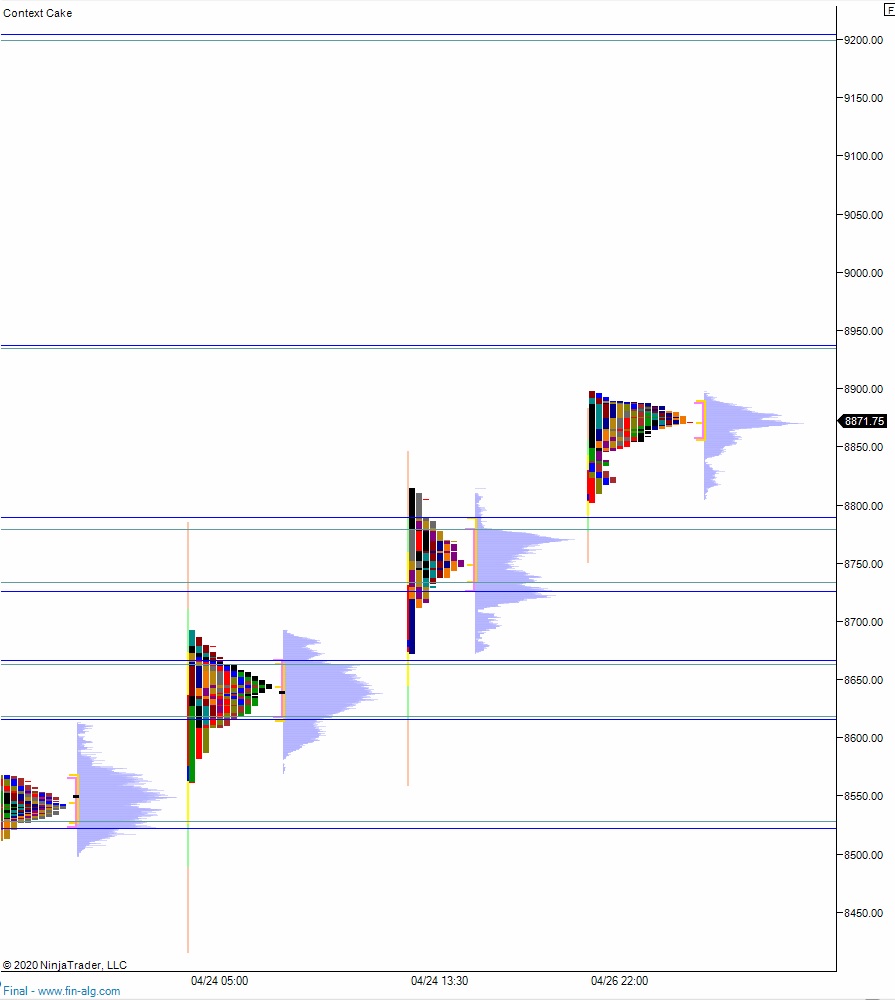

NASDAQ futures are coming into Monday pro gap up after an overnight session featuring extreme range and volume. Price worked higher overnight after being in balance until about 10pm New York. Since then price has exceeded recent swing high and as we approach cash open, we are hovering at the 03/04 open gap.

On the economic calendar today we have 6-month T-bill and 2-year Note auctions at 11:30am, then 3-month T-bill and 5-year Note auctions at 1pm. Likely to be purchased by the Federal Reserve.

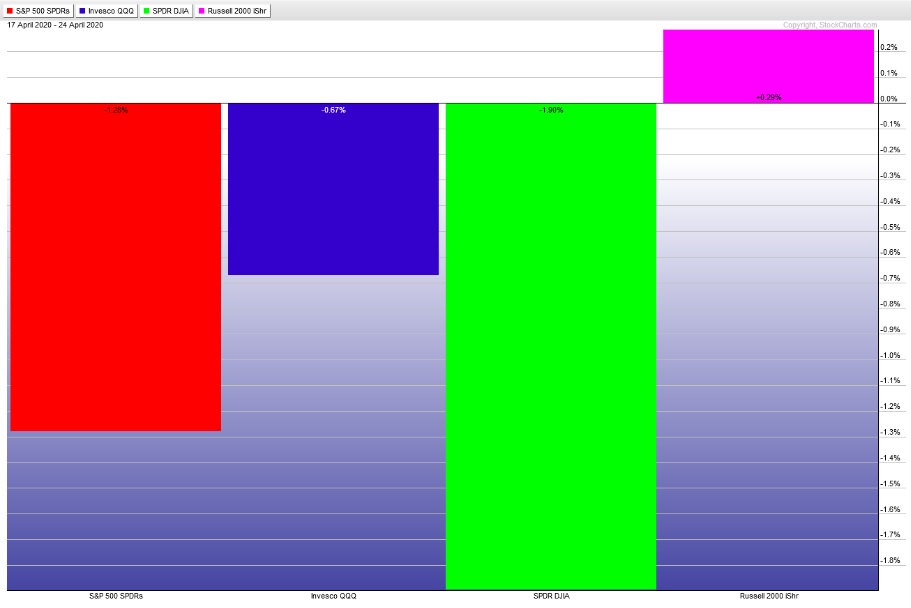

Last week began with a gap down across all major indices. Early Monday strength gave way to afternoon selling that extended into much of Tuesday. Responsive buyers showed up late Tuesday and that set up a strong reversal trend up Wednesday. We then had big chop Thursday and Friday, which eventually resolved with us ending about flat on the week. The last week performance of each index is shown below:

On Friday the NASDAQ printed a double distribution trend up. The day began with a slight gap up. Sellers closed the overnight gap in early trade and exceeded Thursday’s low before a strong responsive bid stepped in. Buyers then reclaimed the midpoint then began a steady campaign higher, eventually trading up near Thursday’s high and closing near it (but not exceeding it).

Heading into today my primary expectation is for buyers to gap and go higher, trading up through overnight high 8898. Look for sellers up at 9000 and two way trade to ensue.

Hypo 2 stronger buyers trade up to 8934.50 before two way trade ensues.

Hypo 3 sellers press into the overnight inventory and close the gap down to 8767.50. Sellers take out overnight low 8730 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: