NASDAQ futures are coming into Monday gap down after an overnight session featuring extreme range and volume. Price popped higher Sunday evening, briefly making a new swing high and holding the gains until about 4:20am. From then onward we’ve been rotating lower. As we approach cash open, price is hovering near Friday’s low.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

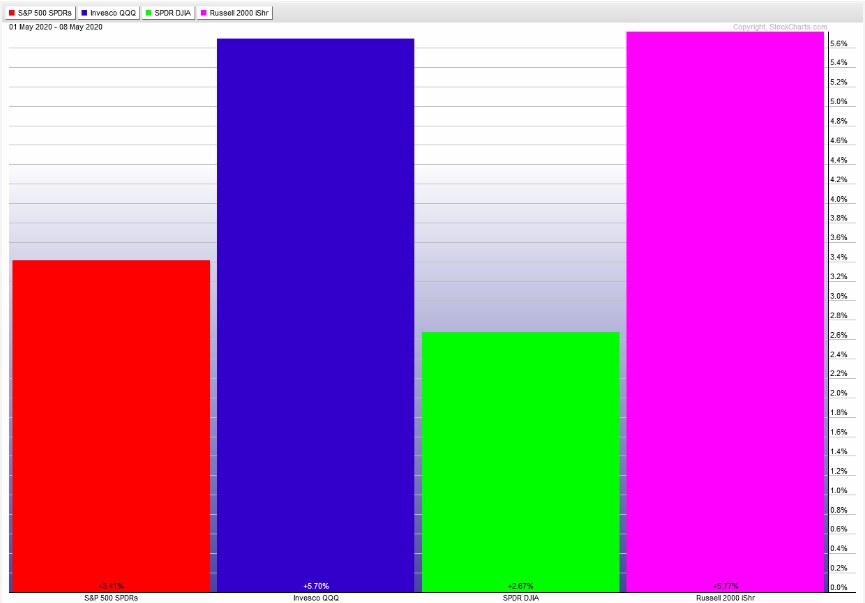

Last week buyers took control of the tape. We spent al week auctioning higher across all major indices, with the NASDAQ and Russell leading the way. The last week performance of each index is shown below:

On Friday the NASDAQ printed a normal variation up. The day began with a gap up and after a brief two way open auction buyer stepped in and made new swing high. Buying continued through New York lunch hour before sellers stepped in around 1:15pm and send price back down to the daily midpoint. Then, by end of day buyers had rotated us back up to the highs and we ended the day there.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 9219.25 before two way trade ensues.

Hypo 2 stronger buyers take out overnight high 9285 before two way trade ensues.

Hypo 3 sellers press down to 9100 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves:

as always, a great read.

ETA on stocklabs.io ?