Big day for the markets.

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring extreme range and volume. Price worked higher overnight springing up through Tuesday’s midpoint around 9pm New York and sustaining trade above it for the duration of the session. At 8:30am GDP data came out weaker than expected. As we approach cash open price is hovering near the upper quadrant of Tuesday’s range.

Also on the economic docket today we have pending home sales at 10am followed by crude oil inventories at 10:30am. At 2pm we have an FOMC meeting annoucement with consensus being that the Fed is out of options and likely to stay the course of their current target 0% interest rates. At 2:30pm there is a Fed Chair presser and this is likely to drum up more of a reaction than the actual meeting announcement.

After the bell Tuesday Google parent Alphabet, Inc. reported earnings:

Alphabet Q1 EPS $9.870 May Not Compare To $10.330 Estimate, Sales $41.160B Beat $40.380B Estimate

Shares of the major NASDAQ component are +8% in pre-market trade.

Today after the bell we have more key NASDAQ components reporting. Microsoft, Tesla and Facebook are set to report earnings after the bell.

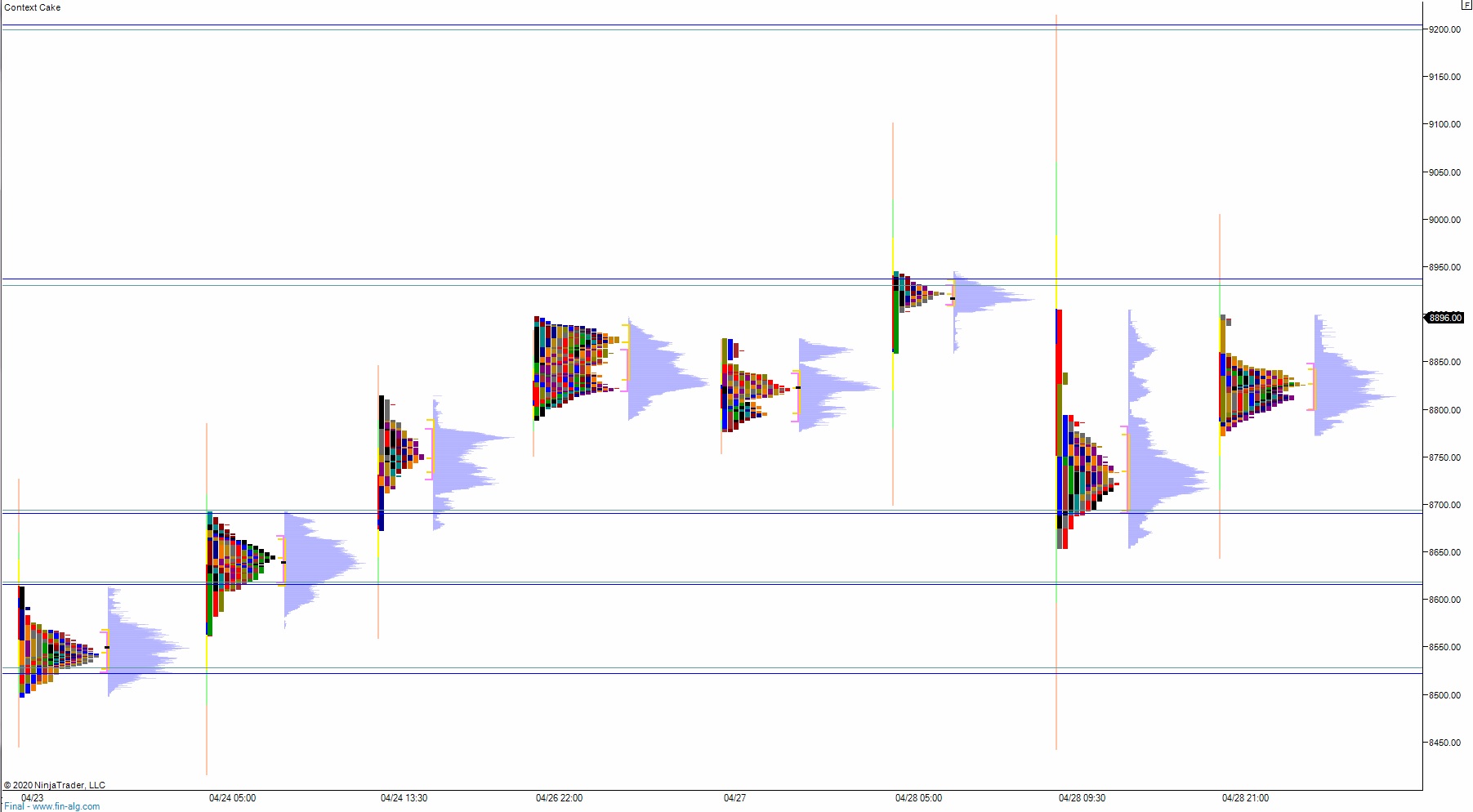

Yesterday we printed a double distribution trend down. The day began with a gap up to new swing high then a open sell drive down. Sellers quickly reversed all of Monday’s gains and closed the weekend gap before continuing lower, down through last Friday’s midpoint. The sellers met some responsive buying by late morning and we chopped along the session low for most of the day, eventually closing near the low before a spike higher during settlement (likely due to Alphabet earnings).

Heading into today my primary expectation is for buyers to gap-and-go higher, trad up to 8931 before two way trade ensues.

Hypo 2 stronger buyers trade up to 9000 before two way trade ensues.

Hypo 3 sellers press into the overnight inventory and close the gap down to 8720.25. Look for buyers down at 8700 and two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: