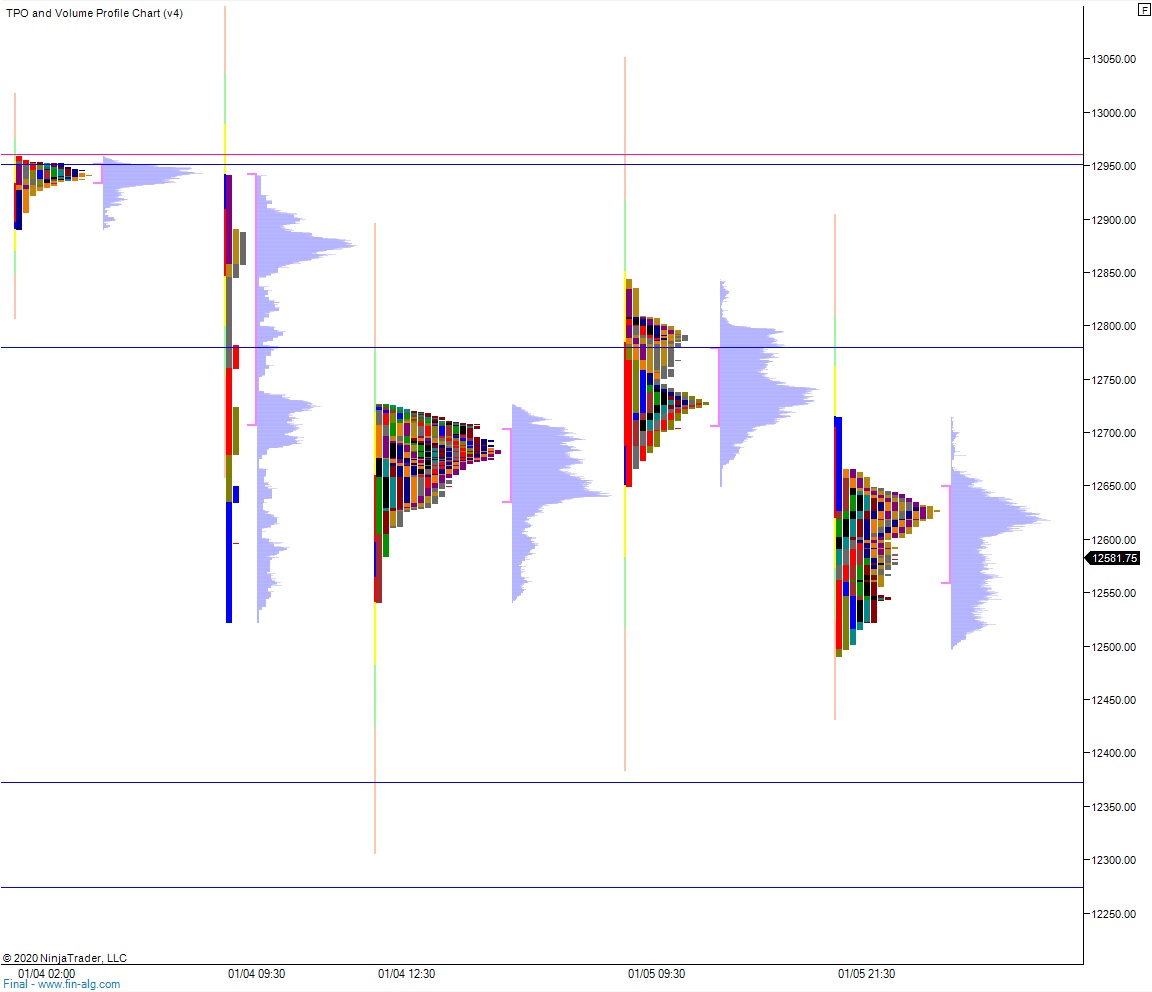

NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme range and volume. Price worked steadily lower overnight in two big rotations that lasted until about 3:45am New York. Responsive buyers stepped in after price action worked down below the Monday low. Since then action has been choppy, chopping inside the lower quadrant of Monday’s range as we approach cash open.

On the economic calendar today we have factory orders at 10am, crude oil inventories at 10:30am then the FOMC minutes at 2pm.

Yesterday we printed a normal variation up. The day began with a slight gap down that buyers quickly resolved with an open drive up. The buying continued up through the Monday midpoint before stalling around 10:30am and falling back to the daily mid. Price chopped the mid for several hours before the buyers resassumed control around 1:45pm. Said buyers made a new daily high which was quickly met with responsive selling. A ramp into the close ensured a close near the daily high.

Heading into today my primary expectation is for buyers to work into the overnight inventory and reclaim the Monday low 12,650.25 setting up a run to 12,700 before two way trade ensues.

Hypo 2 stronger buyers work a full gap fill up to 12,791.50 then continue higher, taking out overnight high 12,844.25 before two way trade ensues.

Hypo 3 sellers gap and go lower, trading down through overnight low 12,491.25 setting up a liquidation down to 12,400. Look for buyers down at 12,373 and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: