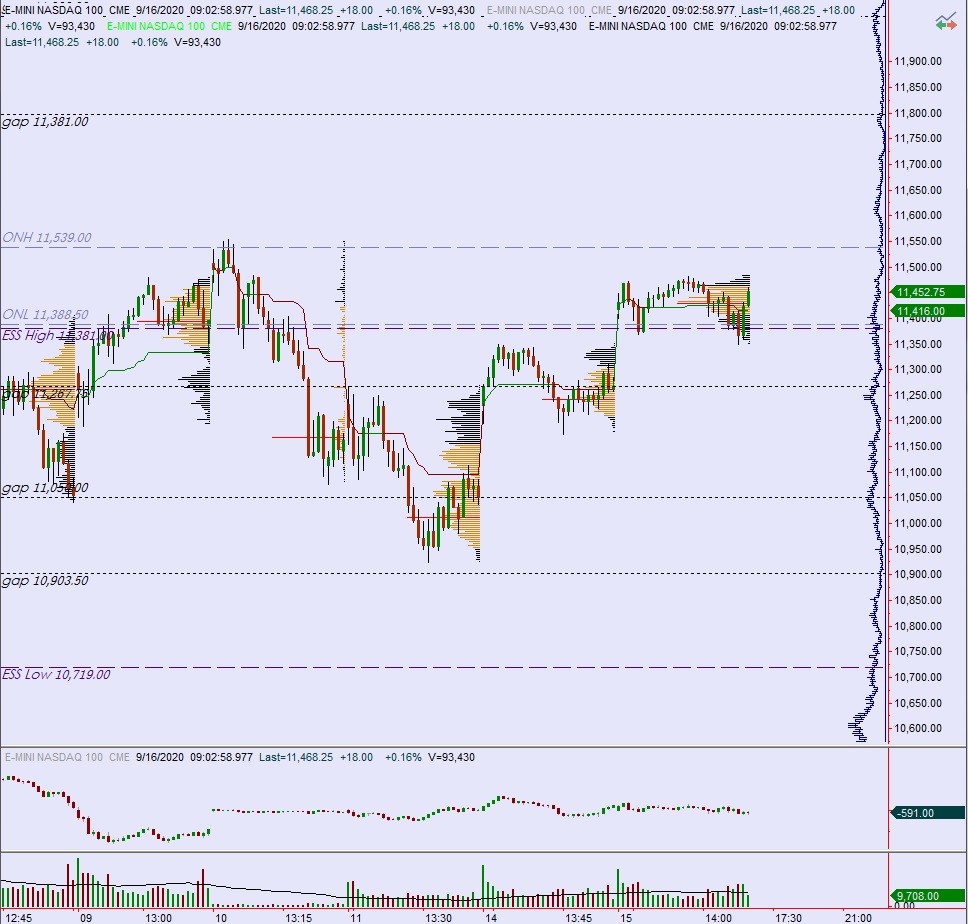

NASDAQ futures are coming into Wednesday with a slight gap up after an overnight session featuring extreme volume and range. The campaign higher continued overnight, with buyers bidding the Globex market back up near last Thursday’s high (but not exceeding it) before discovering responsive sellers. Said sellers stepped in around 7am New York and knocked price back down into Tuesday’s range. At 8:30am retail sales data came out weaker than expected. The market hasn’t shown much reaction to the data point so far, and as we approach cash open price remains hovering in the upper quadrant of yesterday’s range.

Also on the economic docket today we have business inventories and housing market index at 10am followed by crude oil inventories at 10:30am. Then comes the FOMC rate decision at 2pm followed by a press conference from Federal Reserve Chairman Powell at 2:30pm.

Fed fund futures are currently pricing in a 100% probability that the Fed will keep their benchmark borrowing rate pinned at 0%. The event is likely to cause an uptick in volatility as investors attempt to price in any further clarity they gain on the changes announced by Powell at the Jackson Hole symposium last month along with other factors like new economic forecasts and whether the central bank will commit to allowing inflation to overshoot their 2% target before tightening.

Yesterday we printed a neutral day. The day began with a gap up beyond Monday’s range. There was an open drive higher which stalled out within the first 30 minutes. Sellers managed to press the market range extension down right around 10:30am but buyers rejected an attempt back into Monday’s range. Instead price recovered the daily midpoint by late morning. Around 1:15 the market went range extension up, pressing into a neutral print. Sellers quickly reverted that move back to the midpoint before crossing down through it and making a new low of day. Again buyers were seen rejecting a move back into Monday’s range. Price ramped back up through the mid and ended the day in the upper quadrant of range.

Choppy neutral day.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 11,452.75. From here sellers continue lower, taking out overnight low 11,388.50 before two way trade ensues. Then watch for third reaction to the FOMC announcement to dictate direction into the close.

Hypo 2 stronger sellers trade down to 11,300. Then watch for third reaction to the FOMC announcement to dictate direction into the close.

Hypo 3 buyers press up through overnight high 11,539. Look for sellers just above at 11,545.25. Then watch for third reaction to the FOMC announcement to dictate direction into the close.

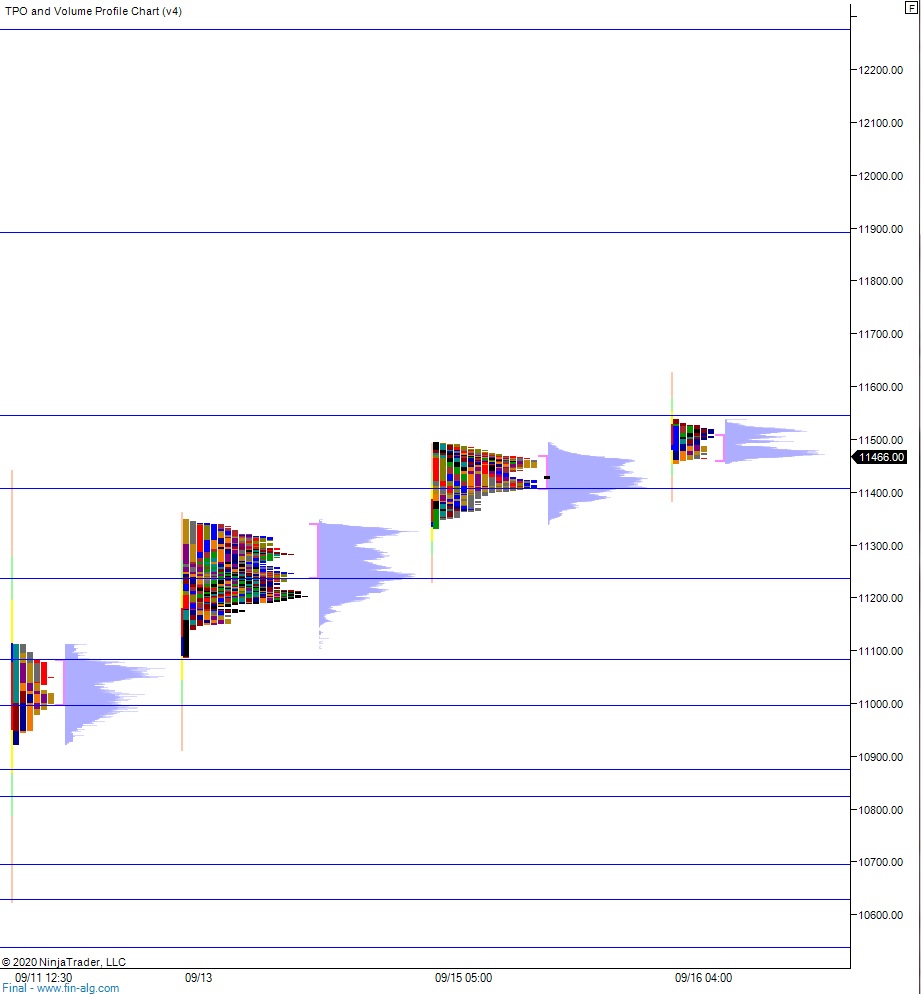

Levels:

Volume profiles, gaps and measured moves: