NASDAQ futures are coming into Tuesday pro gap up after an overnight session featuring extreme range and volume. Price was trend up overnight, after a brief bout of selling following weaker-than-expected sales from Google parent Alphabet, Inc:

Alphabet Q4 EPS $15.35 Beats $12.53 Estimate, Sales $46.075B Miss $46.94B Estimate

Google earning sent price about 30 points lower during settlement, but that was all the control sellers would have for the rest of the Globex session. From then onward, price was trend up, forming one short squeeze after another, methodically migrating price back up near all-time highs. Around 7am the World Health Organization declared that were are not in a pandemic with Coronoavirus. This news was greeted with an additional wave higher in prices. As we approach cash open, price is about 30 points off of all-time highs.

On the economic calendar today we have durable goods and factory orders at 10am.

There are no major earnings due out for the rest of the week.

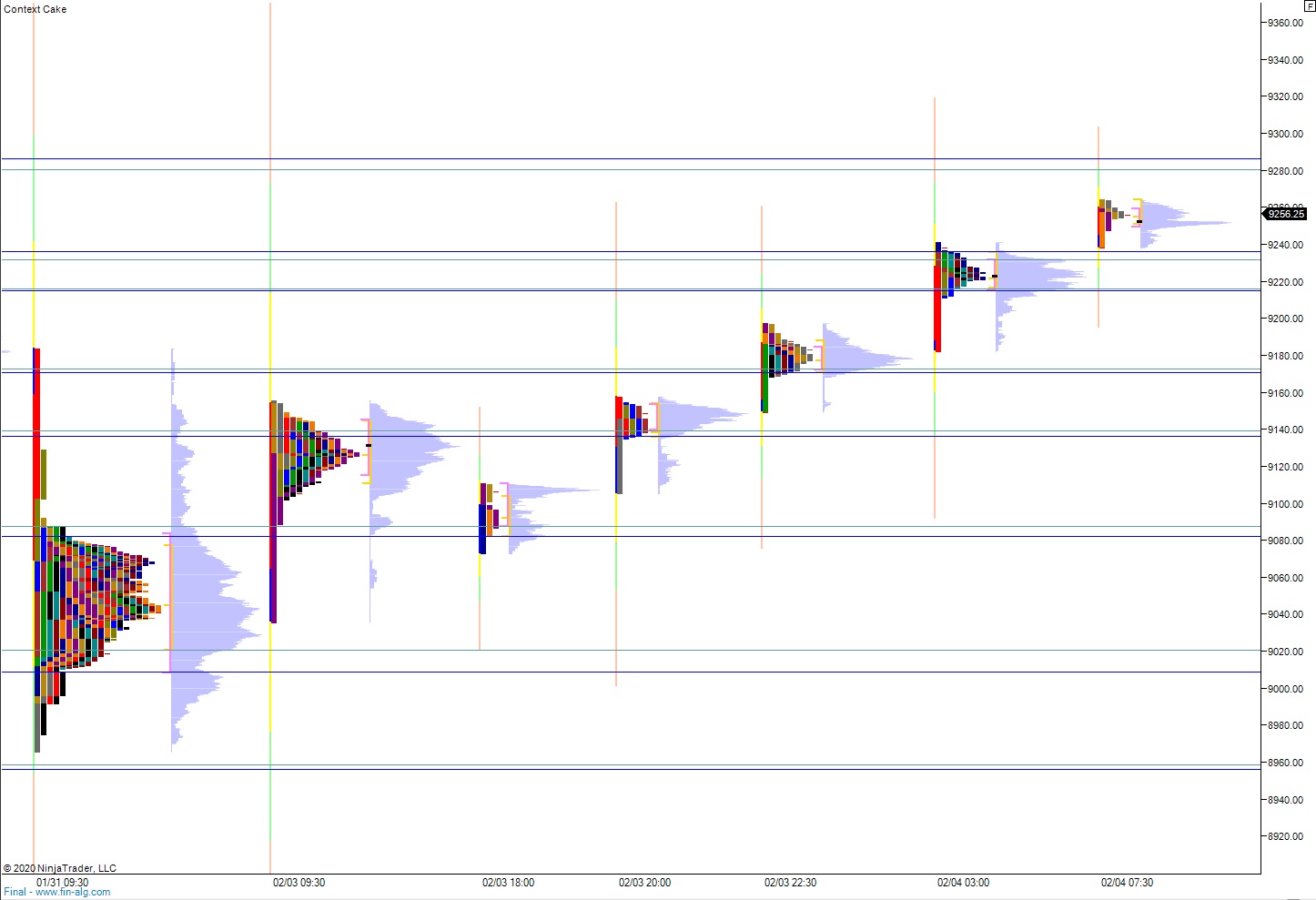

Yesterday we printed a normal variation up, short-squeeze. The day began with a gap up and drive higher, with buyers driving price up beyond our weekly measured move ATR band 9131.75. This right away suggested that something big might be going on, with the higher timeframe active. Shortly after the first hour of trade we went range extension up for a few minutes before we settled into a tight chop along the upper quadrant for the duration of the session. Late in the day we fell back into the midpoint. The action served to printed a p-shaped market profile, which suggests a short squeeze occured. These are often short-term phenomena, however with the upward action seen overnight, it appears to be more that that.

Heading into today we are way out of balance. Expect the higher time frame to duke it out for the first hour or so. Primary hypo is for buyers to gap-and-go higher, trading up to 9280 before two way trade ensues.

Hypo 2 stronger buyers sustain trade above 9280 and make a run for 9300.

Hypo 3 sellers work into the overnight inventory and tag the odd open gap at 9218.75 before two way trade ensues.

Hypo 4 some kind of liquidation takes hold, ripping down through 9200, pausing briefly at 9172.50 before continuing lower, effectively erasing the overnight gains and closing the gap down to 9113.75 on our way to taking out overnight low 9073. Look for buyers down at 9088 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves:

Bravo!

https://ibankcoin.com/raul3/2019/09/11/quick-update-on-tesla/#sthash.oIynmV30.xIegdyhG.dpbs

What, you thought nobody was looking?

Standing ovation!

Take a bow, write ‘I told you so” article – you earned it!

thank you, thank you, humbled that you linked back to this one for sure 🙂 but not victory yet, we haven’t tagged 1k

While I obviously disagree with your theory (as evidecned by mu past posts), I can’t argue with your results so far: pretty phenomenal, so congrats for that.

However, I’m still not buying it (the theory or the stock). Momentum stocks do well in bull markets, but if TSLA (the stock, not the company) is real, then it should hold up during a recession bear market as well. The crucible of flame is how I judge stocks.

If TSLA stock stays over $400 during the next recession, then I’ll concede that “Investing is about FAITH” and not cash flow – and I’ll link to your post as an example to others.