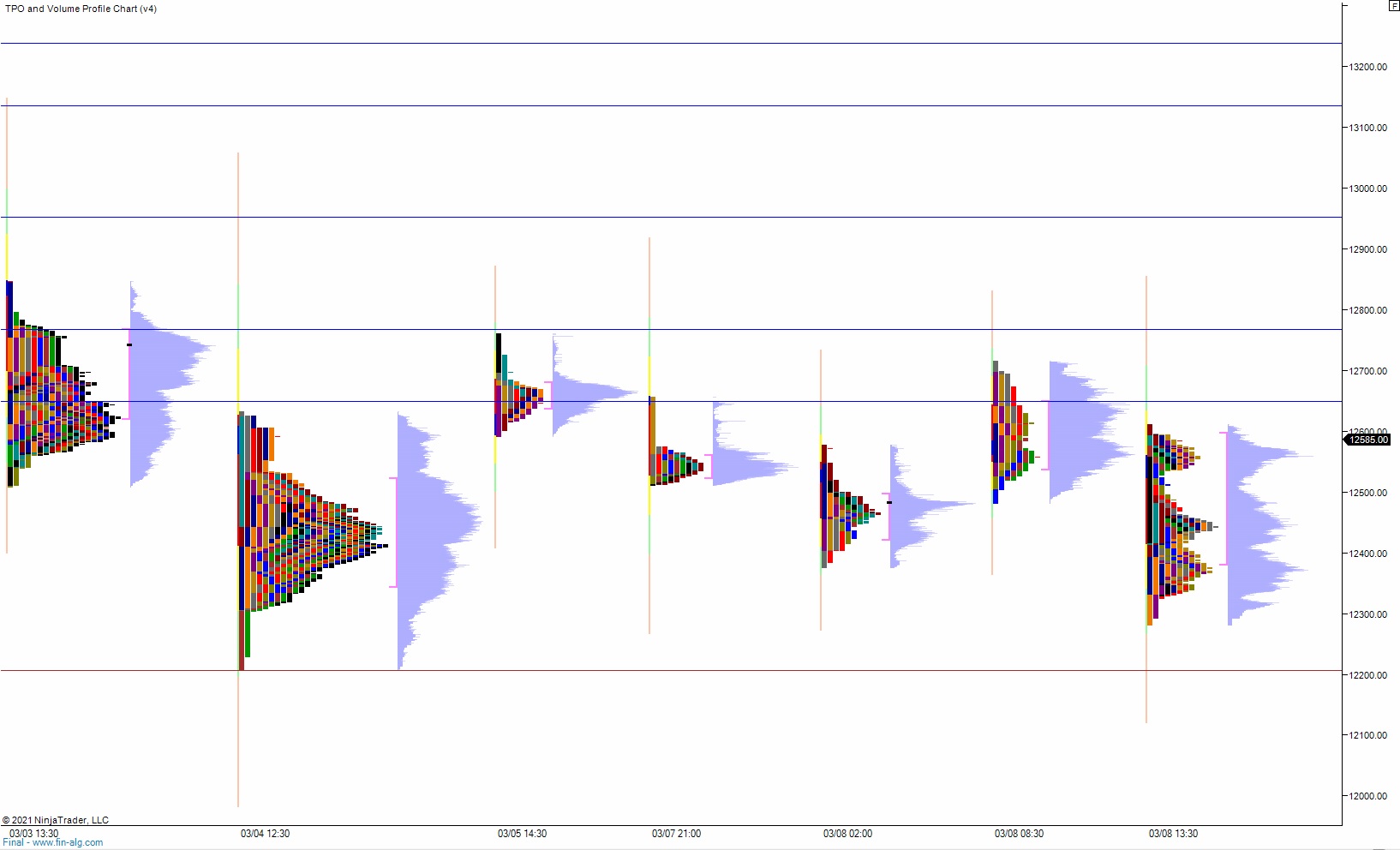

NASDAQ futures are heading into the second day of the second week of March up about +250 after an overnight session featuring extreme range and volume. Price steadily climbed higher overnight, via one small than one large rotation higher, ascending up past the Monday VPOC before finding sellersaround 7am New York. Since then a choppy balance has formed and as we approach cash opne price is hovering a bit below the Monday VPOC and above its mid.

On the economic calendar today we have a 3-year note auction at 1pm. With the recent lack of demand for Treasuries, the outcome of these auctions is likely to be more keenly attended to by investors.

Yesterday we printed a neutral extreme down. The day began with a slight gap down in range and after a quick open drive down buyers emerged and pressed the gap fill and beyond, briefly tagging 12,700. This all happened within the first 15 minutes. Price then fell back to the midpoint, buyers defended and sent us to a new daily high and brief range extension up. That was the end of the buyer control for the day. The rest of the session was spent auctioning lower, eventually pressing neutral and closing on the daily low. This move effectively tagged the odd VPOC left behind at the lows last Friday (see the second chart below). However, value migrated a bit higher during Monday’s action despite being a neutral extreme down.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up to 12,648.75 before two way trade ensues.

Hypo 2 stronger buyers trade up to 12,767 before two way trade ensues.

Hypo 3 sellers press down and close the overnight gap down at 12,336.50. Look for buyers ahead of 12,300 and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: