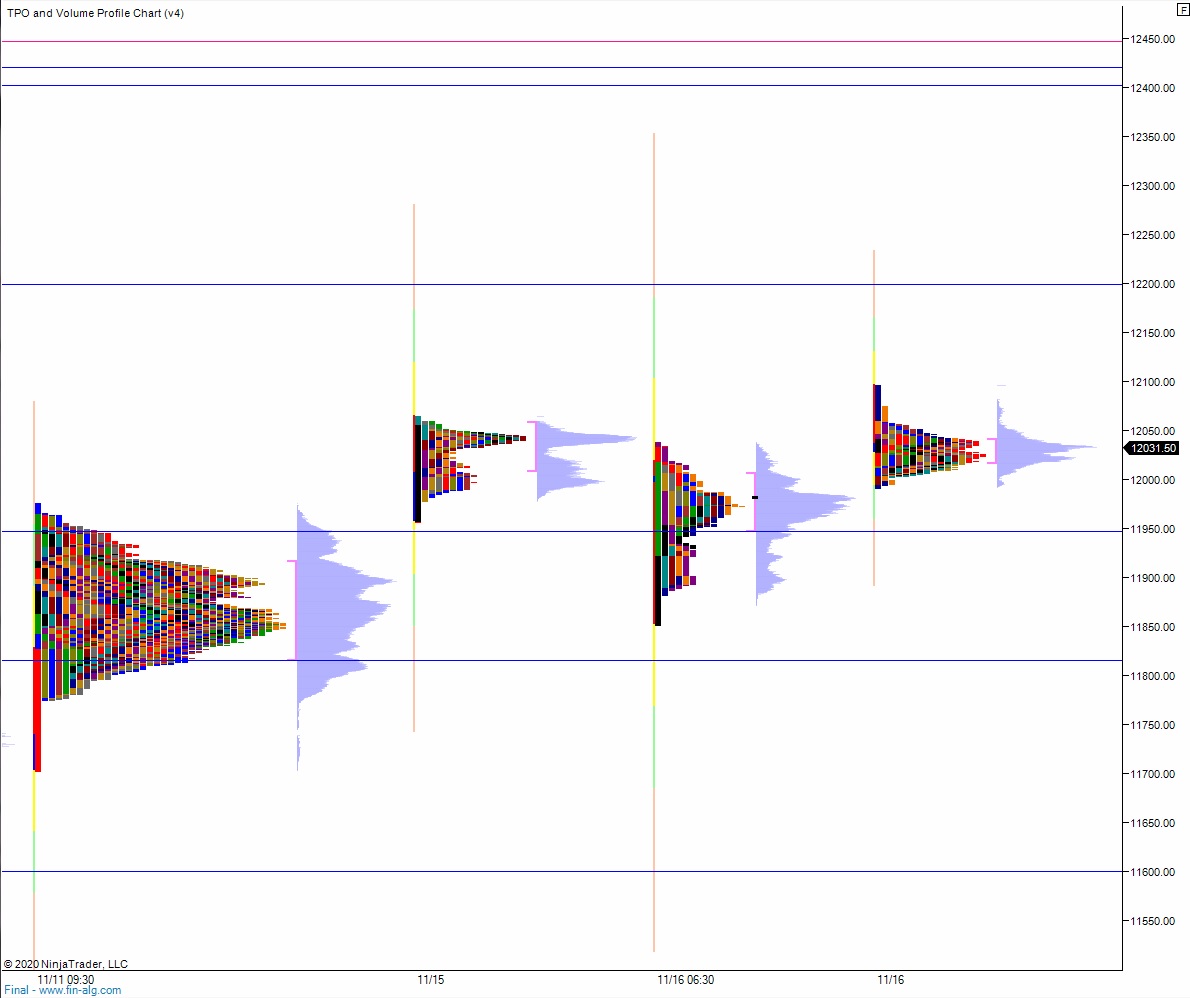

NASDAQ futures are coming into Tuesday with a slight gap up after an overnight session featuring elevated range and volume. Price popped higher overnight, trading up beyond the weekly high set Sunday evening around 8pm New York. The action saw price tag the naked VPOC from last Monday before coming into a tight balance. At 8:30am retail sales data came out a bit below expectations and more importantly Walmart earnings have the general retailers share off by -1.5% in pre-market trade. At 9:15 industrial production data came in as expected, and as we approach cash open price is hovering right along the Monday high.

Also on the economic calendar today we have business inventories and housing market index at 10am.

Yesterday we printed a normal variation up. The day began with a slight gap down and after an open two-way auction buyers quickly closed the overnight gap. The buying campaign continued higher, trading up and tagging the 12,000 century mark and going about 25 points beyond it before encountering any resistance. Then price checked back to the midpoint, went slightly below it, but buyers ultimately held the mid. Price ramped up into the closing bell and closed along the highs.

Heading into today my primary expectation is for buyers to work up through overnight high 12,096.25 and tag 12,100.

Hypo 2 sellers work into the overnight inventory and close the gap down to 12,025.75. From here sellers continue lower, down through overnight low 11,991.50 before two way trade ensues.

Hypo 3 stronger sellers trade down to 11,946.75 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: