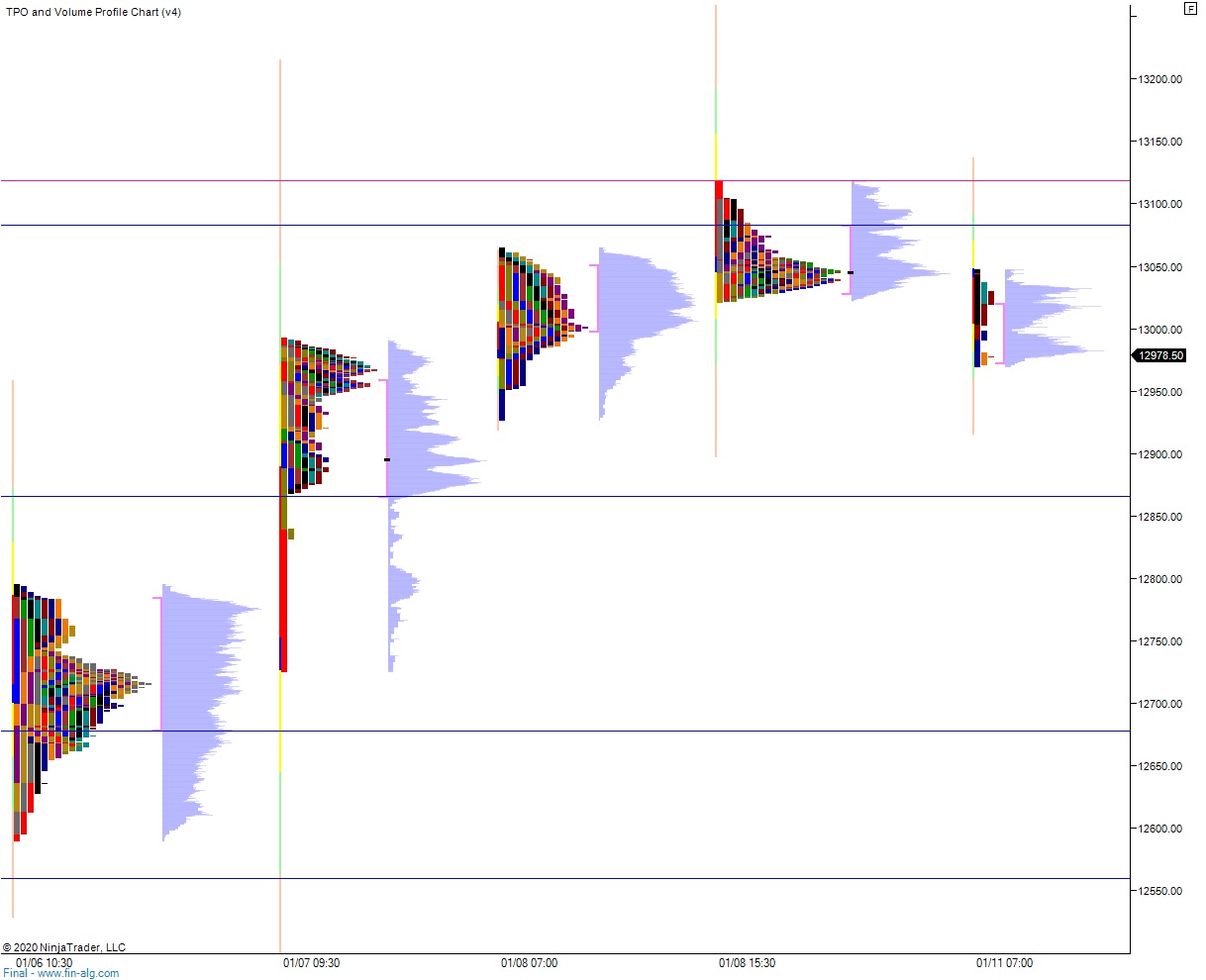

NASDAQ futures are off record highs heading into the second full trading week of the year after briefly poking to a new record high Sunday evening. The tech-heavy index made a new high when Globex opened for trade around 6pm New York before dropping off the high and going into a balance above last Friday’s midpoint. Then around 7:20am the overnight sellers became initiative and another down rotation formed. As we approach cash open, price is hovering below the Friday midpoint.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am followed by a 3-year note auction at 1pm.

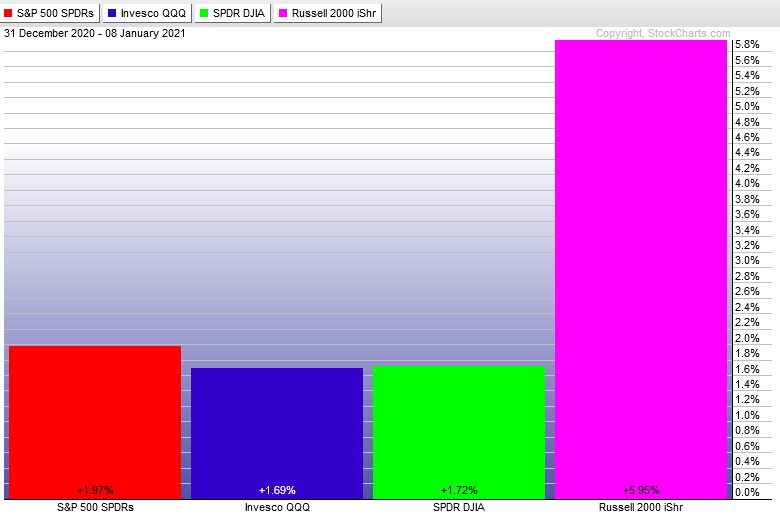

Last week kicked off with a small gap up that was faded by sellers. Sellers managed to resolve all open gaps left behind Christmas eve with three heavy hours of selling before a responsive bid stepped in, marking the low of the week. An early attempt Wednesday to recapture the lows came close on the NASDAQ but the other majors were well off their lows and we rallied into the weekend. Russell 2000 continued to be bullish divergent for a third week suggesting risk tolerance remains high.

Here is the last week performance of each major index:

On Friday the NASDAQ printed a neutral extreme up. The day began with a gap up beyond Thursday range. After a brief open auction outside range sellers stepped in and spiked price lower. The early spike failed to recapture the Thursday range. Instead buyers rejected the move and price made an early range extension up. Buyers held price above the daily midpoint until just after New York lunch when a strong sell rotation pressed the market to a new low of day, ultimately closing the overnight gap before a strong responsive bid was found. The rest of the session was spent rallying, from about 2pm onward, ultimately making a new daily high and closing on high of day.

Neutral extreme up.

Heading into today my primary expectation is for buyers to work into the overnight inventory and trade up to 13,082.75 before two way trade ensues.

Hypo 2 stronger buyers work a full gap fill up to 13,118.75 before two way trade ensues.

Hypo 3 sellers gap-and-go lower, tagging 12,928.75 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: