NASDAQ futures are coming into the last full week of September gap down after an overnight session featuring extreme range and volume. Price was balanced overnight until about 3:20am when sellers stepped in and drove price down through last Friday’s low. As we approach cash open, price is bouncing along, right around the Friday low.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

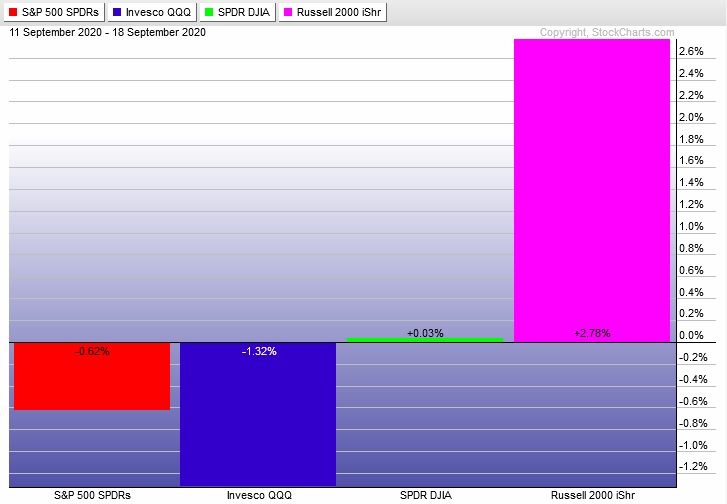

Last week featured a three day rally—rallying up into the FOMC rate decision then selling off for the rest of the week. There was a decent ramp higher into the Friday close. The Russell was divergent strong, suggesting a decent risk appetite still exists. The last week performance of each major index is shown below:

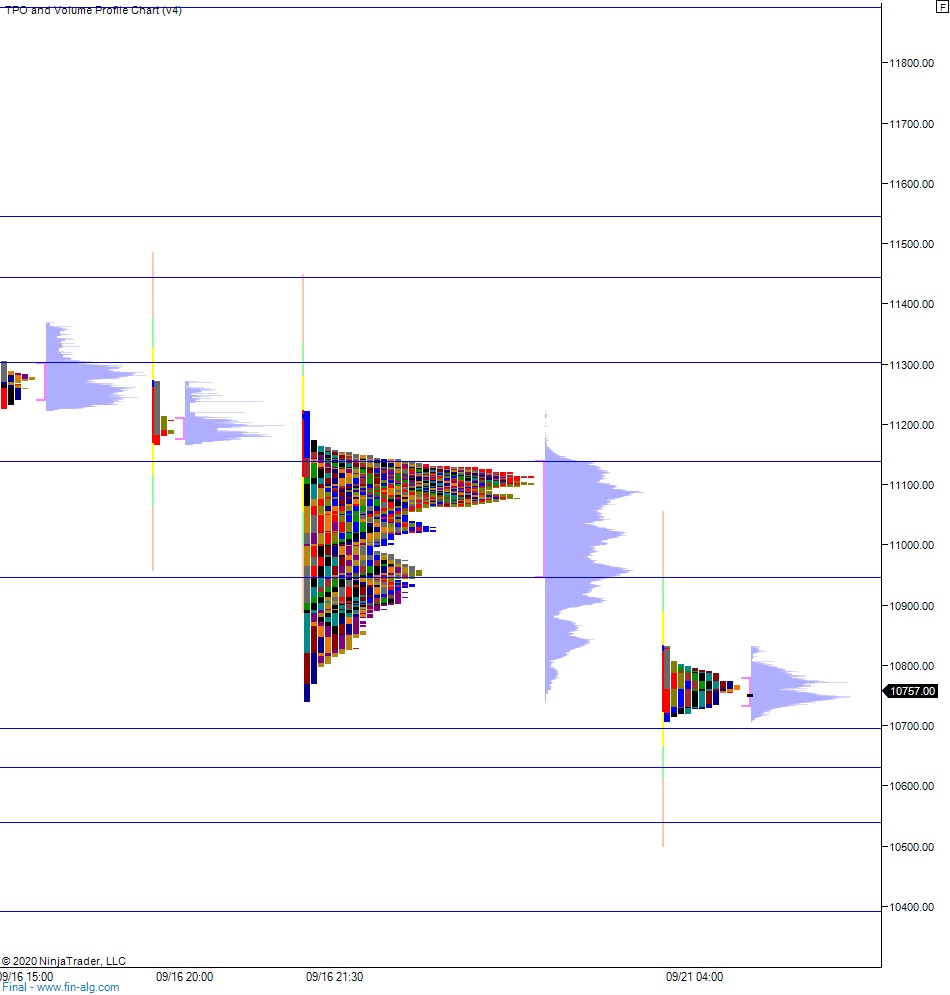

On Friday the NASDAQ printed a double distribution trend down. The day began with a slight gap up that sellers drove down into at the open. This selling continued until tagging Thursday’s volume point of control. A strong responsive bid stepped in here and formed a sharp excess low. The low would not hold, however, by late morning sellers were pressing into the tap again and before lunch the Thursday low was taken out. There was a minor battle along the Thursday low before the selling campaign continued, trading down into levels unseen since July 31st. Then around 1:45pm the auction reversed. We spent the rest of the day ramping higher. We closed just below the daily midpoint.

Heading into today my primary expectation is for buyers to work into the overnight inventory and work a partial gap fill up to 10,880 before two way trade ensues.

Hypo 2 gap-and-go lower, liquidating down through overnight low 10,708.50. Buyers cannot hold 10,700 setting up a move down to 10,630.25 before two way trade ensues.

Hypo 3 buyers work a full gap fill up to 10,927.50 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: