NASDAQ futures are coming into Thursday with a slight gap down after an overnight session featuring extreme range and volume. Price was balanced overnight, first working down below Wednesday low for a bit, then rotation a bit beyond the Wednesday midpoint, then again rotating lower. At 8:30am jobless claims data was worse than expected and Philadelphia Fed data unexpectedly better. As we approach cash open, price is hovering near the Wednesday low.

Also on the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am and a 5-year TIPS auction at 1pm.

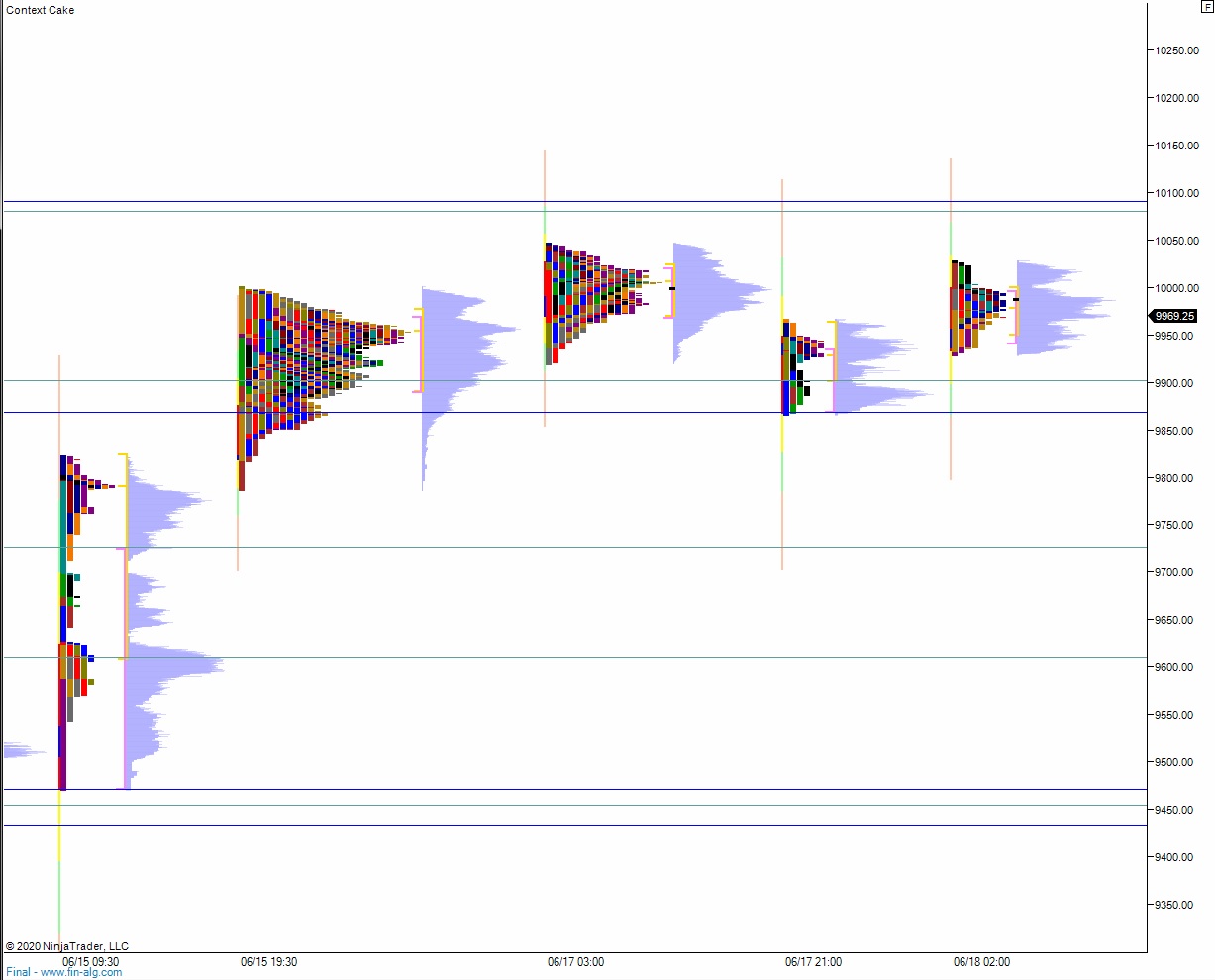

Yesterday we printed a normal variation up. The day began with a gap up just beyond the Tuesday high. After a brief two-way auction sellers stepped in and closed the overnight gap. Before 10:30am the sellers dried up and the campaign higher resumed. Eventually we went range extension up, nearly tagging the naked VPOC left behind on 06/10 before responsive sellers worked price back down through the daily midpoint. We ended the day with a small ramp, right back to the bottom side of the mid.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 9981.50. Sellers defend just above at 10,000 and two way trade ensues.

Hypo 2 stronger buyers close overnight gap 9981.50 then continue higher, up through overnight high 10,029 setting up a 06/10 gap fill up to 10,083.50 before two way trade ensues.

Hypo 3 sellers gap-and-go lower, trading down through overnight low 9866.50 setting up a move to tag 9800 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves:

If you enjoy the content at iBankCoin, please follow us on Twitter