NASDAQ futures are heading into the final Tuesday of the second quarter down about -90 after an overnight session featuring extreme range and volume. Price steadily rotated lower overnight, traversing most of the Monday range but never exceeding its ranges. As we approach cash open price is hovering in the lower quadrant of Monday’s range.

On the economic calendar today we have consumer confidence at 10am.

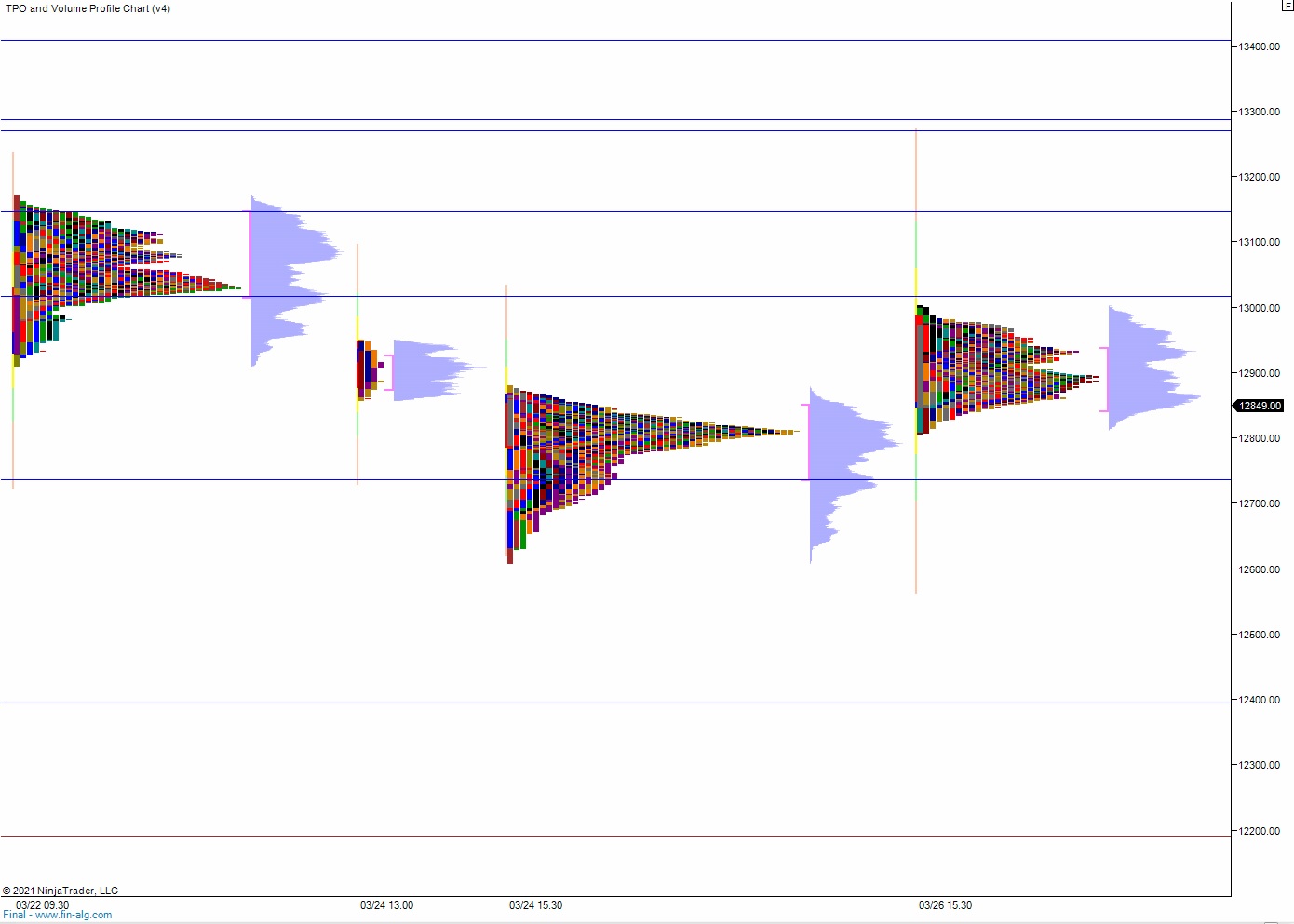

Yesterday we printed a normal variation up. The day began with a slight gap down in range. Buyers resolved the gap with a small drive higher on the open before sellers stepped in and made a hard drive lower. This selling managed to tag the Friday naked VPOC nearly to the tick before finding a strong responsive bid. Said bidders stepped in ahead of the first hour, meaning no range extension had taken place. Instead there was a battle along the daily low before a spike back to the midpoint just before 11am New York. Sellers defended the mid twice, but on the first push just after lunchtime buyers pressed through the mid and rapidly made a new daily high, going range extension up in the process. Then price checked back to the mid late in the afternoon, buyers defended, and we wrapped up the session trading in the upper quad.

Of note—the daily VPOC never shifted up to the highs. Instead it remained down where that morning battle took place, down in the lower quad.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 12,975.75. Buyers continue higher, tagging 13,000 before two way trade ensues.

Hypo 2 sellers gap-and-go lower, tagging 12,800 before two way trade ensues.

Hypo 3 stronger sellers tag 12,736.25 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: