NASDAQ futures are coming into Tuesday down a quick -225 after an overnight session featuring extreme range and volume. The selling began around 1am New York and the campaign lower continued unidirectionally until about 5:30am with the market catching a bid down in the lower quadrant of the January 29th range (the last trading day of January). As we approach cash open, price is hovering a touch higher, just below 13k, holding up a bit above the February 1st lows.

On the economic calendar today we have consumer confidence at 10am, a 52-week T-bill auction at 11:30am followed by a 2-year note auction at 1pm.

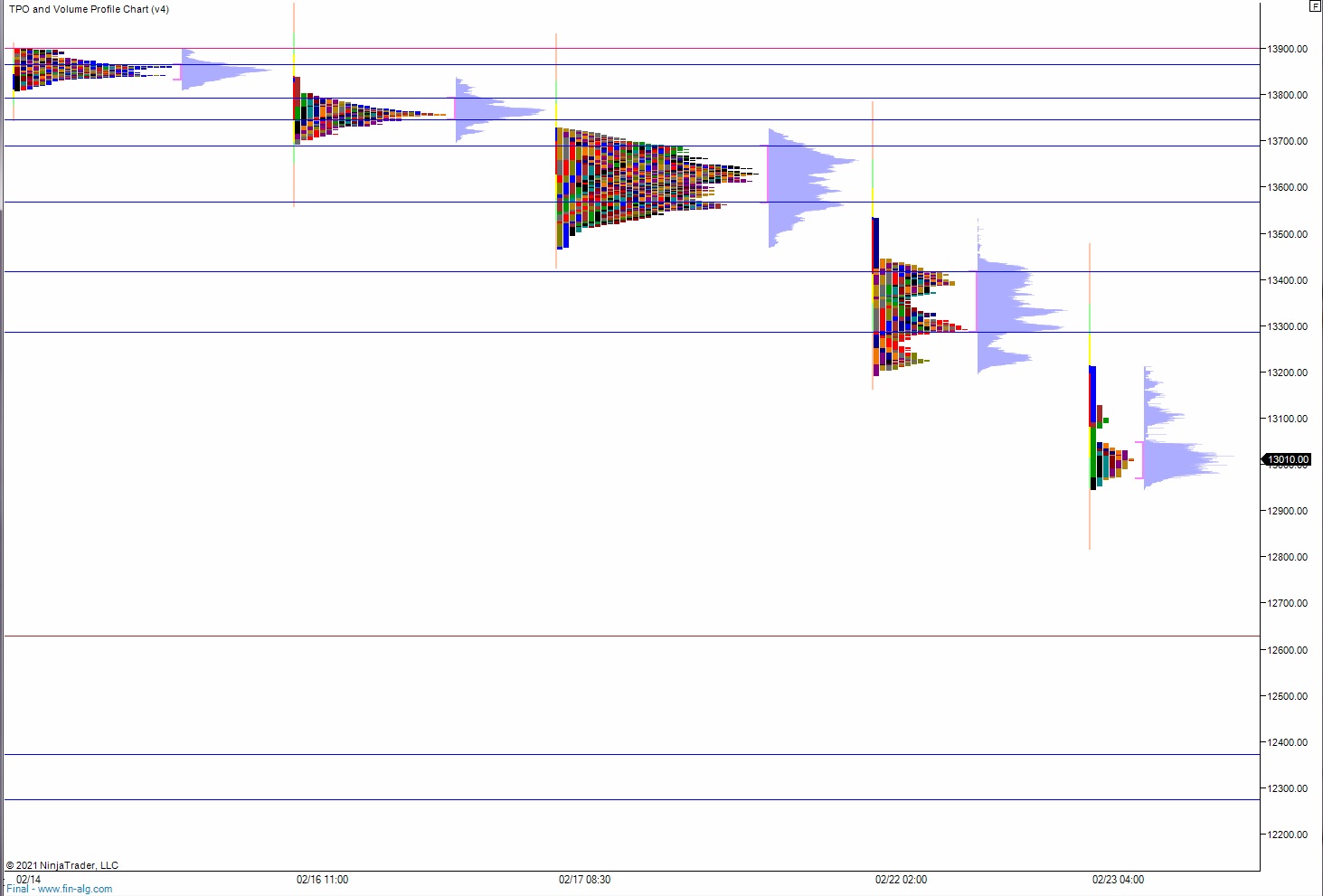

Yesterday we printed a double distribution trend down. The day began with a gap down below the prior three sessions, down near the lows of February 2nd-4th. After an open auction outside range buyers made the initial push, pushing a bit beyond the opening swing but ultimately stalling and printing an excess high before the first hour was complete. That would mark the high. Sellers pressed down through the range quickly, then made an early range extension down. Price checked back to the midpoint around 2:15pm after one ticking below the prior daily low. Sellers defended, setting up a push lower into the close. We closed on the lows.

Heading into today my primary expectation is for buyers to work into the overnight inventory and work a half gap-fill up to 13,100 before two way trade ensues.

Hypo 2 sellers gap-and-go lower, trading down through overnight low 12,946.50 on their way to closing the open gap down at 12,886.25 (Jan 29th) before two way trade ensues.

Hypo 3 stronger sellers tag the MLK gap down at 12,772.25 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: