Extreme emotions are not helpful to the investor/trader. Nor is it to be totally dead inside. Awareness is key. Know thyself. Know also that your ego is not your amigo. So whatever that dashing lad in the mirror is saying to you in your pretty head–take it with a grain of salt.

We gotta be so careful to protect our energy. Our job as progressive, successful participants in society is to seek good explanations for events. There are billion dollar industries, and even modestly successful websites, built on peddling bad explanations for how/why the market behaves the way it does.

For years, about nine, I’ve offered an objective explanation for market behavior and walked through life, live, one week then one day at a time, chronicling how I see things, what I am doing and how it is working out.

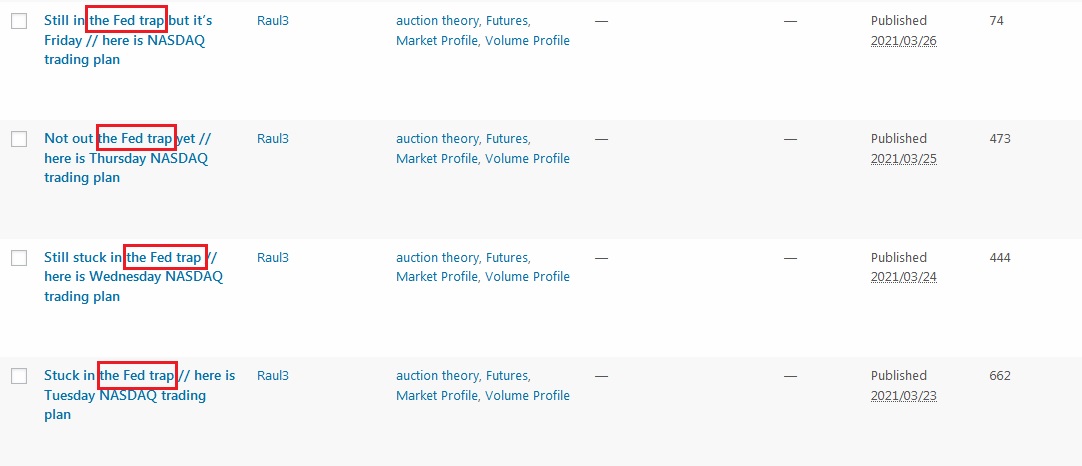

Last week was, in my subjective point-of-view, a body of work that I would consider art. Behold:

Alongside these entries, I further discussed my actions on Twitter (@IndexModel) where I am easily one of the most well-known and least popular finance handles in existence.

What is popular? Jokes. MEMES. I like memes. Strong emotional outbursts.

I like memes. Last week’s boat memes have been great fun.

What is not popular? Some dude with laser eyes putting on a seminar in consistent profitability.

Fine.

I never wanted to be popular on the internets. It comes at too great a cost. Too many loons and I work to hardt as it is to have privacy so I can do my psychedelics in peace.

Anyhow. I have several indicators lining up bullish into quarter end. I intend to work the long side of the tape via the NASDAQ 100 futures as good set-ups present themselves while doing nothing with my massive Twitter and Del Taco positions.

Cheers to the week.

Raul Santos, March 28th 2021

And now, the Sunday Research that powers everything I do. Enjoy:

Stocklabs Strategy Session: 03/29/21 – 04/02/21

I. Executive Summary

Raul’s bias score 3.50, medium bull*. Choppy, sideways action into quarter-end, perhaps with a slight upward bias. Then look for non-farm payroll data Friday morning to provide direction into the weekend.

*Extreme Rose Colored Sunglasses (e[RCS]) bullish bias triggered. See Section IV.

II. RECAP OF THE ACTION

Conviction buying Monday. Seller control Tuesday through Thursday morning. Sharp excess low formed Thursday then a rally into the weekend which was accentuated by a late Friday ramp.

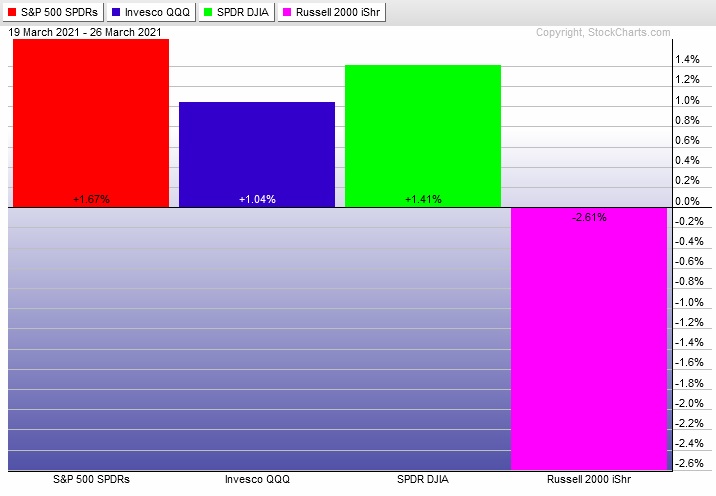

The last week performance of each major index is shown below:

Rotational Report:

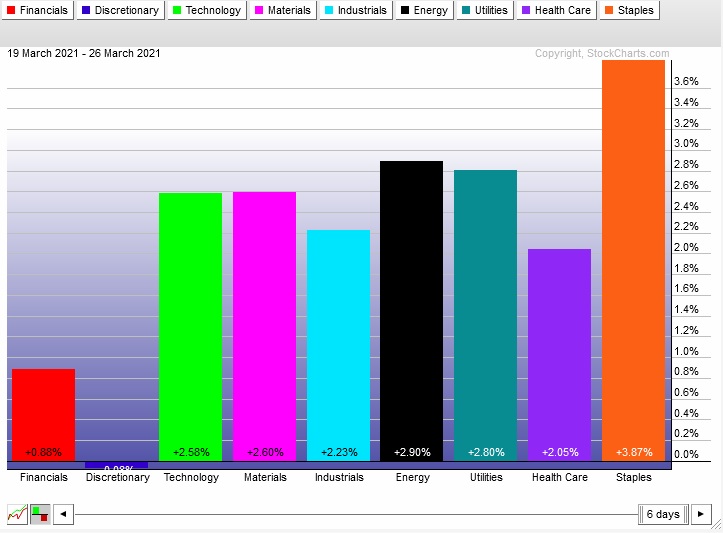

Strong rotations across the board, except for key Discretionary sector. Slightly unsettling leadership from Staples and Utilities.

neutral

For the week, the performance of each sector can be seen below:

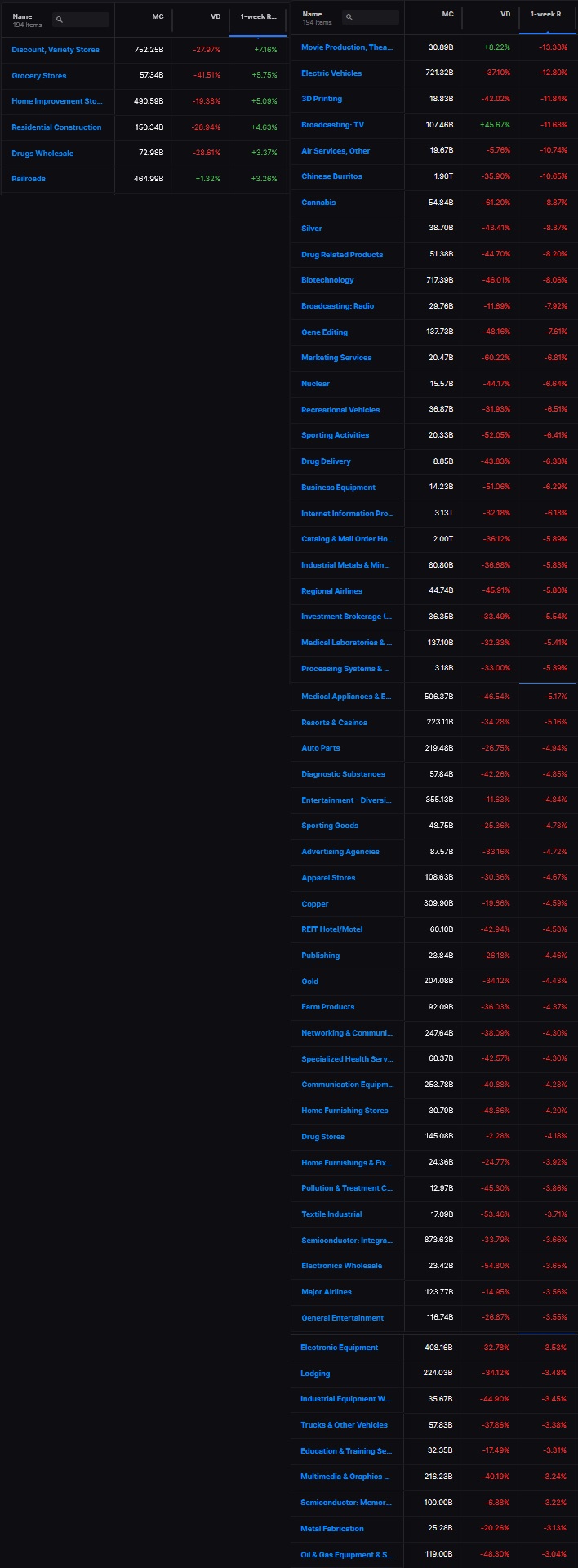

Concentrated Money Flows:

Don’t forget the major buy flows three weeks back. We have not seen any follow through on them yet, nor have we seen any selling of a magnitude that would expect us to doubt upside follow through.

Two weeks ago most of the selling was seen in energy industry groups which we’ve already established trade independent of the overall market.

Last week’s flows did skew slightly bearish, but not quite enough to negate that massive buy flow three weeks ago.

Median return last week was below -1.5% and volume delta over the last 30 days is negative.

What we need. And I will discuss this with The Fly, is a 1-week volume delta. That would help us make actionable use of the volume delta data Stocklabs has.

Money flows are neutral.

Here are this week’s results:

III. Stocklabs ACADEMY

Three month oversold signal lines up with e(RCS) into quarter-end

On Thursday, March 18 Stocklabs flagged oversold on the 3-month technical and hybrid signals. You may notice I never include any 3-month signals in the Weekly Strategy Session, but lately I’ve been giving it more consideration.

The 3-month has a decent probability of success into the second half of the cycle. Now we also have a 6-month Tech oversold cycle in play AND Indexmodel going extreme Rose Colored Sunglasses bullish bias.

These factors are stacking up to favor a bullish bias.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Choppy, sideways action into quarter-end, perhaps with a slight upward bias. Then look for non-farm payroll data Friday morning to provide direction into the weekend.

Bias Book:

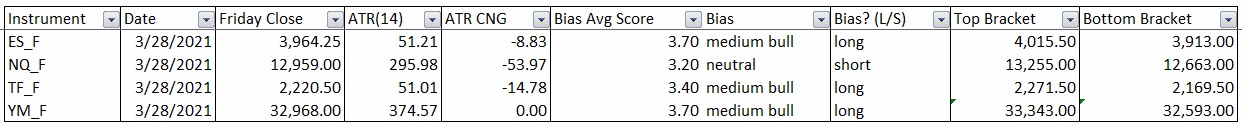

Here are the bias trades and price levels for this week:

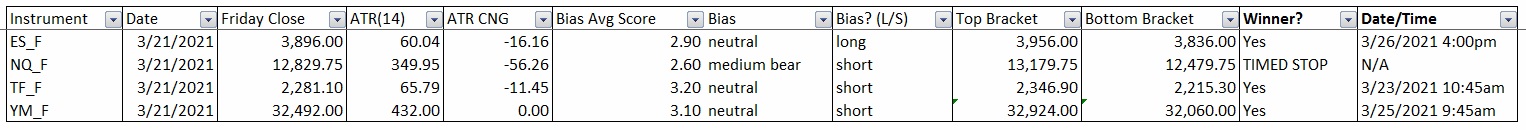

Here are last week’s bias trade results:

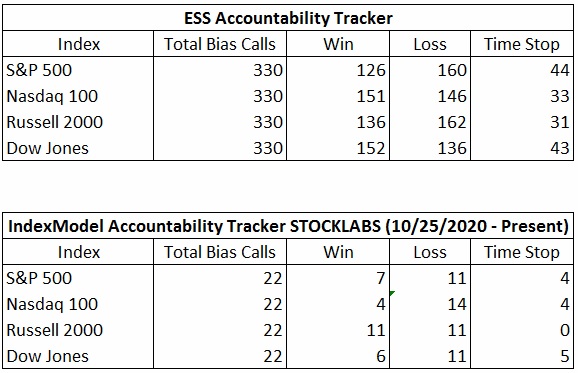

Bias Book Performance [11/17/2014-Present]:

Semiconductors probe top of balance, Transports discovery up mode

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports steadily discovering new higher prices.

See below:

Semiconductors have that head-and-shoulders pattern printed and it is so obvious it likely won’t play out how technical analysts expect. However, we are nearing the top-side of our range. How we behave up here will tell a story heading into Q2.

See below:

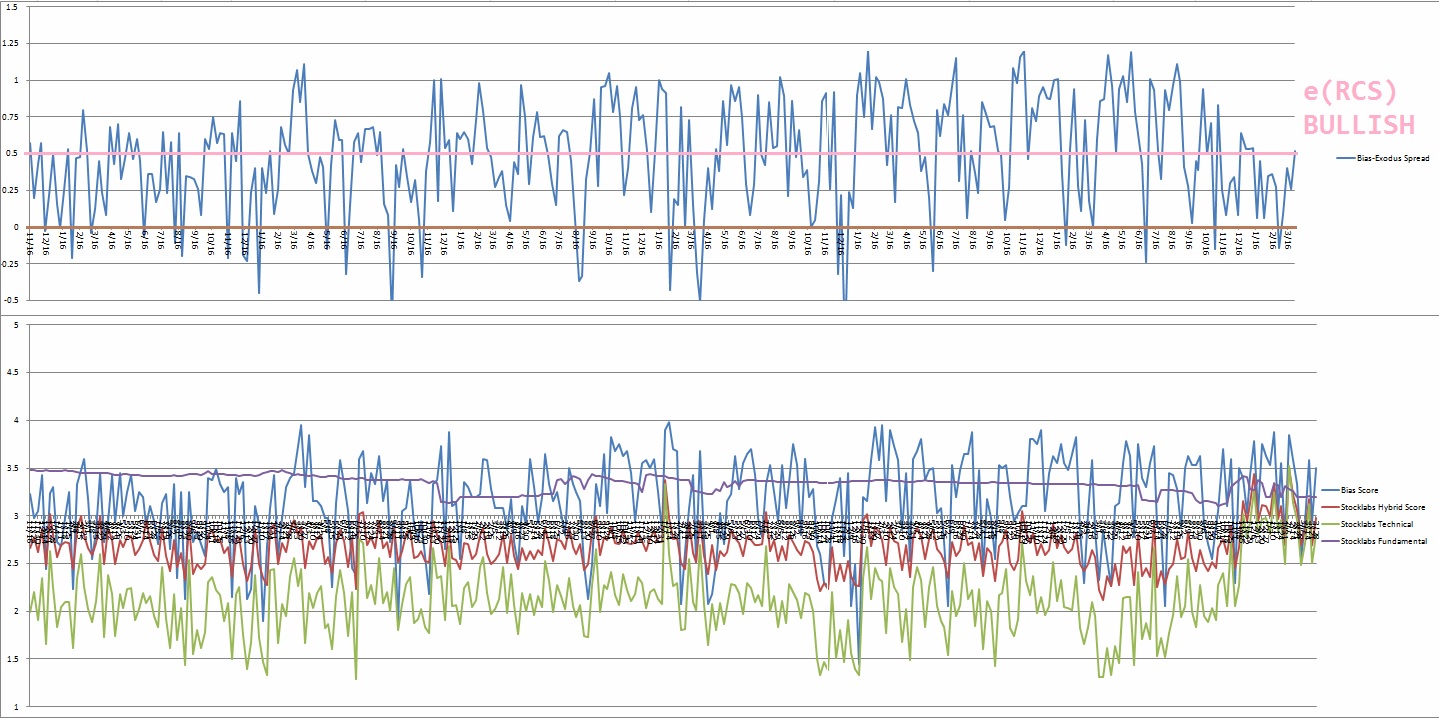

V. INDEX MODEL

Bias model is flagging extreme Rose Colored Sunglasses after being neutral for three weeks after signaling Bunker Buster four weeks ago and being neutral for the thirteen weeks prior to that. E(RCS) calls for a sideways drift, perhaps with a slight upward bias.

Here is the current spread:

VI. QUOTE OF THE WEEK:

“We buy things we don’tt need, with money we don’t have, to impress people we don’t like.” Chuck Palahniuk, Fight Club

Trade simple, clarify your reason for getting’ money

If you enjoy the content at iBankCoin, please follow us on Twitter