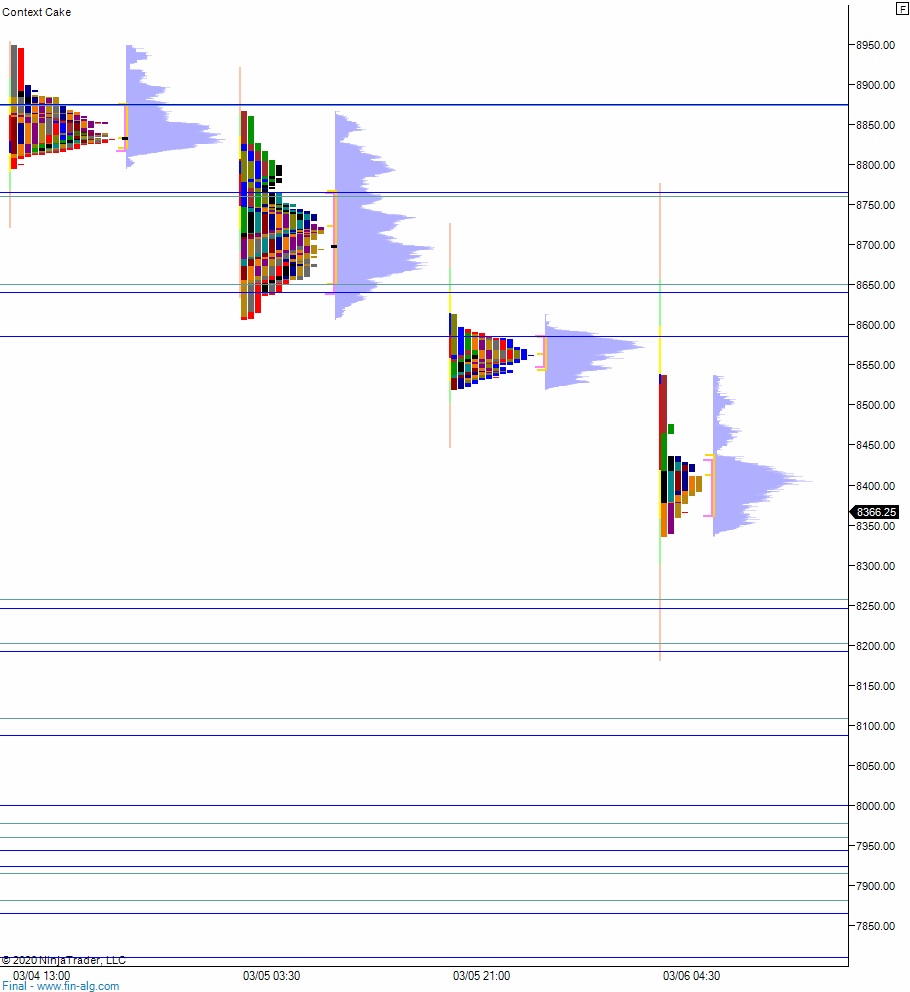

NASDAQ futures are coming into Friday pro gap down after an overnight session featuring extreme range and volume. Price worked lower overnight, uni-directionally traversing to a new low of week. At 8:30am Nonfarm payroll data came out stronger than expected. As we approach cash open, price is hovering near last Friday’s midpoint.

On the economic calendar today we have consumer credit at 3pm.

Costco earnings bested analyst expectations and the firm saw same store comps stronger than expected amid coronavirus fear-based purchasing. Shares are down -1.5% in pre-market trade.

Yesterday we printed a neutral extreme down. The day began with a gap down in range right at the Wednesday VPOC. Buyers worked into the overnight inventory but could not fill the overnight gap. Instead responsive sellers (responsive relative to Thursday open, initiative relative to Wednesday close) stepped in right at the U.S. airstrike of Iran level and reversed the intra day gains, pushing us neutral. We then closed near session low, in the lower quad of Wednesday’s range.

Heading into today my primary expectation is for buyers to work into the overnight inventory and trade up to 8581.25. Look for sellers up at 8584 and two way trade to ensue.

Hypo 2 sellers gap and go lower, trading down through overnight low 8337.25 to tag 8300. Look for buyers down at 8294.25 and two way trade to ensue.

Hypo 3 stronger sellers trade down to 8258.25 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: