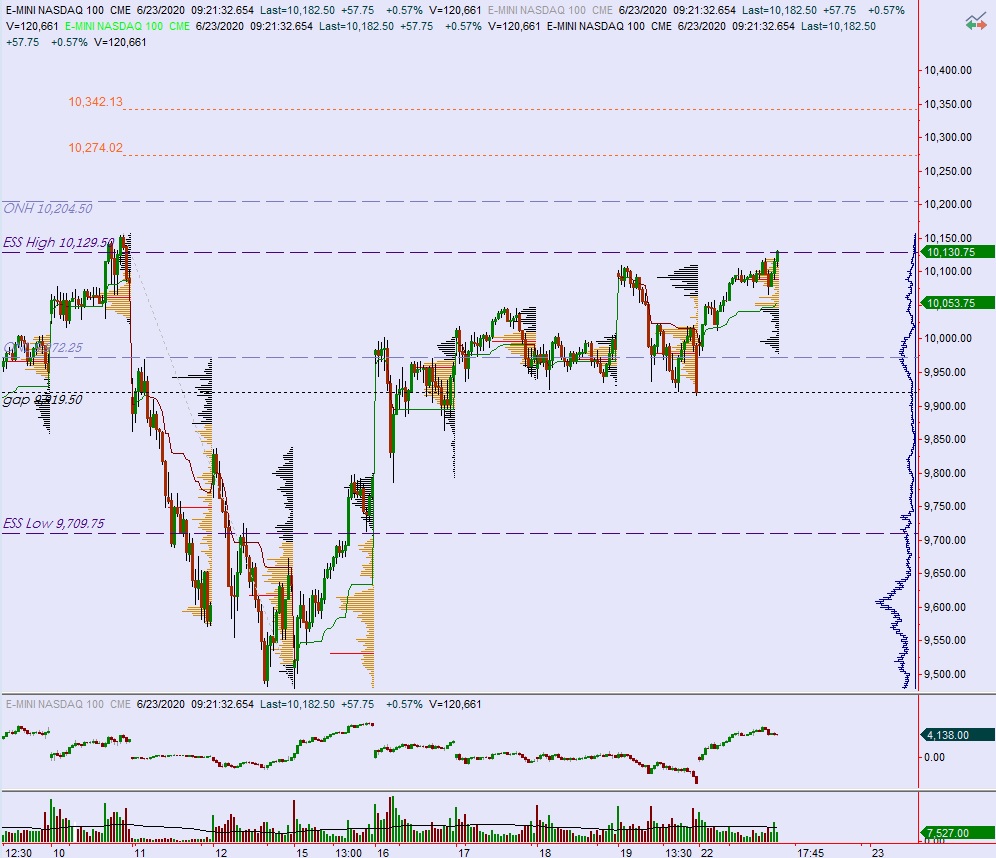

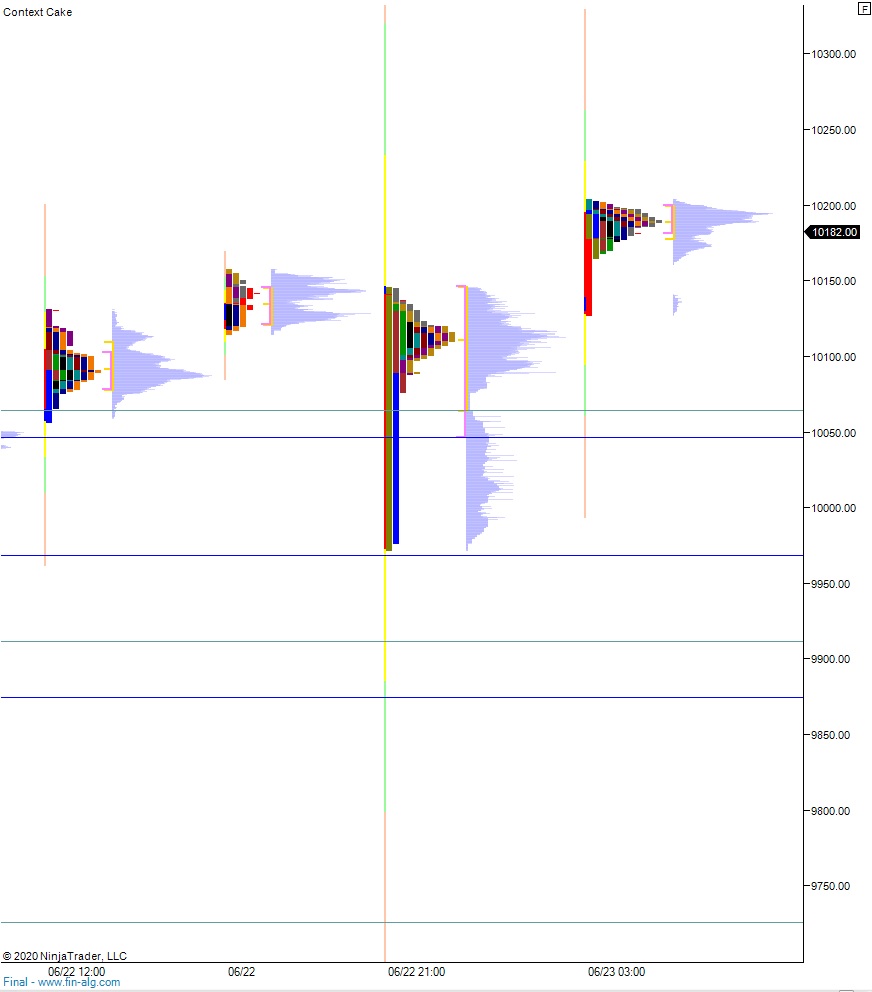

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring extreme range and volume. Price was drifting higher overnight until about 7:20pm when White House adviser Peter Navarro seemed to suggest the trade deal was over. This sent price down near Monday’s low before President Donald Trump tweeted that the agreement was “fully intact” and buyers emerged to reverse the sell spike. As we approach cash open, price is trading up at all-time highs.

On the economic calendar today we have PMI composite flash at 9:45am, new home sales at 10am and a 2-year note auction at 1pm.

Yesterday we printed a double distribution trend up. The day began with a gap up in range, with price beginning the week just below last Friday’s midpoint. After an open two-way auction buyers drove higher, taking price up through 10,000 and sustaining trade above it. We were range extension up before lunchtime, and continued to discover higher prices throughout the session. We ended the day in the upper quadrant of the June 10th (prior swing high) range.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up to 10,274 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the gap down to 10,130.75. Look for buyers down at 10,100 and two way trade to ensue.

Hypo 3 stronger sellers trade down to 10,065 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: