NASDAQ futures are coming into Wednesday with a slight gap up after an overnight session featuring elevated range and volume. Price was balanced overnight, doing a little down rotation until about 8pm New York then doing an up rotation to negate it. At 8:30am durable goods orders and jobless claims data came out better than expected. As we approach cash open, price is hovering in the upper quadrant of Tuesday’s range.

Also on the economic calendar today we have new home sales and consumer sentiment at 10am and crude oil inventories at 10:30am.

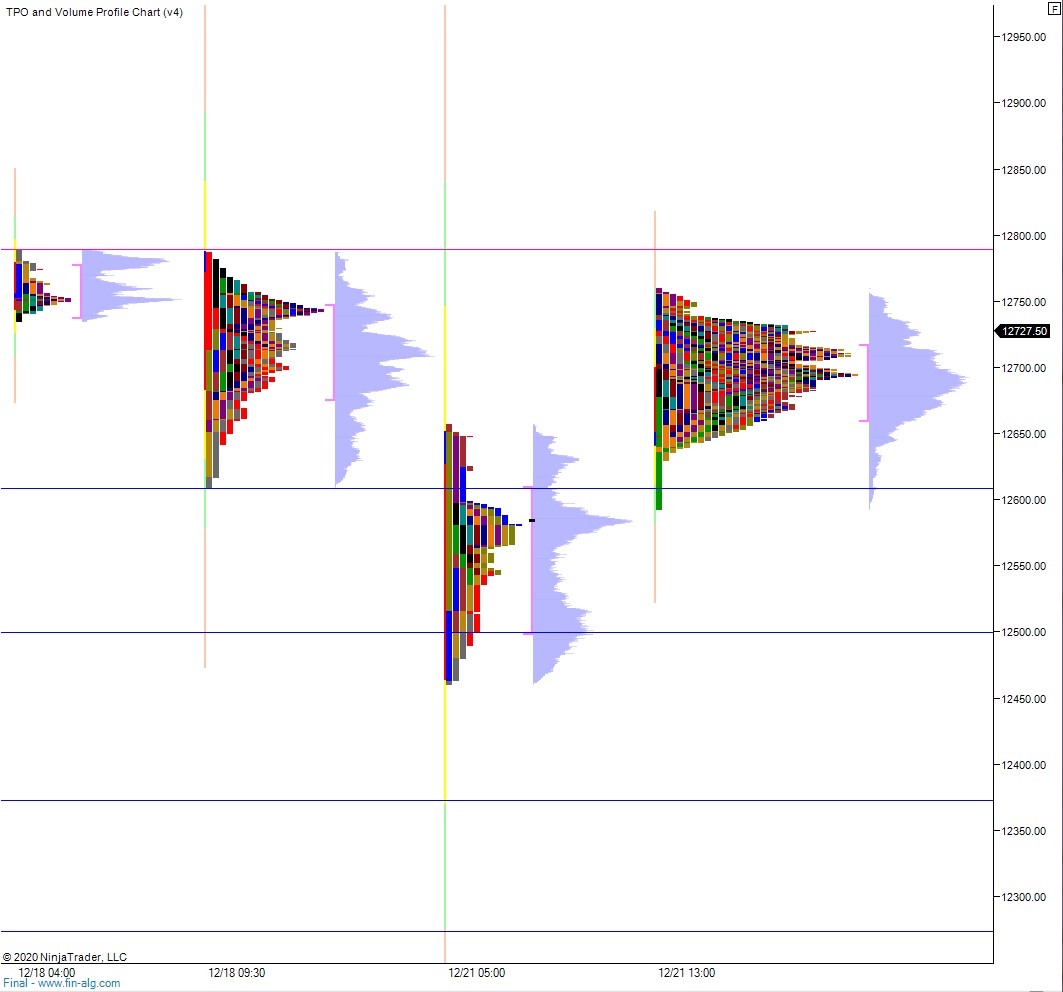

Yesterday we printed a normal variation down. The day began with a gap up just beyond the Tuesday range. The open two-way auction first saw buyers rejecting an attempt back into Monday range. Then a brief push higher before sellers stepped in and worked the overnight gap fill closed. Sellers then spiked a bit lower, probing into the conviction buying seen Monday afternoon. Buyers defended their territory and formed a sharp excess low before reclaiming the midpoint. The rest of the session was spent marking time and we ended the day above the midpoint.

Heading into today my primary expectation is for buyers to gap-and-go higher, poking up beyond Tuesday high 12,754.25 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the gap down to 12,709.75. From here sellers continue lower, taking out overnight low 12,630.25 before two way trade ensues.

Hypo 3 stronger buyers trade up to 12,800 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: