NASDAQ futures are coming into the holiday week with a slight gap up after an overnight session featuring elevated range and normal volume. Price worked higher overnight, working up near the upper quadrant of last Friday’s range before falling back into the middle of balance. At 8:45am this activity out of the White House caused a minor stir in the price of NASDAQ futures:

**White House Weighs New Action Against Beijing–Sources

— *Walter Bloomberg (@DeItaone) November 23, 2020

As we approach cash open, price is hovering right along last Friday’s midpoint.

On the economic calendar today we have PMI composite flash at 9:45am, 6- month and 2-year bill and note auctions at 11:30am and 3-month and 5-year note auctions att 1pm.

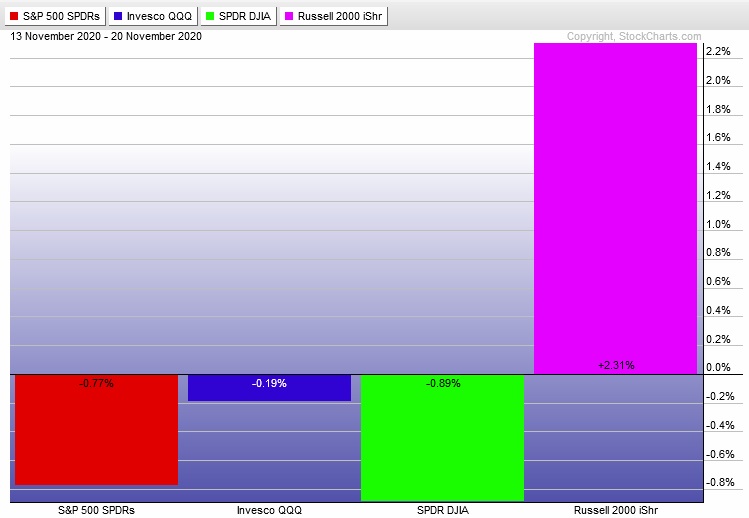

Last week was a bit of a chop fest. Little price discovery happened except for what we saw from the Russell 2000 which was bullish divergent. This suggests risk tolerance remains elevated. The last week performance of each major index is shown below:

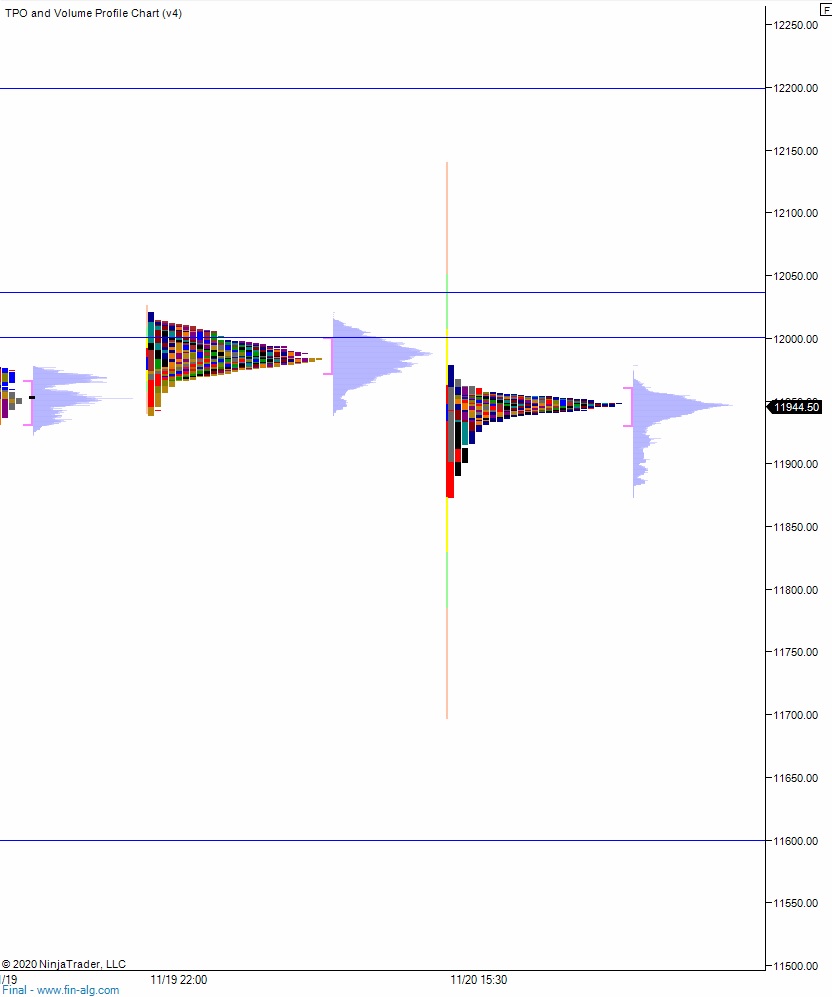

On Friday the NASDAQ printed a neutral extreme down. The day began with a slight gap up beyond the Thursday range. After an open two-way auction sellers managed to close the small overnight gap before buyers made a small rotation higher and into range extension up. Said buyers never exceeded the Wednesday high. Instead we fell back to the midpoint and chopped along its topside for several hours. Late in the session a wave of selling pressed us into a neutral print and continued slashing lower into settlement. The move never made it through the prior session low.

Heading into today my primary expectation is for buyers to hold bids above 11,900 setting up a move up through overnight high 11,979. Look for sellers up at 12,000 and for two way trade to ensue.

Hypo 2 sellers work into the overnight inventory and close the gap down to 11885.25. This sets up a run down through overnight low 11,873.50. Look for buyers down at 11,800 and for two way trade to ensue.

Hypo 3 stronger buyers trade up to 12,035.75 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: