NASDAQ futures are coming into Tuesday with a slight gap up after an overnight session featuring extreme range and volume. Price popped higher overnight, making a new swing high before sellers knocked the price back down into balance. As we approach cash open price is hovering in the upper quadrant of Monday’s range.

Walmart reported earnings this morning that bested expectations, shares are higher by +3% in pre-market trade.

On the economic calendar today we have Fed Chair J.Powell set to speak to the Senate at 10am. At the same time e-commerce retails sales data is due out. at 11am we have 4- and 8-week T-bill auctions, and at 11:30am a 52-week bill auction.

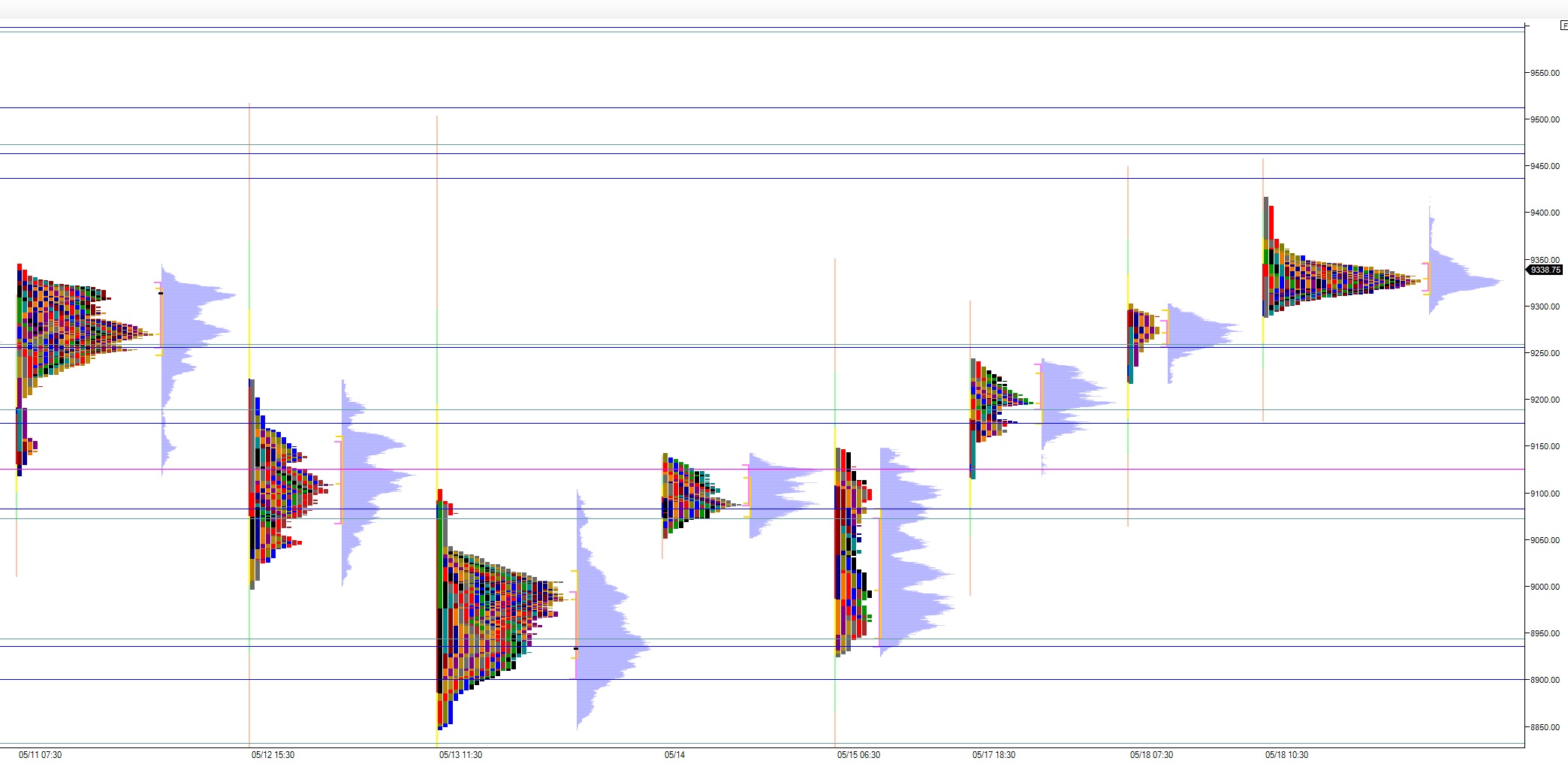

Yesterday we printed a double distribution trend up. The day began with a pro gap up and after a brief open two-way trade buyers drove higher, nearly but not quite making a new swing high before flagging for several hours. In the afternoon the new swing high was finally made. We were choppy from then-on, eventually closing off the highs by a bit.

Heading into today my primary expectation is for buyers to gap-and-go higher, tradign up through 9369.25 and sustaining trade above it to set up a run up through overnight high 8417.25. Look for sellers up at 9435.75 and two way trade ensues.

Hypo 2 stronger buyers fill the 02/21 open gap up at 9459.25 before two way trade ensues.

Hypo 3 sellers sustain trade below 9369.25 then work down through overnight low 9291. look for buyers down at 9258.75 and two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: