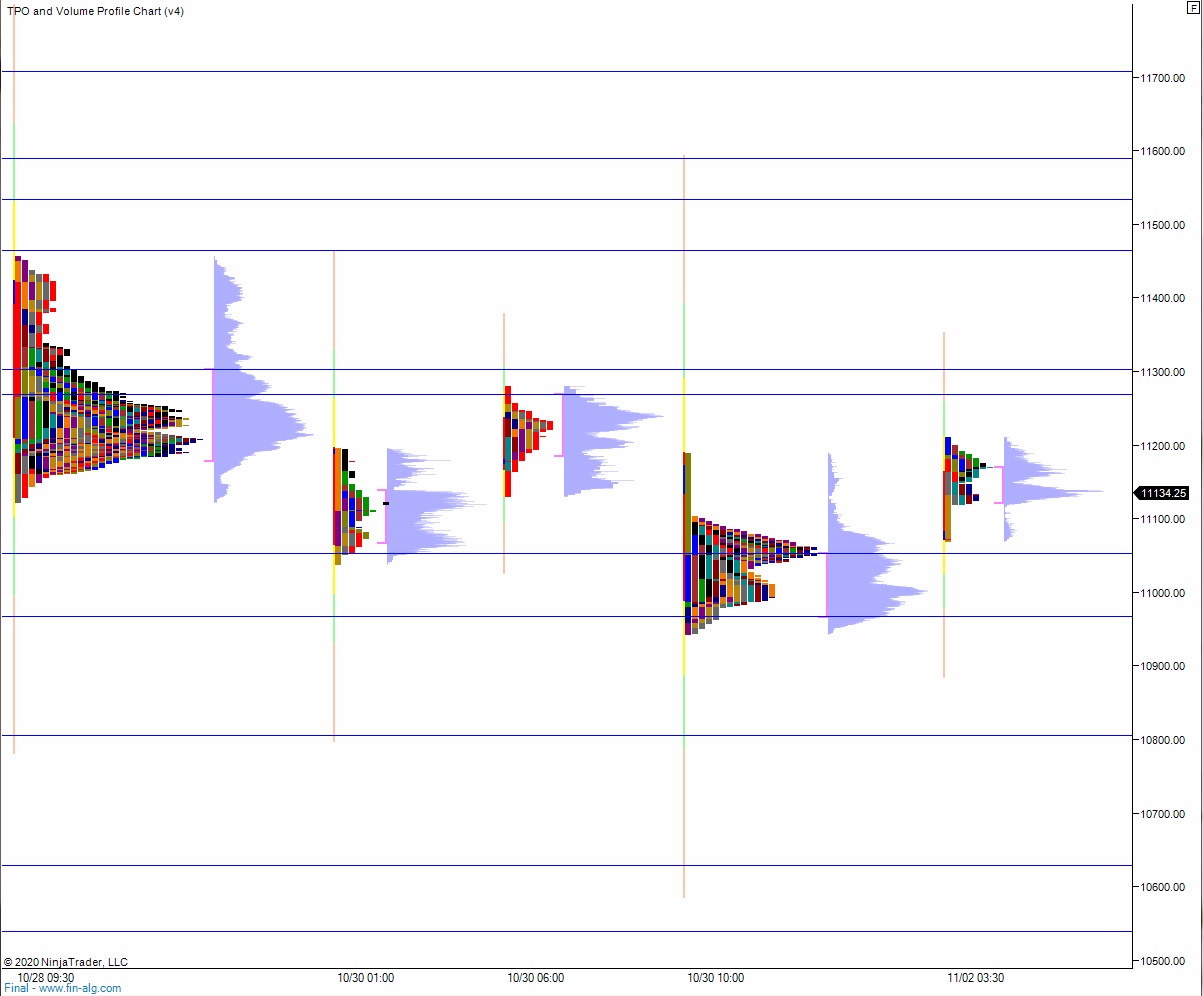

NASDAQ futures are coming into the first day of November and the day before the presidential election gap up after an overnight session featuring extreme range and volume. price was choppy overnight, chopping around the unchanged level until about 4am New York. Buyers pushed price higher around then, driving up into the upper quadrant of last Friday’s range before encountering meaningful responsive selling. Sellers defended the 11,200 level, and as we approach cash open price is hovering a bit above the Friday midpoint.

On the economic calendar today we have ISM manufacturing at 10am.

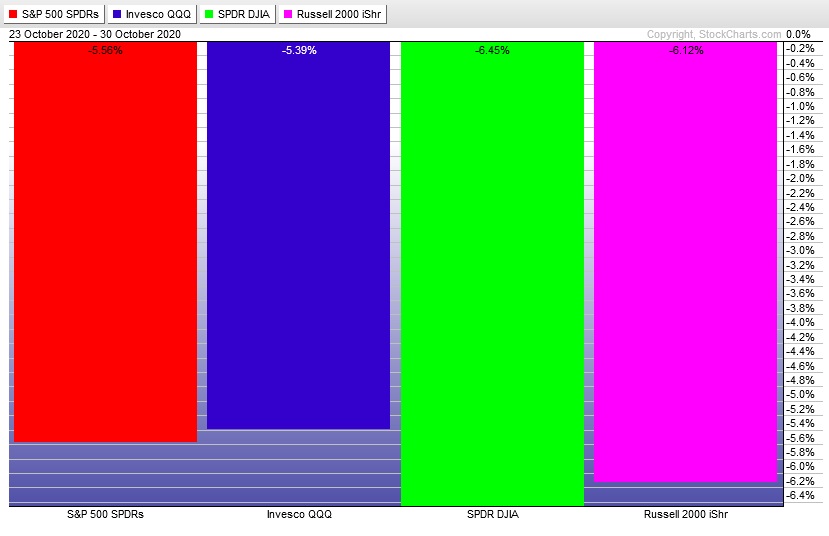

Last week was choppy through Tuesday then we saw a big move lower Wednesday. Thursday was buyers attempting to reject the big sell but then Friday prices continued to slide lower. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a double distribution trend down. The day began with a gap down near the Thursday low. A brief two-way auction saw buyers fail to press out of the lower quadrant of Thursday’s range. Instead sellers stepped in and drove down through the weekly low. The selling continued, unidirectional rotating down into the lower quadrant of the range from 09/25, a conviction buying day. Around 11:30am responsive buyers stepped in and worked a sharp rotation higher but were again overwhelmed by sellers. Sellers had price back on the lows by 3pm and we chopped along the lows until the end of the day when a ramp higher took price about a quarter of the way off the lows.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 11,072.25. Look for buyers down at 11,054.25 and for two way trade to ensue.

Hypo 2 stronger sellers tag 11,000 then continue lower, taking out overnight low 10,981.75. Look for buyers down at 10,967.25 and for two way trade ensue.

Hypo 3 buyers press a gap-and-go, trading up through overnight high 11,211.50 early on and continuing up to 11,267.50 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: