NASDAQ futures are coming into the holiday shortened week with a slight gap down after an overnight session featuring extreme range and volume. Price was balanced overnight. After kicking off Globex trade Sunday evening with a slight gap down, buyers quickly regained their footing and managed to slowly campaign price back into last Friday’s range. Since then we’ve been chopping along the lower quadrant of Friday’s range, marking time. As we approach cash open, price is hovering a few points above last Friday’s low.

On the economic calendar today we have pending home sales at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

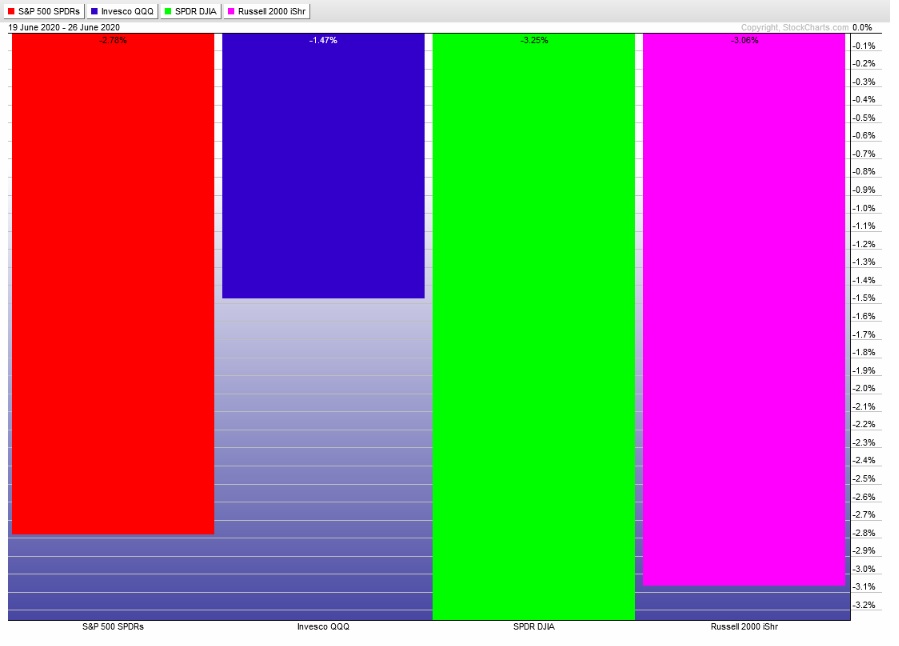

Last week began with a gap up that buyers took and ran with, rallying us clean through lunch Tuesday. From then onward sellers took control of the tape, eventually making new weekly lows across the board. We ended on the lows. The last week performance of each major index is shown below:

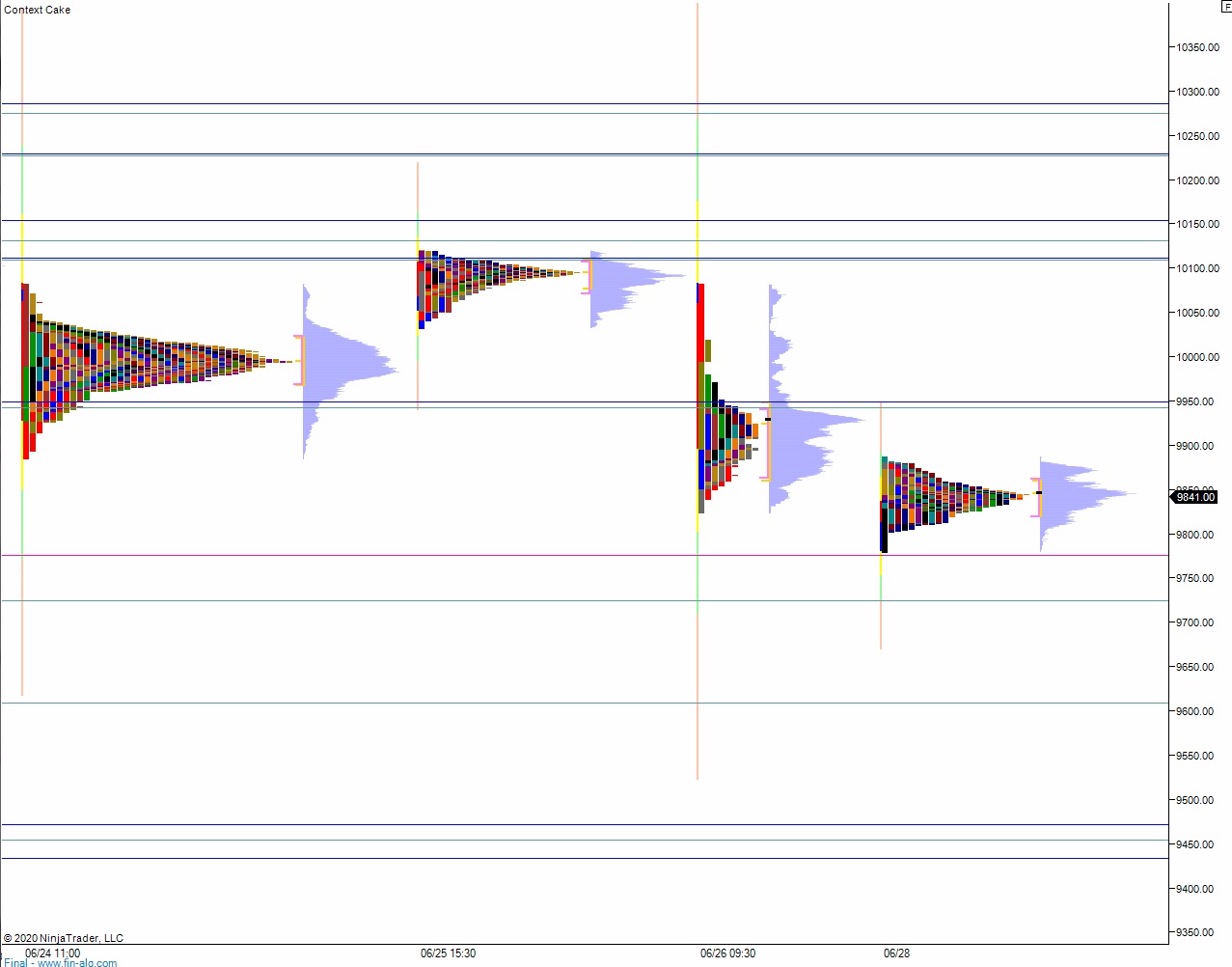

On Friday the NASDAQ printed a double distribution trend down. The day began with a slight gap down. Buyers were unable to resolve the overnight gap before an open test drive down took hold. Sellers quickly worked price down trough the Thursday low before discovering a responsive bid just below it. Said bid sent price back up to the daily midpoint. Sellers defended the midpoint and we drove lower again. There was one more upward rotation before price ultimately made new daily lows. We ended the week near the lows.

Heading into today my primary expectation is for sellers to gap-and-go lower, trading down through overnight low 9781. This sets up a move down to 9724.25 before two way trade ensues.

Hypo 2 stronger sellers trade down through 9700 and sustain trade below it setting up a move down to 9630.25.

Hypo 3 buyers work into the overnight inventory and close the gap up to 9866.75. From here they continue higher, up to 9900 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: