NASDAQ futures are coming into Friday pro gap up after an overnight session featuring extreme range and volume. Price spiked upward during settlement on the winds of big tech earnings then marked time for the duration of Globex, balancing in the upper quadrant of the July 21st range (cash high day). As we approach cash open, price is hovering above the July 21st midpoint.

On the economic calendar today we have Chicago PMI at 9:45am followed by consumer sentiment at 10am.

Yesterday afternoon we heard earnings from Apple, Alphabet and Amazon. Apple is +6.5% in premarket trade. Alphabet and Amazon are -1% and +5.5% respectively.

Facebook may have reported yesterday also. They are +7.5% in premarket trade.

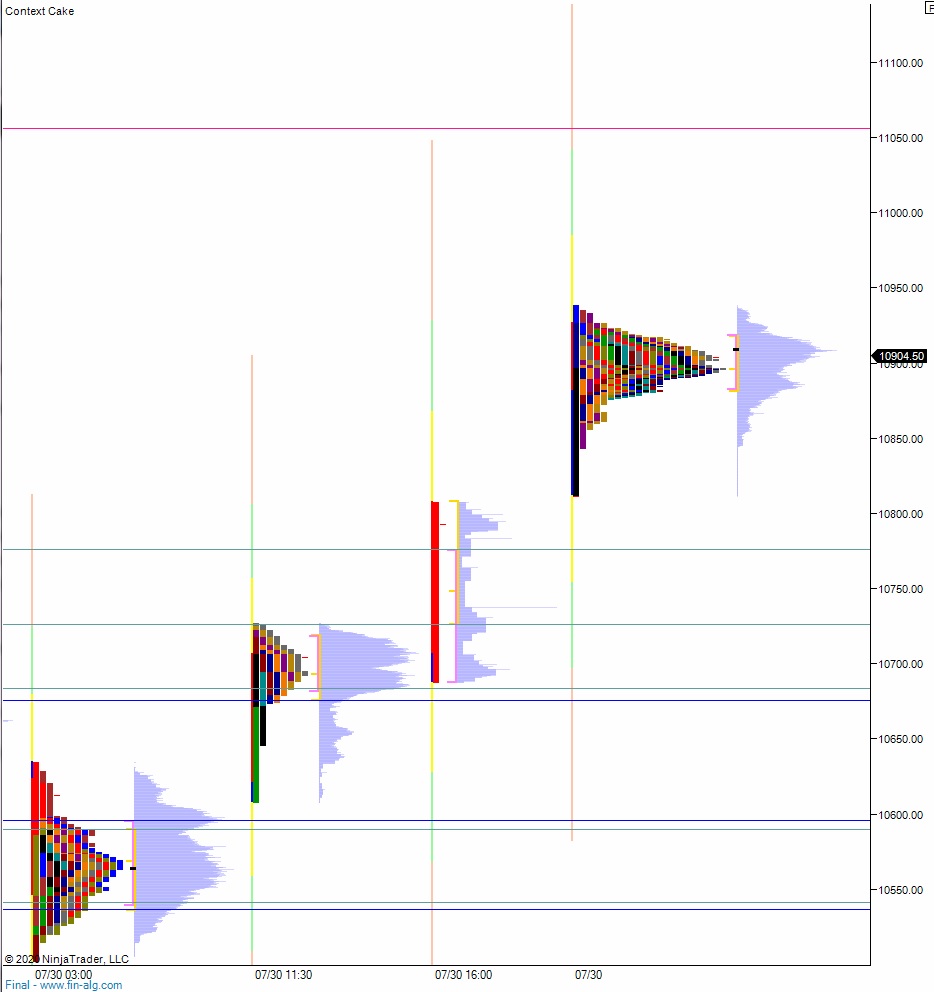

Yesterday we printed a double distribution trend up. The day began with a gap down in range. After a brief open two-way auction seller stepped in and worked price down through the Wednesday low by a few points. Sellers failed to rotate lower and this set up a sharp reversal. Price was range extension up before New York lunch hour and continued to campaign higher through the break. By early afternoon price was chopping and grinding higher, up beyond the week’s high prints. Then during settlement it spiked higher and erased the majority of the 07/23 conviction sellling.

Heading into today my primary expectation is for buyers to press up through overnight high 10939 and tag 11,000 before two way trade ensues.

Hypo 2 stronger buyers make a run for all-time-highs, taking out the high print11,058 on their way to tagging 11,100.

Hypo 3 sellers press into the overnight inventory and close the gap down to 10,793.50 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: