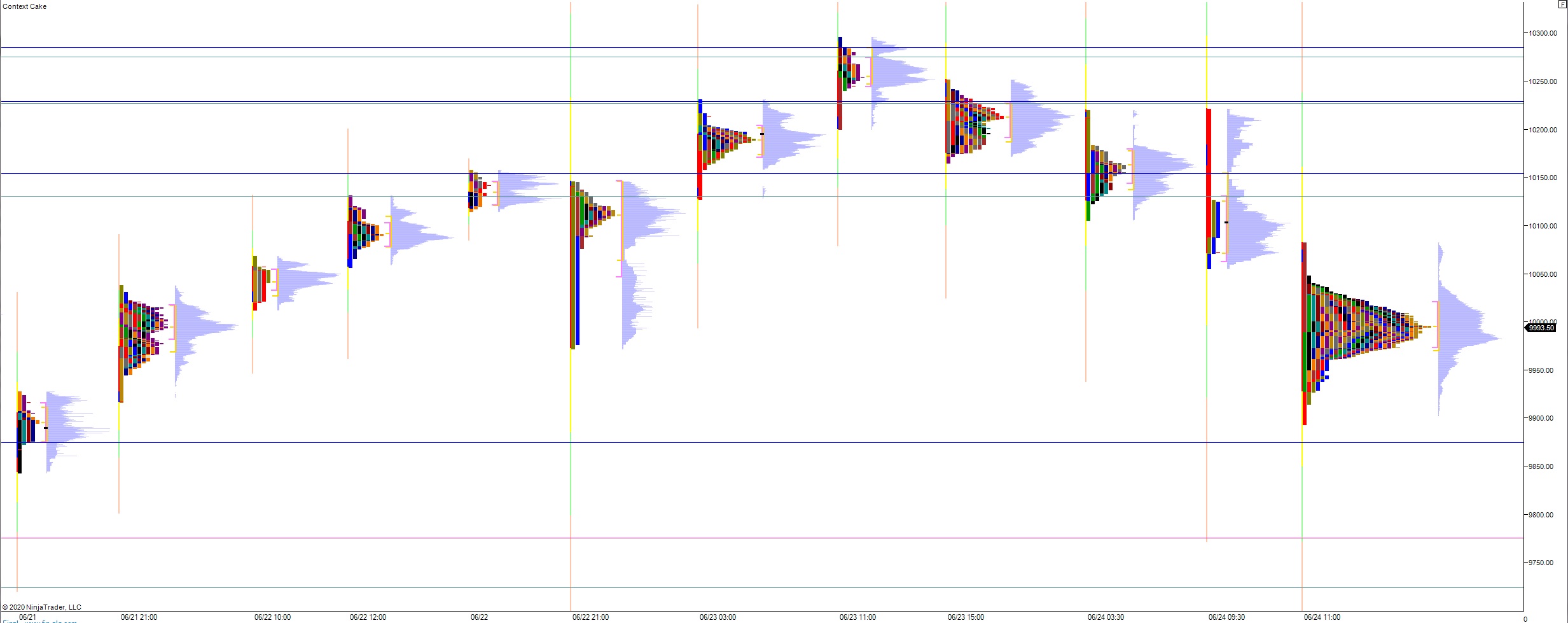

NASDAQ futures are coming into Thursday with a slight gap down after an overnight session featuring extreme range and volume. Price was balanced overnight, briefly taking out the Wednesday low before a strong rotation higher sent price firmly back into Wednesday range and balance. The 10,000 level continues to behave like a magnet as investors digest new information. At 8:30am durable goods, gpd, and jobless claims data came out. They were mixed and invoked little in the way of a reaction. As we approach cash open, price is hovering in the lower quadrant of Wednesday’s range.

Also on the economic calendar today we have a 7-year note auction at 1pm.

Yesterday we printed a double distribution trend down. The day began with a gap down in range. Buyers resolved the overnight gap and tagged the Tuesday naked volume point of control during the open auction in range. Shortly after sellers drove lower, trading down through Tuesday low and closing the Monday gap. Selling continued through the morning, then the rest of the session was spent balancing along the lows but never making a new daily low. We ended the day in the lower quadrant of range.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 10,016.50. From here we continue higher, up through overnight high 10,048.50. This sets up a run to 10,100 before two way trade ensues.

Hypo 2 sellers press down through overnight low 9893.75, closing the open gap at 9919.50 along the way. Look for buyers down at 9900 and two way trade to ensue.

Hypo 3 stronger sellers trade down to 9874.50 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: