Good afternoon and good tidings lads. That first working week of 2021 was something was it not? Yes yes and while external events seem to continually trigger babied boomers and weak chinned men who hide behind even weaker beards, the woke or whatever you want to call us are just like…of course.

Nothing amuses me more than when a person logs into a social media platform to air their grievances about the social media platform using the social media platform’s tools. These are very special people. This one especially amuses me. Some folks think I bootlegged Mike’s handle when I made mine. Now here he is, up in his ivory tower somewhere in Florida (lol) tweeting about how he left Twitter:

i propose mike surrenders his handle to me https://t.co/pAkeUamkSd

— RAUL (@IndexModel) January 9, 2021

Going on Twitter to talk about how he doesn’t use Twitter. L. O. L.

Alright now listen, I mean nothing ill upon Mike or anyone else. Life is hardt enough as it is. There is no need for me to project cruelty across the interwebs. I am a decent feller, predisposed with a heck of a beautiful build, who happens to have bolted a model onto the side of Le Fly’s dang time machine that analyzes the behavior of the four major U.S. indices using AUCTION THEORY to create a five day forecast for the stock market. In other words, I built and index model.

That’s it.

That is why my handle on Twitter is @IndexModel (follow me bb…for fleets and tweets).

I came up through the school of thought that said it is impossible to predict the behavior of the stock market. While I hold this to be true, I learned that using data to drive the decision process takes a bit of the mental anguish out of this profession. Then, the more I began to viscerally understand auction theory and order flow, and the natural way that behavior can move and sway the markets short term, the more I realized I could develop a short term hypothesis that was correct more times than wrong.

I could see…what the market was likely to do over the next 6-30 minutes.

Not always correct.

But correct more times than wrong.

You can drive all the way across the country seeing only a small bit of highway illuminated by the headlights. Same idea. Take it one turn, one straight away, at a time. Okay now make a broad brush stroke in the general vicinity you wish to travel. Now pick your way across the land, back tracking if you reach an impasse, following the water, and so on. This is the five day index model forecast.

If you’re not good at being wrong trading, investing…not for you. Go find some fucking cave with a decent echo chamber, on parler or 8chan or wherever the autists have reconvened, and join along in the circle jerk fantasy of being right.

Hahaha…I’m “right” just barely more than I’m wrong. It comes down to risk management and having my ego stomped, ground up, mutilated, humiliated, and ultimately disintegrated into the ethereal realm where my being simply became just another orb of light occupying a fleshy chemical compound for a blip of time, before floating back into the darkness of space.

Preserving the bindu, I then made my way back to the speculative markets of high finance and began to make my way through the great rotarian scheme as a consistently profitable speculator.

Anyhow nothing lasts. For now things are going okay and that means my job is to convert the recent inflow of fiat into real assets. Places and things I can work with my hands. Earthships and ground-to-air heat transfer systems that will stand for hundreds of years, off the grid, sustaining plant and mammal life.

That’s all. Listen I don’t want to make anyone feel bad about being on the wrong side of history. But dammit, sometimes the only way to make you fuckers see the light is to demean you a bit. For the sake of clarity. The devil knows you’ll need it if you’re to make your way through a world dominated by artificial intelligence and constant surveillance.

Google is good. Amazon is great. We surrender or privacy, as of this date. I’d much rather my life be in the hands of The United Technology Congomerate than The United States of America. Big tech, the internet, these things are more powerful than the intangible (aka collective consciousness) notion of nation states.

Lines on a piece of paper, man. If anything, this place belongs to the trees, man. They were here long before us. They’ll be here long after us—if I have anything to say about it.

We own nothing. Land. We are merely stewards of it during our brief mortal existence. Our body…could easily be caged up by a team of robots. Stocks…L.O.L.

I think they get the point.

Ciao,

Raul Santos, January 10th, 2021

And now, the 320th edition of Strategy Session. Read and enjoy:

Stocklabs Strategy Session: 01/11/21 – 01/15/21

I. Executive Summary

Raul’s bias score 3.88, medium bull. Markets continue to hold the highs, perhaps trading sideways to mark time, perhaps with a slight upward drift. Keep an eye on Thursday morning. Earnings from Delta airlines and Taiwan semiconductor could put some directional movement into the overall tape heading into the weekend.

II. RECAP OF THE ACTION

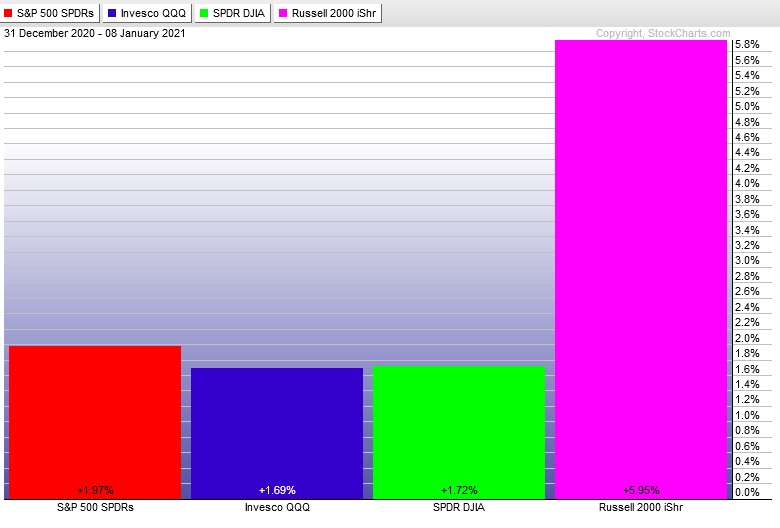

Small gap up into the week is faded by sellers. Sellers manage to resolve open gaps left behind Christmas eve with a three heavy hours of selling before a responsive bid steps in, marking the low of the week. An early attempt Wednesday to recapture the lows came close on the tech-heavy NASDAQ but the other majors were well off their lows and we rallied into the weekend. Russell 2000 continues to be bullish divergent for a third week suggesting risk tolerance remains high.

The last week performance of each major index is shown below:

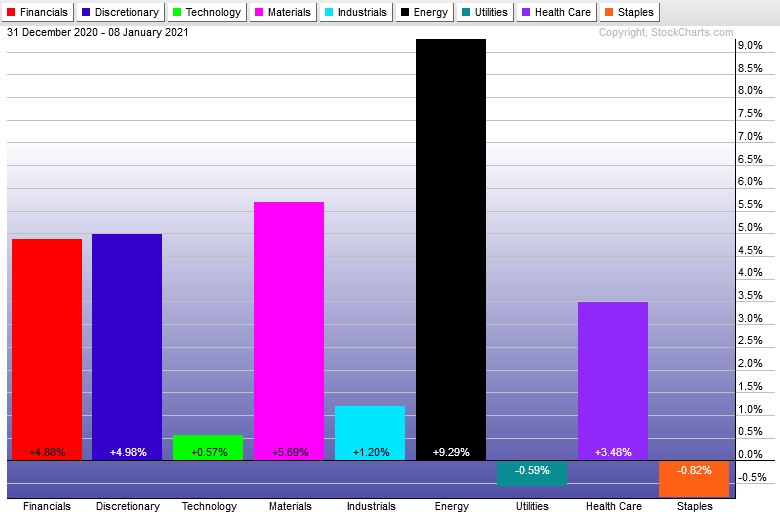

Rotational Report:

Lagging tech leaves reason for concern. Energy continues to behave independently from the overall market. Staples and Utilities lagged.

slightly bullish

For the week, the performance of each sector can be seen below:

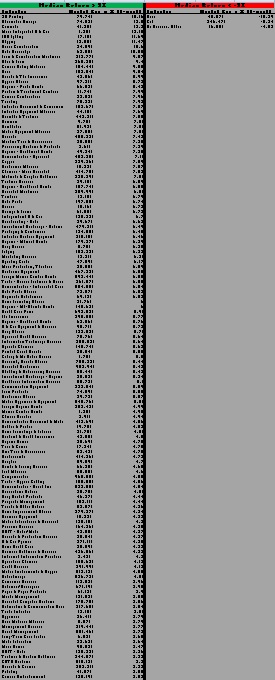

Concentrated Money Flows:

Industry flows break and show big inflows after being muted for several weeks. Last big skew happened back on December 20th: http://ibankcoin.com/raul3/2020/12/20/how-to-invest-like-a-proper-degenerate/

bullish

Here are this week’s results:

III. Stocklabs ACADEMY

Earnings

The biggest improvement to Stocklabs is the quality and amount of data fed into the systems. As we head into earnings season a key feature becomes critical for navigating the week—knowing who is set to report and when.

This information can be accessed from the Market Overview page. Click the “Earnings” heading to bring up a seven day calendar. Click any date to see who is set to report earnings on that date.

As noted in the executive summary this week, keep an eye on earnings out of TSM and DAL Thursday morning. Semiconductors are the primary driver of our secular bull market and TSM is a major chip maker that could sway the entire PHLX semiconductor index.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Markets continue to hold the highs, perhaps trading sideways to mark time, perhaps with a slight upward drift. Keep an eye on Thursday morning. Earnings from Delta airlines and Taiwan semiconductor could put some directional movement into the overall tape heading into the weekend.

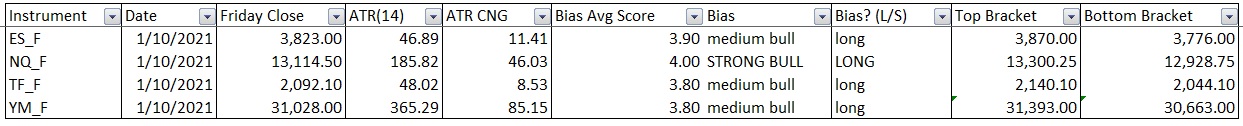

Bias Book:

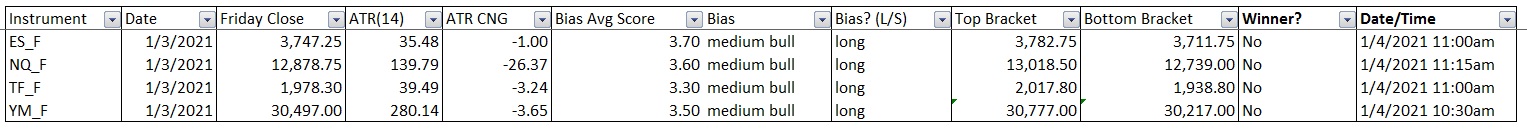

Here are the bias trades and price levels for this week:

Here are last week’s bias trade results:

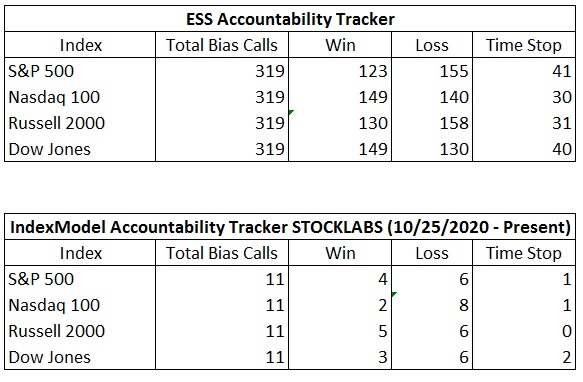

Bias Book Performance [11/17/2014-Present]:

Semiconductors back to rallying, Transports faked lower than ripped

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports nearly confirmed the failed auction set-up we’ve been watching for weeks. Instead the big red candle printed Monday was immidietly met by a big reversal higher Tuesday than an massive conviction rally Wednesday. This move takes the failed auction risk off the table. Now the question becomes, “are we in a fresh leg of discovery up or a balance?” Delta airline earnings Thursday morning may offer some clarity to our question.

See below:

Semiconductors continue to discover higher prices. MU earnings Thursday afternoon defiantly

See below:

V. INDEX MODEL

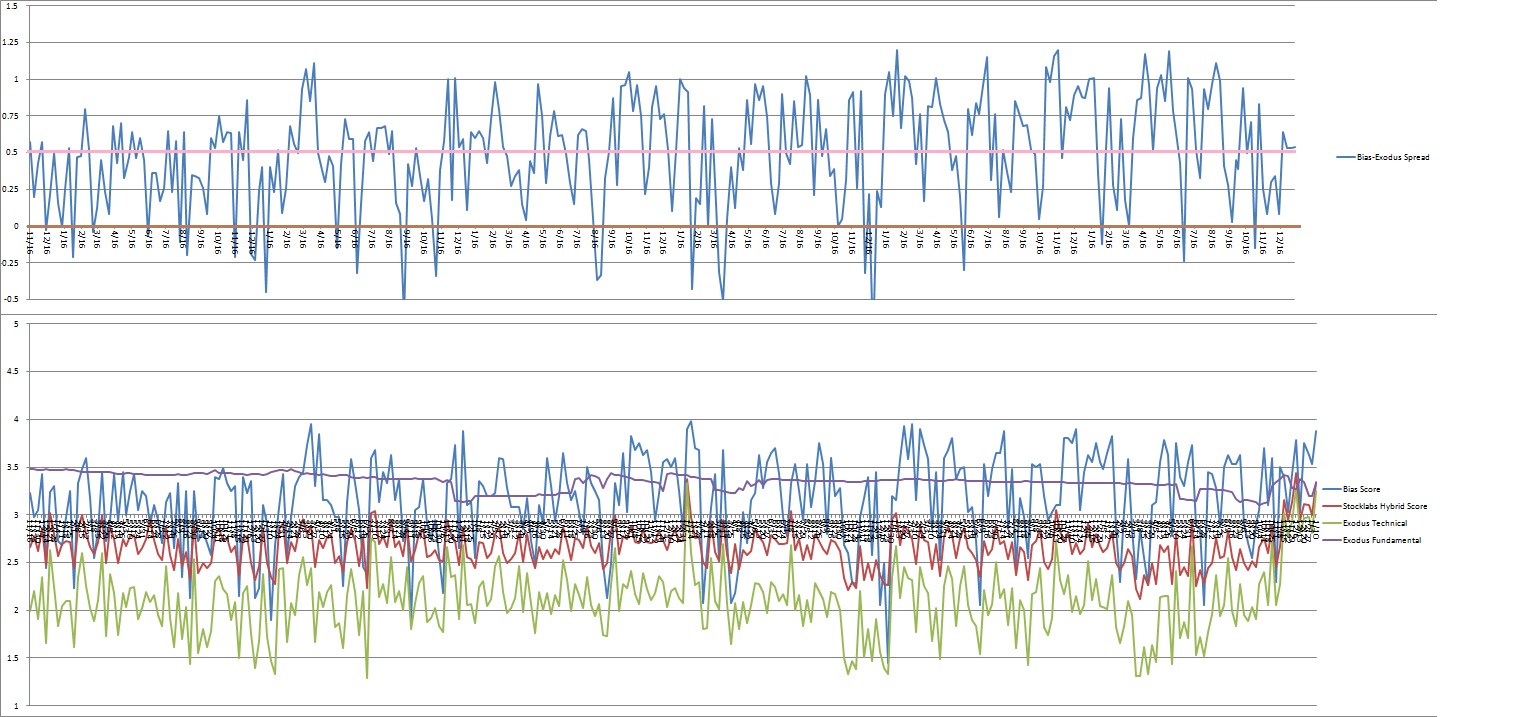

Bias model is neutral for a seventh consecutive week. No bias.

VI. Stocklabs Hybrid Overbought.

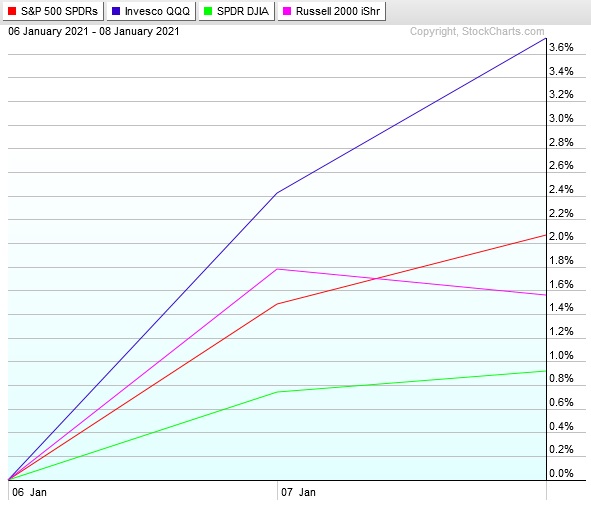

On Wednesday, January 6th Stocklabs flagged hybrid overbought on the 12-month algo. This is a bullish cycle that runs through Wednesday, January 20th end-of-day. Here is the performance of each major index so far:

VII. QUOTE OF THE WEEK:

“I done the best I could with what I had.” – Joe Louis

Trade simple, utilize your resources effectively

If you enjoy the content at iBankCoin, please follow us on Twitter

You are Ted DiBiase

perhaps a hybrid haha