NASDAQ futures are coming into the final trading session of November with a slight gap up after an overnight session featuring extreme range and volume. Price was choppy overnight, first taking out last week’s high, then steadily rotating lower until taking out Friday’s low before eventually working back to the middle of Friday’s range. As we approach cash open, price is hovering at Thursday’s midpoint.

On the economic calendar today we have Chicago PMI at 9:45am, pending home sales at 10am and 3- and 6-month T-bill auctions at 11:30am.

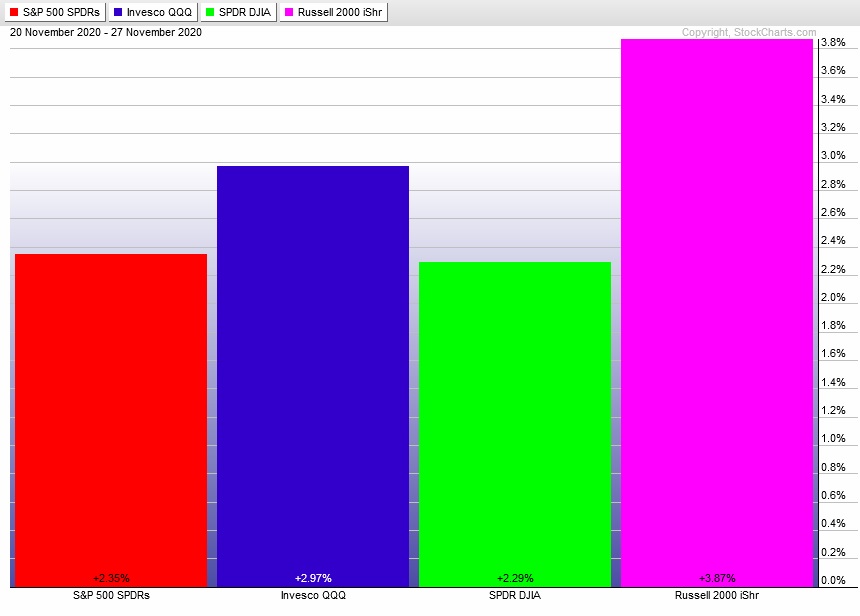

Last week featured sellers early Monday discover a strong responsive bid. The rest of the holiday week was spent rallying. The last week performance of each major index is shown below:

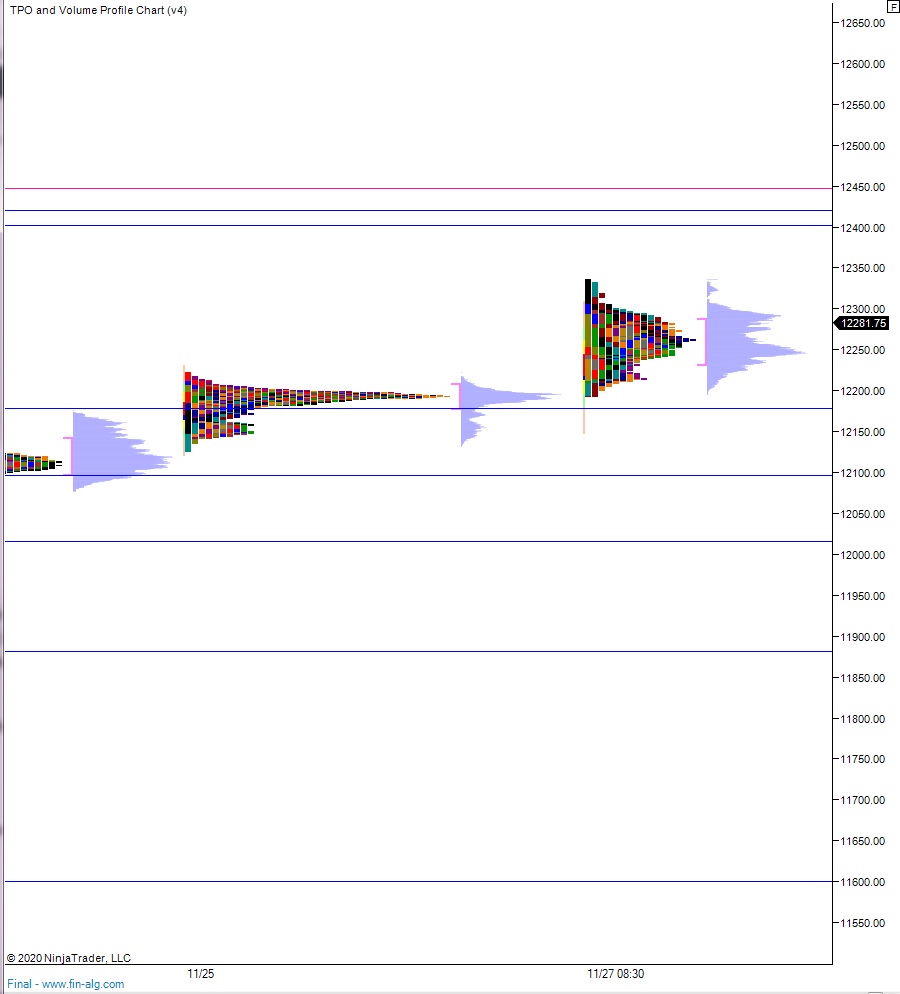

On Friday the NASDAQ printed a normal variation up. The day began with a gap up beyond the prior day’s range and after a brief two-way auction buyers ramped price higher. The auction continued higher for a bit more than an hour, going range extension up and trading into levels unseen since September 2nd before falling back to the mid. The truncated session wrapped up around 1:15pm with price just above the mid.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 12,272.25. Then we press up through overnight high 12,337.25 before two way trade ensues.

Hypo 2 gap-and-go higher, working up to 12,400 before two way trade ensues.

Hypo 3 stronger sellers close overnight gap 12.272.25 then continue lower, down through overnight low 12,193.50. Look for buyers down at 12,178 and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves:

good