NASDAQ futures are coming into Thursday with a slight gap down after an overnight session featuring extreme range and volume. Price was balanced for much of the overnight session after springing higher during settlement on the wings of strong earnings from Microsoft, Tesla and Facebook. We traded into levels untouched since late February before settling into a chop above Wednesday’s high. Then around 7:45am New York prices eased off the highs. At 8:30am initial/continuing jobless claims data came out worse than expected. As we approach cash open price is hovering in the upper quadrant of Wednesday’s range.

Also on the economic calendar today we have Chicago PMI at 9:45am and 4- and 8-week T-bill auctions at 11:30am.

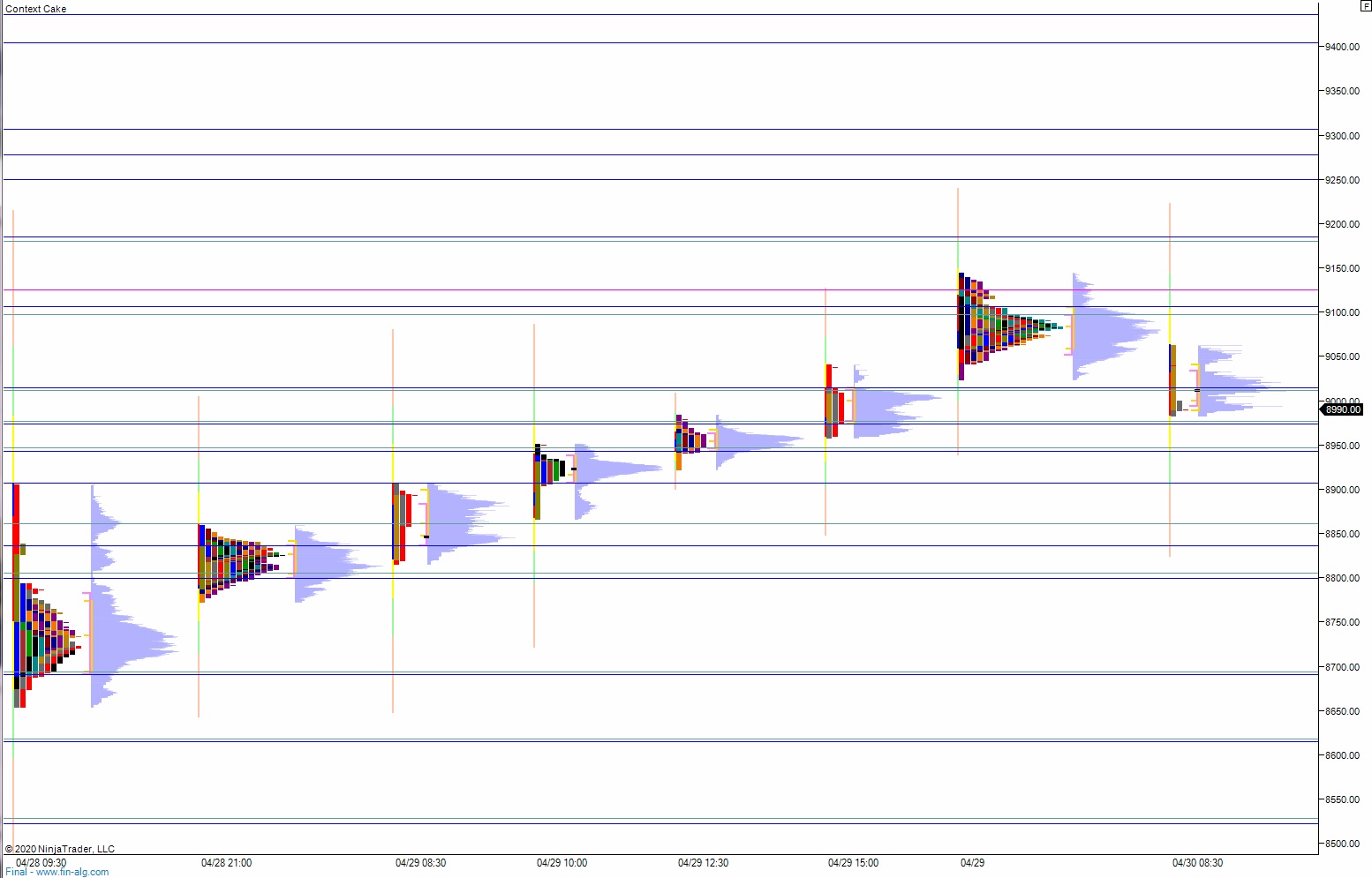

Yesterday we printed a double distribution trend up. The day began with a gap up in range, with price opening above Tuesday’s midpoint. Buyers drove higher after a brief two-way opening auction, trading to a new weekly high before settling into a tight flag. Then, after the 2:30pm Fed Chair presser buyers stepped in and campaigned a fresh leg of discovery higher. The close was choppy but we ultimately went out at session high.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 9038.25. Look for sellers up at 9097.25 and two way trade to ensue.

Hypo 2 sellers gap-and-go lower, sustaining trade below 9000 to set up a move down to 8950 before two way trade ensues.

Hypo 3 stronger sellers trade down to 8900 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: