NASDAQ futures are coming into Wednesday up about +150 after an overnight session featuring extreme range and volume. Price drove higher overnight, steadily campaigning higher until about 6am. Sellers became active around Tuesday’s midpoint, and as we approach cash open, price is hovering below Tuesday’s midpoint.

On the economic calendar today we have JOLTS jobs openings at 10am followed by a 10-year note auction at 1pm.

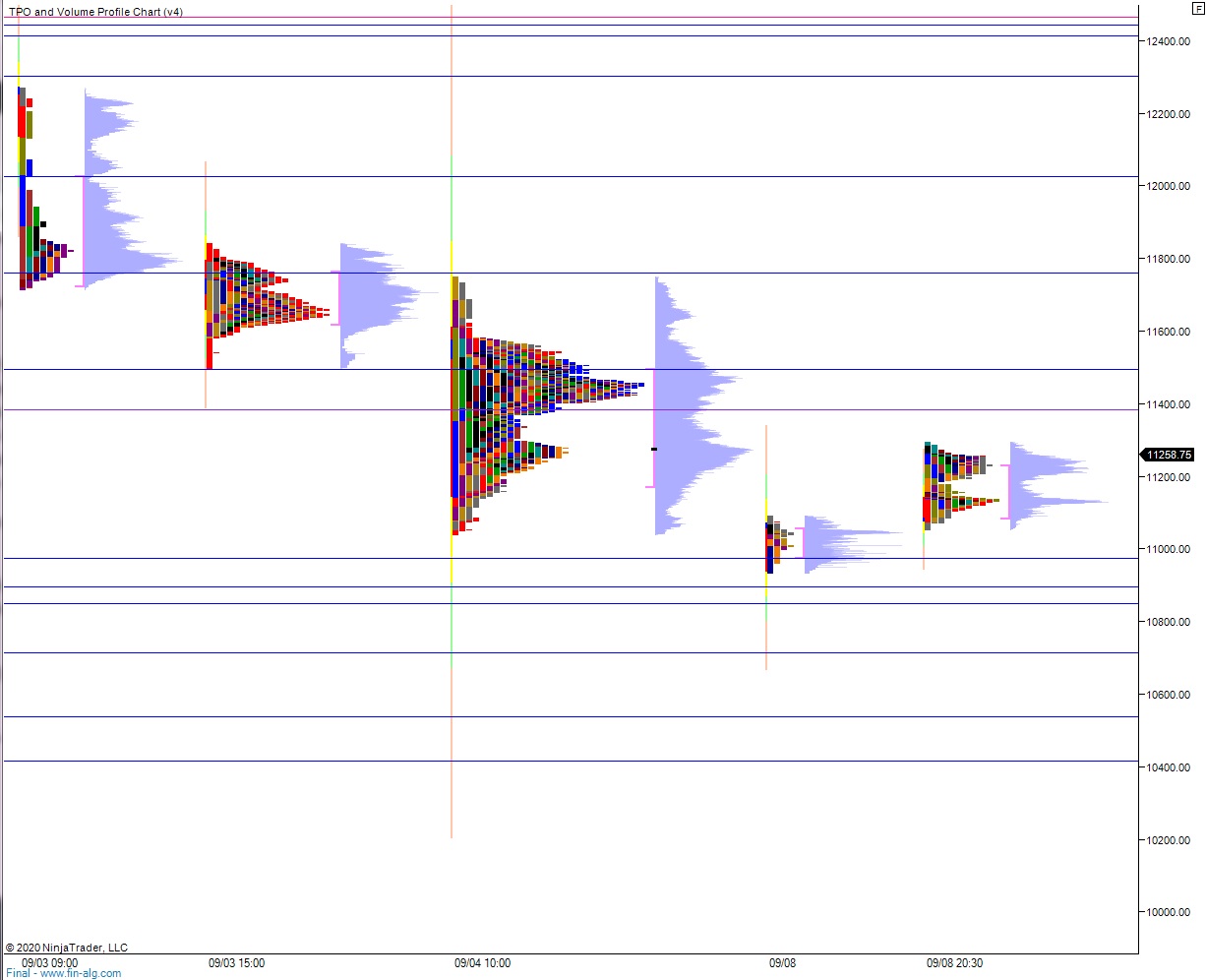

Yesterday we printed a neutral extreme down (barely). The day began with a gap down near last Friday’s low. The open auction was fast, bouncing first higher then lower to take out the Friday low by a few points before forming a sharp excess low. From then on the next hour was spent campaigning higher, filling a half gap up to 11,400. Then sellers knocked price back down through the daily midpoint. We chopped along the daily midpoint until about 2:30pm when sellers stepped in and drove lower. Sellers worked lower and ended the day on the lows.

We were only range extension up for about 2 minutes. It is debatable that yesterday was a normal variation down.

Heading into today my primary expectation is for sellers to work into the overnight inventory, closing the gap down to 11,054.50. Look for buyers down at 11,000 and for two way trade to ensue.

Hypo 2 stronger sellers trade down through overnight low 10,935.25 tagging the open gap at 10,903.50 before two way trade ensues.

Hypo 3 buyers gap-and-go up through overnight high 11,296.25. Look for sellers up at 11,411.50 and two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: