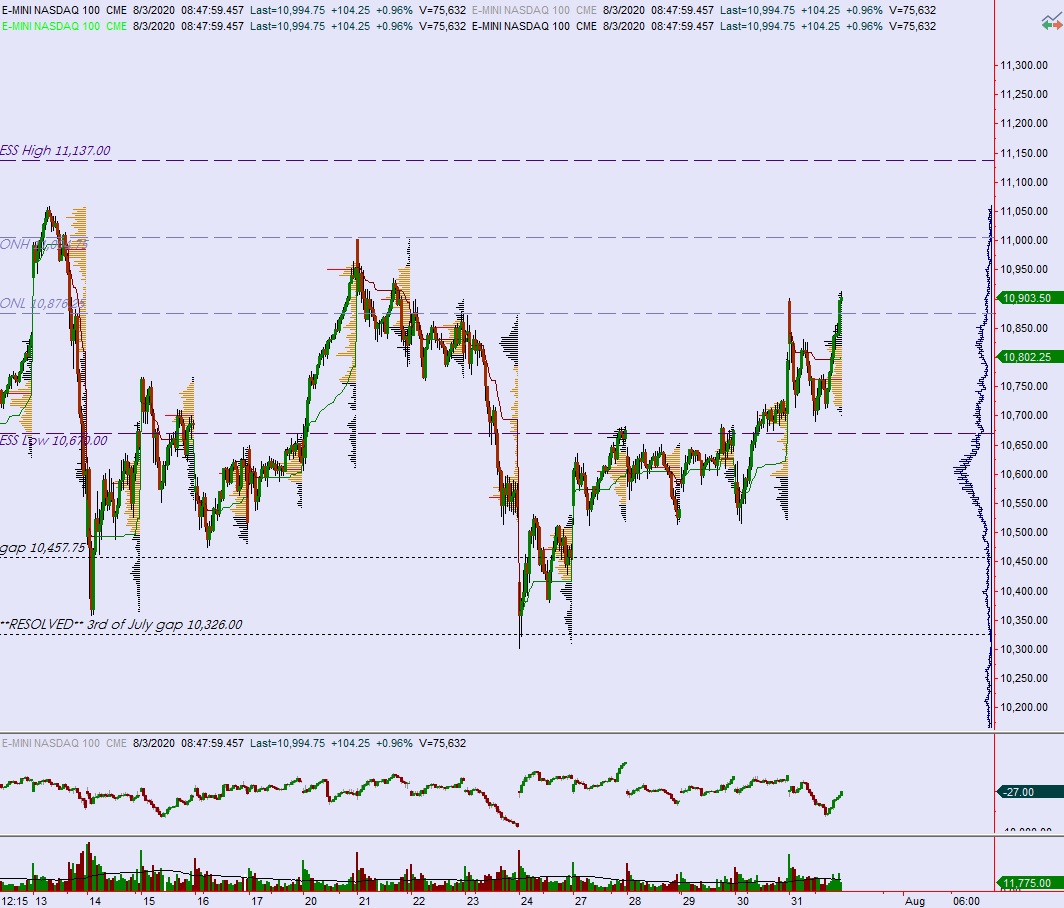

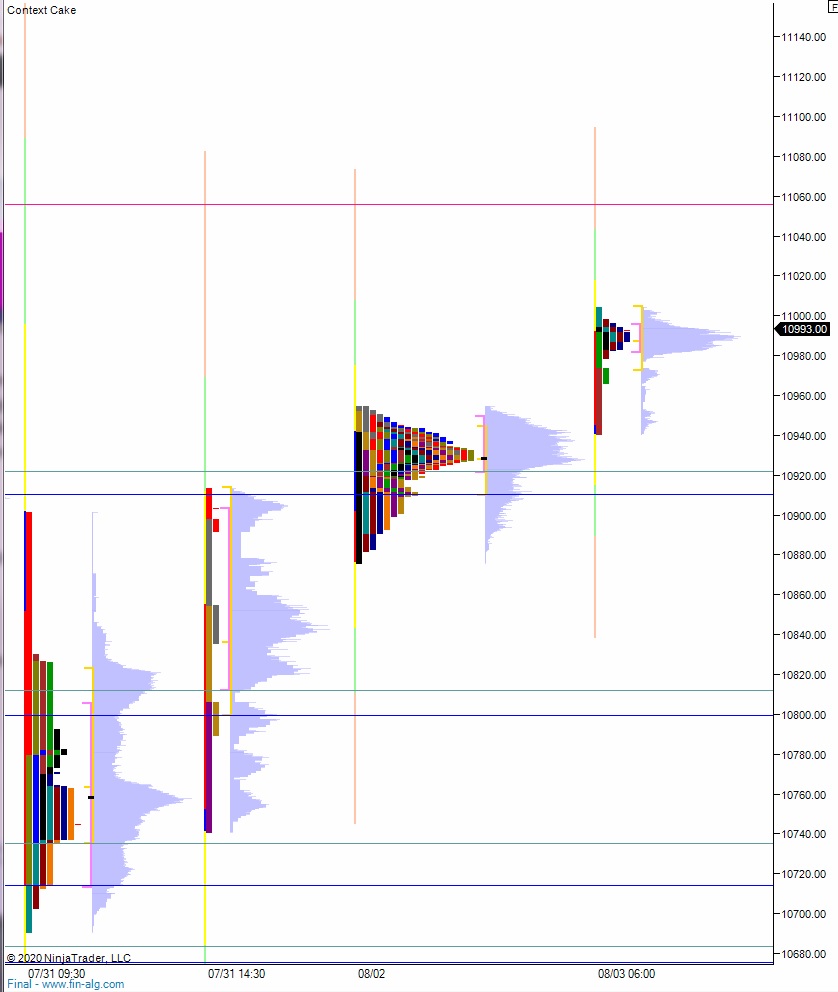

NASDAQ futures are coming into the first official trading day of August gap up after an overnight session featuring extreme range on elevated volume. Price worked steadily higher overnight, first taking out the Friday high during the Globex open at 6pm Sunday, then balancing up along it until about 6:20am New York. Since then price has worked higher and as we approach cash open price is hovering above the 07/21 high. Recall that 7/21 was the day sellers defended the top of their 07/13 conviction selling day and reversed the auction lower.

On the economic calendar today we have ISM manufacturing index and construction spending at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

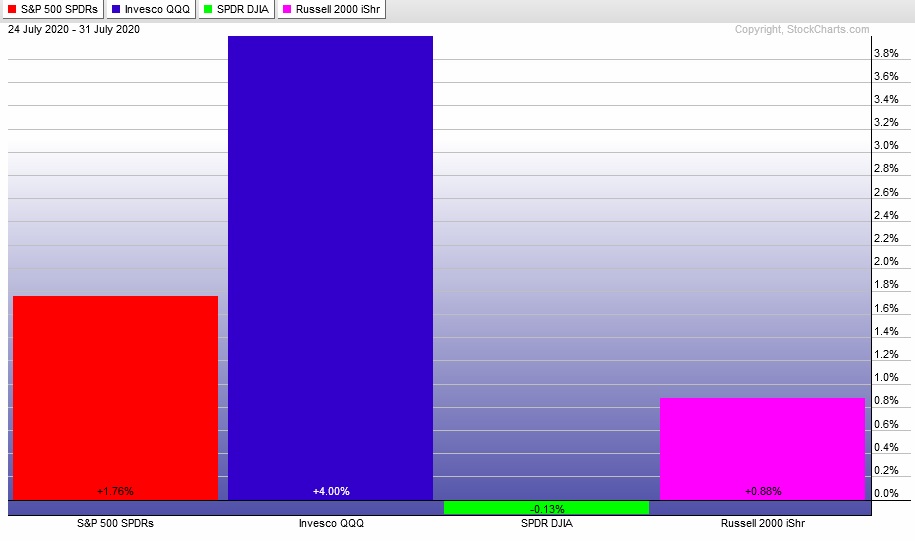

Last week also kicked off with a gap up. The whole week was spent bouncing along, above last Friday’s high before buyers eventually ended the week on a strong note. Through all this the Russell and Dow (which don’t contain big tech) lagged behind. The last week performance of each major index is shown below:

On Friday the NASDASQ printed a neutral extreme up. The day began with a gap up. Sellers drove lower off the open and made short work of closing the overnight gap. Sellers then continued lower, tagging Thursday’s naked VPOC before a strong buying rotation sent price back up to the daily midpoint. Sellers defended and made a new low, but by late afternoon a powerful ramp was setting up. Buyers eventually ramped price clean up through the entire daily range and ended at a new high of day.

Neutral extreme up.

Heading into today my primary expectation is for buyers to gap-and-go higher, probing up beyond all-time high print 11,058.50 before two way trade ensues.

Hypo 2 stronger buyers tag 11,137 before two way trade ensues.

Hypo 3 sellers work into the overnight inventory and close the gap down to 10903.50 then continue lower, through overnight low 10,876.25 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: