NASDAQ futures are coming into option expiration day up a quick +80 after an overnight session featuring extreme range and volume. Price first drove lower overnight, rotating downward until about midnight New York when a bid stepped in right near the Thursday midpoint. Price has been unidrectional up since then, effectively driving up through the Wednesday and Thursday highs. As we approach cash open, price is hovering inside the lower quadrant of Tuesday’s range.

On the economic calendar today we have PMI composite flash at 9:45am followed by existing home sales at 10am.

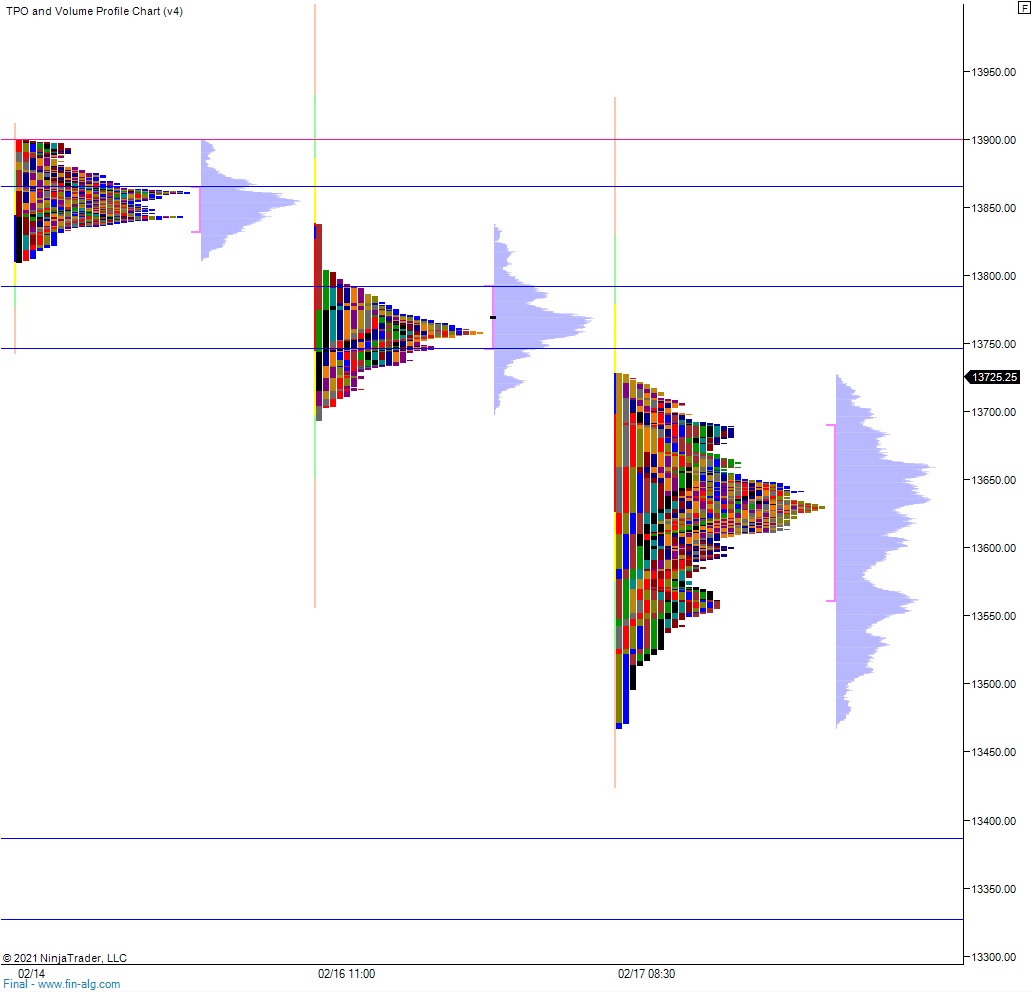

Yesterday we printed a double distribution trend up. The day began with a gap down into the lower quadrant of Wednesday’s range. After an open two-way auction sellers stepped in and drove price down to 13,500. Price overshot the century mark by about 30 points before a responsive bid stepped in. Said buyers reclaimed the midpoint and rallied about 30 points above it before one last check back to the mid. This check-back overshot the mid to the downside before buyers ultimately held the mid going into New York lunch. The rest of the session was spent rallying, with value shifting higher along the way. Buyers eventually tagged the Wednesday naked VPOC before we sort of chopped along the upper quad to end the day.

Heading into today my primary expectation is for buyers gap-and-go higher, trading up and closing the gap up at 13,749 before two way trade ensues.

Hypo 2 sellers to reject a move back into the Tuesday range, holding price below 13,730 before working into the overnight inventory and closing the gap down to 13,638.50. Look for buyers down at 13,600 and for two way trade to ensue.

Hypo 3 stronger buyers trade up to 13,792 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: