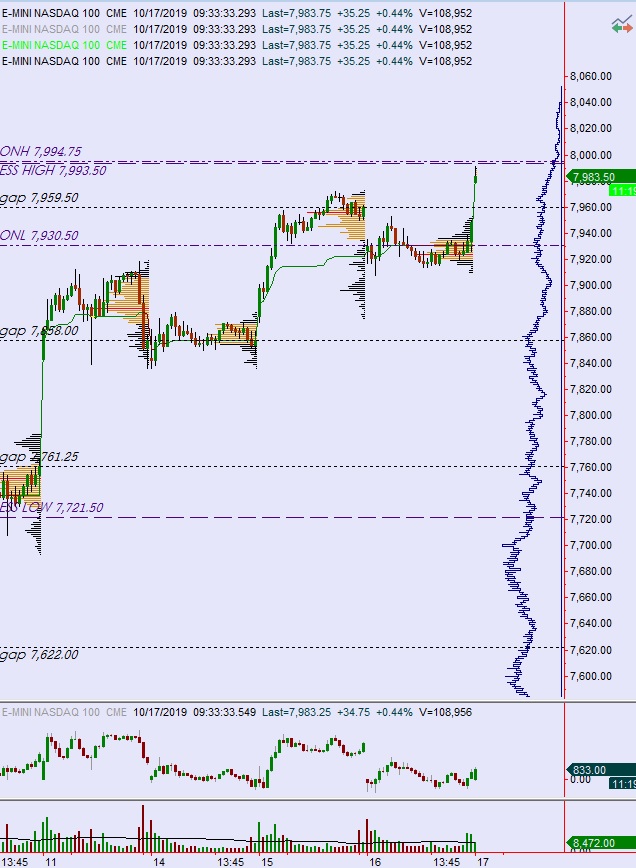

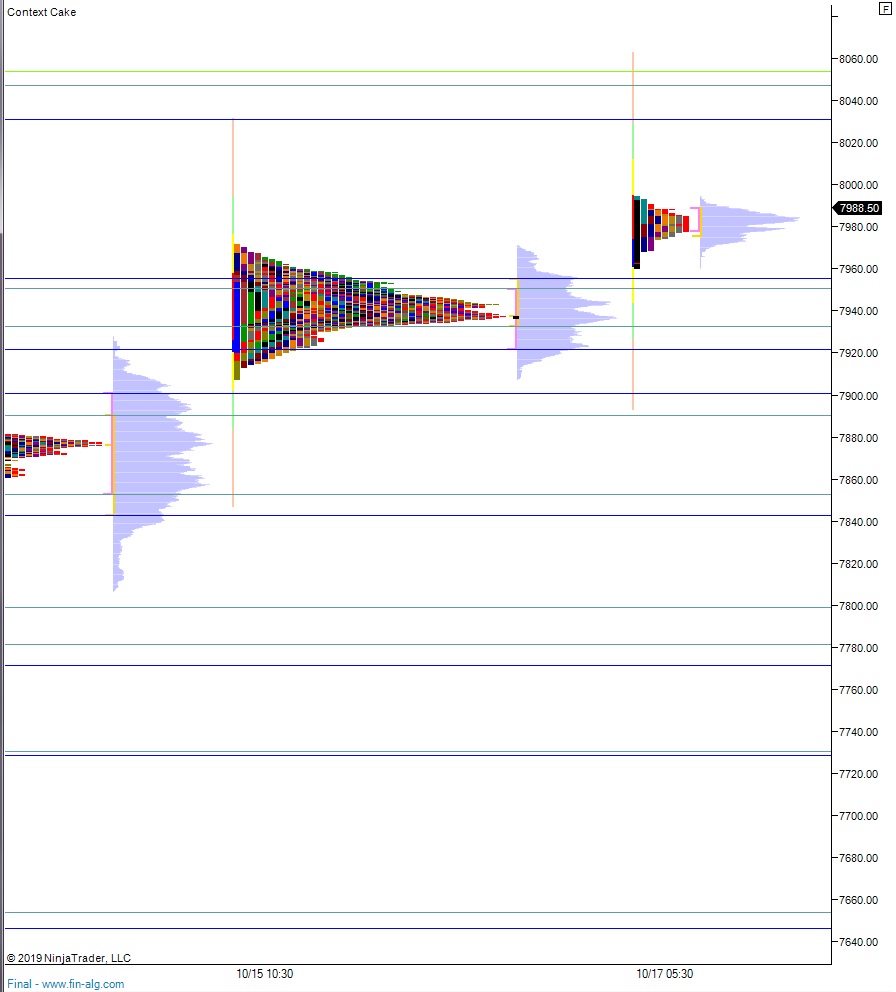

NASDAQ futures are coming into Thursday gap up after an overnight session featuring extreme range and volume. Price worked higher overnight, trading up near (but not exceeding) the swing high set back on 09/12, a day which itself was nearly at record highs. Then we came into a tight balance. At 8:30am several economic data came out—initial/continuing jobless claims data and Philly Fed business outlook were worse than expected, building permits/housing starts were mixed. As we approach cash open, price is hovering above the Wednesday high, in the upper quadrant of the 09/12 range.

Also on the economic calendar today we have crude oil inventories at 11am, 4- and 8-week T-bill auctions at 11:30am followed by a 5-year TIPS auction at 1pm.

Yesterday we printed a normal variation up. The day began with a gap down and two way auction. Sellers had a try lower but couldn’t work much below the Tuesday midpoint before responsive sellers came in and formed a sharp excess low. We then pressed range extension up before grinding back down near the daily low. Late in the day we ramped back up to the high.

Heading into today my primary expectation is for a gap and go higher. Look for buyers to trade up beyond the 8000 century mark and sustain trade above it, setting up a rally up to 8031 before two way trade ensues.

Hypo 2 stronger buyers rally to record highs, trading up through 8053 and sustaining trade above it, open air.

Hypo 3 sellers press down into overnight inventory and close the gap down to 7948 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: