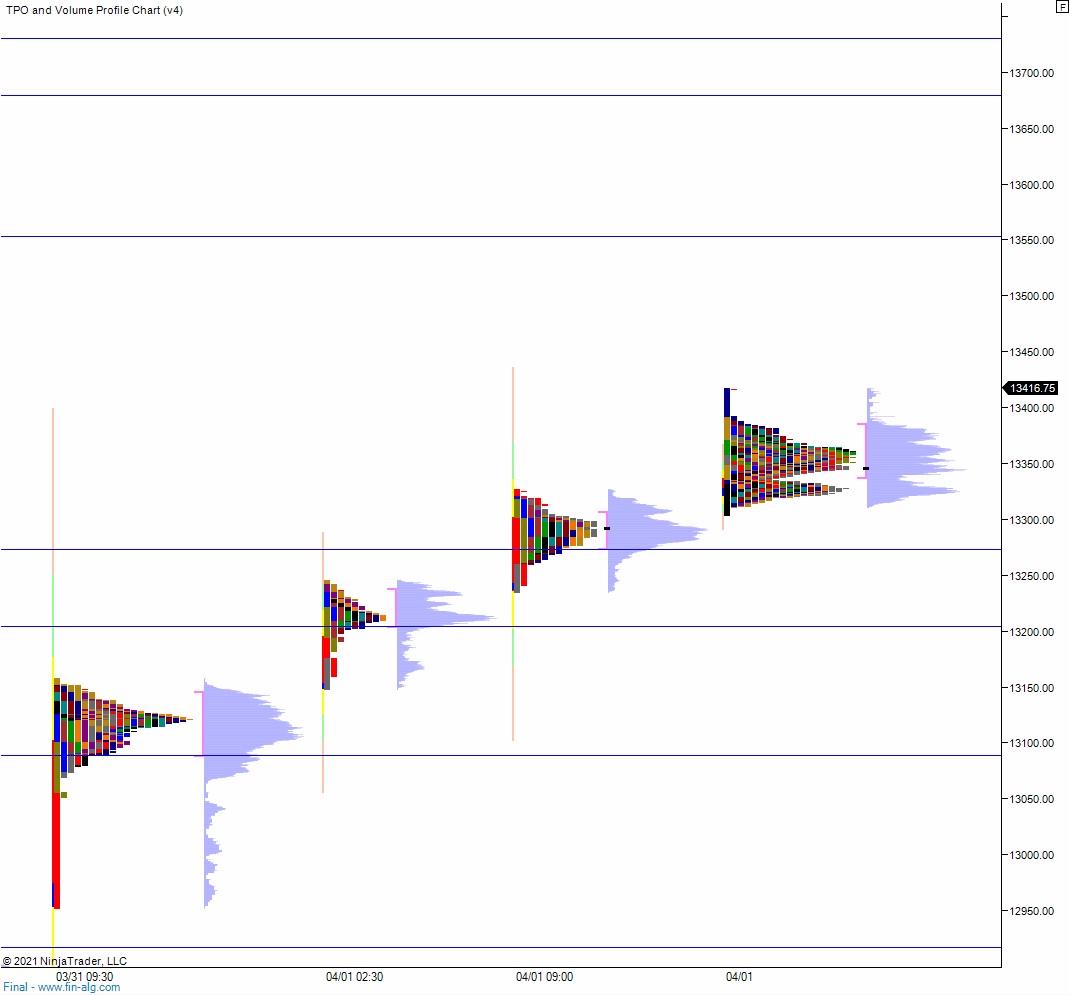

NASDAQ futures are coming into the first full week of the second quarter pro gap up after an overnight session featuring normal volume on elevated range. Price was balanced overnight, first testing last Thursday’s high then rallying away from it. As we approach cash open price is hovering up at levels unseen since February 22nd.

On the economic calendar today we have factory orders and ISM services index at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

Last week was choppy through Tuesday then price rallied through to end of Thursday. Closed Friday.

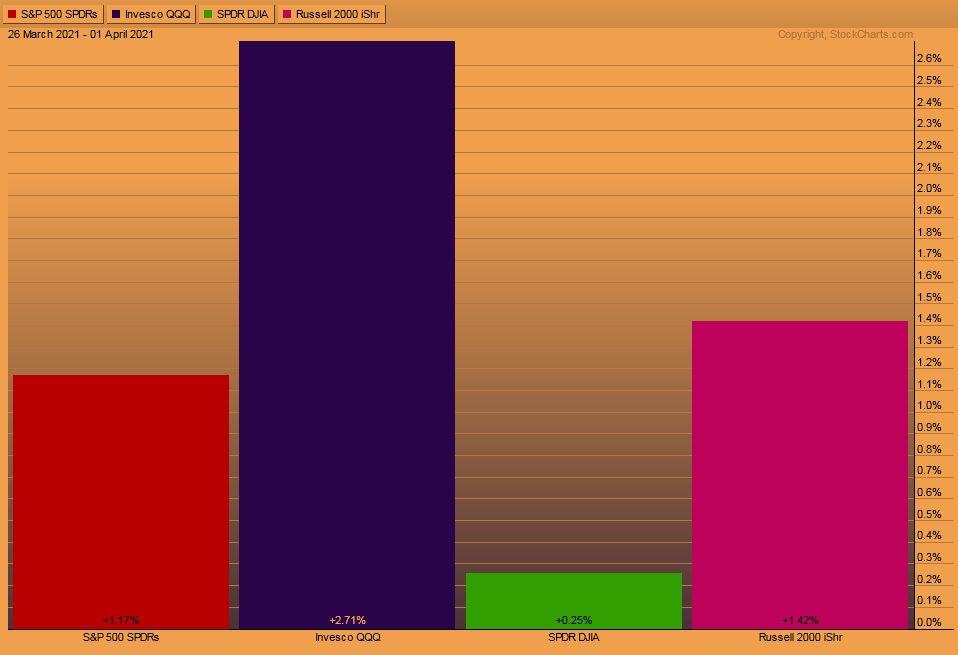

The last week performance of each major index is shown below:

On Thursday the NASDAQ printed a normal variation up. The day began with a gap up beyond range. Buyers drove higher off the open and managed to print a range extension up early on. Then price chopped along the mid for pretty much the rest of the session before ramping back up to the highs near the close.

Heading into today my primary expectation is for buyers to gap-and-go higher, driving up to 13,500 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the gap down to 13,325.75, take out overnight low 13,304.25 before two way trade ensues.

Hypo 3 stronger buyers trade up to 13,550 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: