NASDAQ futures are coming into the second full week of October, option expiration week with a slight gap down after an overnight session featuring extreme range and volume. Price was balanced for most of the Globex session before making a sell rotation around 5am New York. The selling pressed into the open gap left behind last Friday before discovering responsive buyers ahead of the Monday/Thursday highs. As we approach cash open, price is hovering along last Friday’s low.

There are no economic events today. The U.S. Government is taking a holiday.

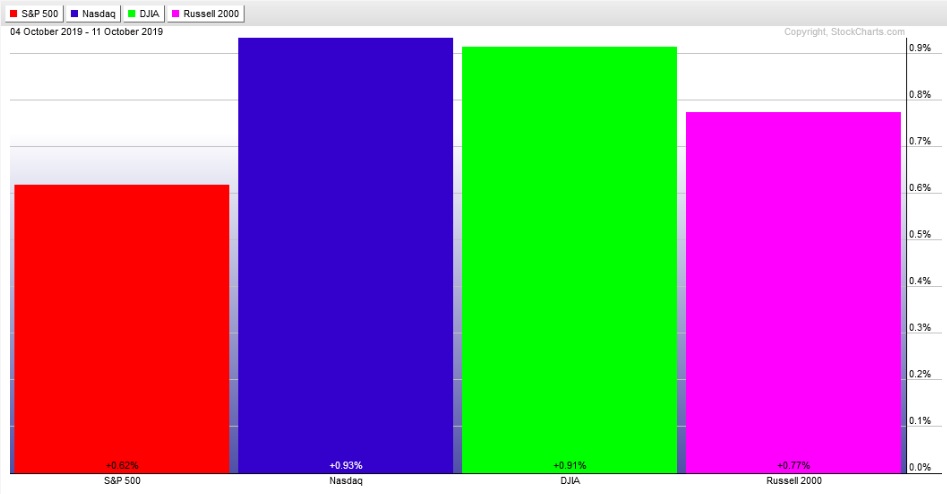

Last week began with a slight gap down also. Monday was strong early on before fading late in the day. There was a big gap down Tuesday that found buyers before reversing and closing on the lows . Wednesday gap up and slow rotation higher that continued through Thursday before a big gap up Friday and drive higher early on before chopping lower into the close. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a neutral extreme down. The day began with a gap up and drive higher, trading up to prices unseen since 09/20 before coming into balance. 09/20 was a strong liquidation sell day and buyers were still present at these levels. There was a considerable amount of volatility Friday, with price oscillating from daily high, to low, then back to a new high before going back to the low and closing near it. Signs of higher timeframe activity and a market out of balance.

Neutral extreme down.

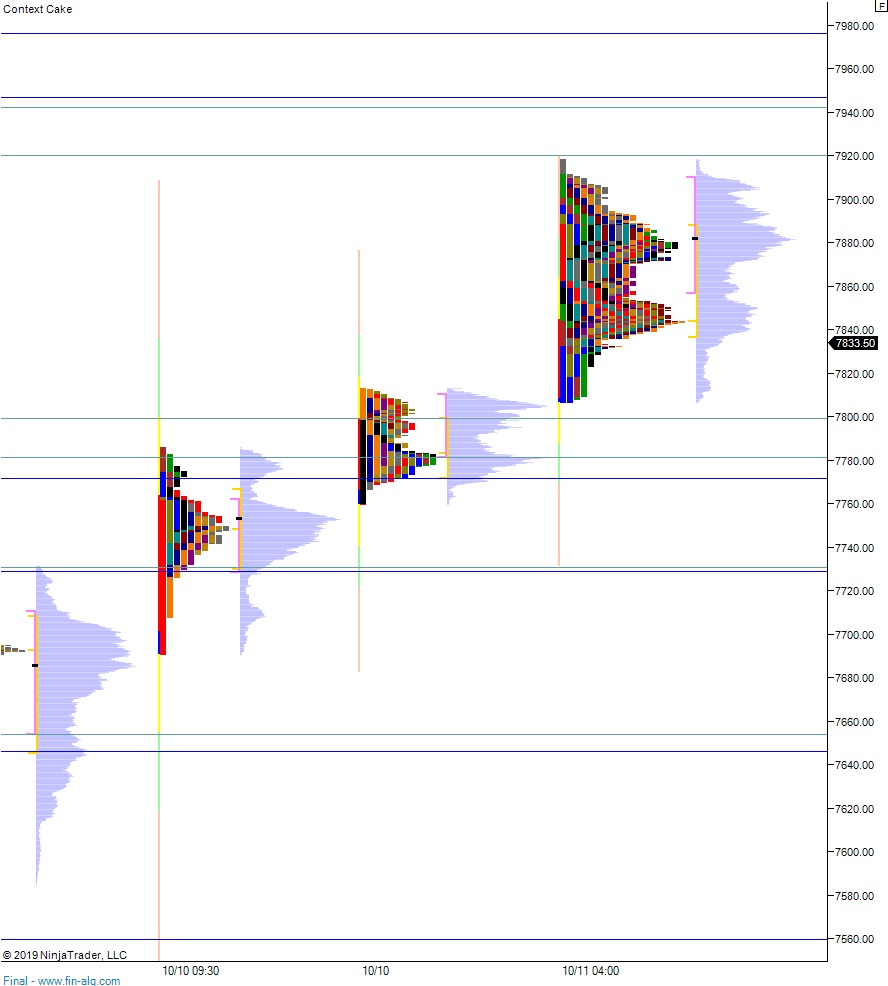

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7857.50. From here we continue higher, up through overnight high 7894.75. Look for sellers up at 7900 and two way trade to ensue.

Hypo 2 sellers press down through overnight low 7807 setting up a move to tag 7800 before two way trade ensues.

Hypo 3 stronger sellers trade down to 7781.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: