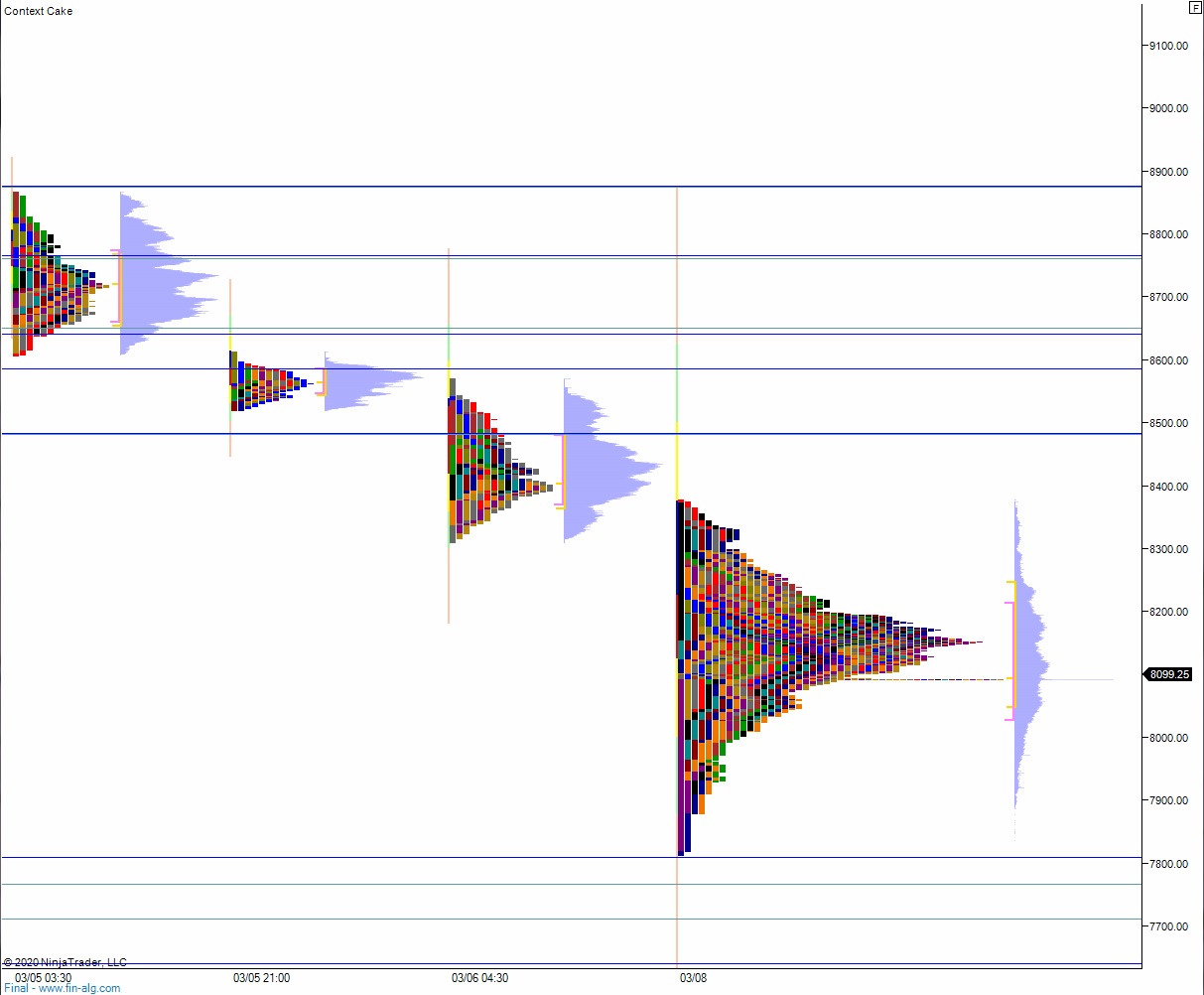

NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme range and volume. Price drove lower until about 9pm New York. From then onward price chopped along the top side of 8100, forming a distinct shelf along the way. At 8:30am CPI data came out in-line with expectations. As we approach cash open, price is hovering below Tuesday’s midpoint, right along the 8100 level.

Also on the economic calendar today we have crude oil inventories at 10:30am, 10-year note auction at 1pm and a 2-year monthly budget statement at 2pm.

Yesterday we printed a neutral extreme up. The day began with a gap up. After a two way auction sellers stepped in and close the overnight gap. From here buyers stepped in and returned price back up to the midpoint. We chopped along here until late in the day then we ramped higher, pushing neutral and closing near high of day for a neutral extreme print.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 8329.25, From here we continue higher, trading up through overnight high 8357.25. Look for sellers up at 8400 before two way trade ensues.

Hypo 2 sellers gap and go lower, trading down through 8000. Look for buyers down at 7900 before two way trade ensues.

Hypo 3 stronger sellers trade down 7800 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: