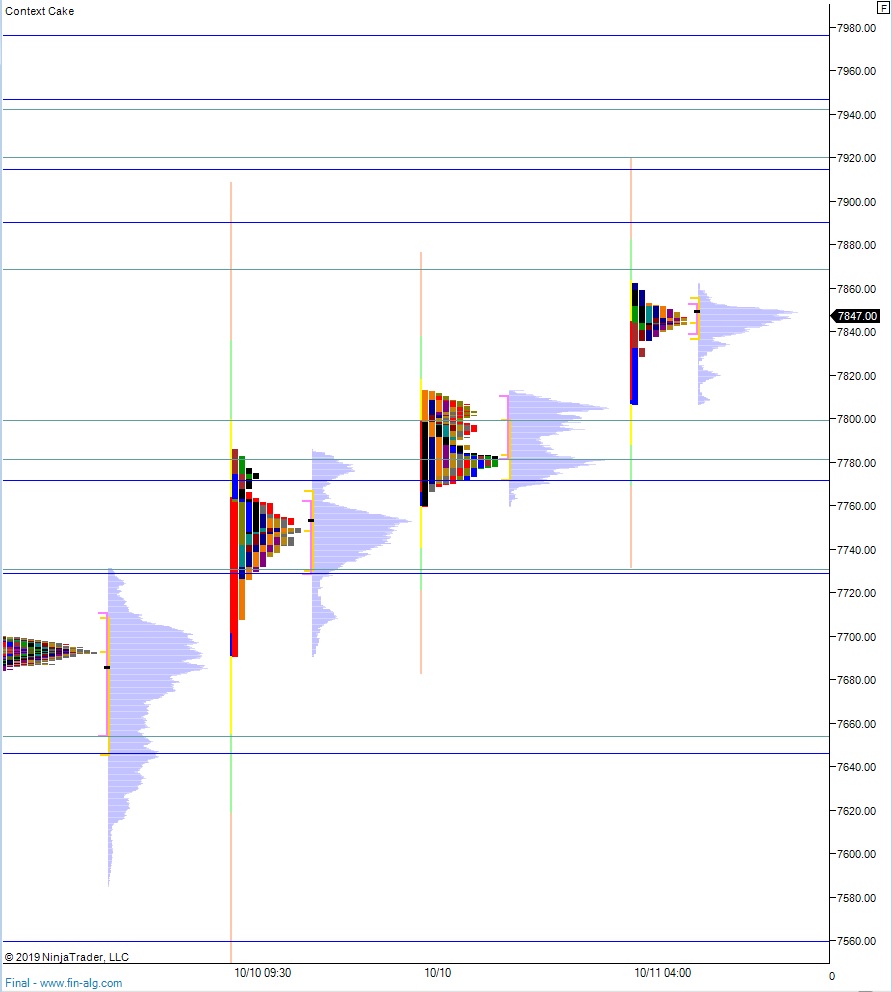

NASDAQ futures are coming into Friday pro gap up, trading at a new 12-day high after an overnight session featuring extreme range and volume. Price worked higher overnight, trading up into the 09/24 range, prices unseen for nearly three weeks before settling into balance. As we approach cash open, price is hovering just up above the tips of responsive seller excess highs printed on 09/25 and 10/01.

On the economic calendar today we have University of Michigan’s primary October reading of sentiment at 10am.

Yesterday we printed a normal variation up. The day began flat then with buyers spiking price higher shortly after the open, closing the Monday open gap. After a tight flag buyers took the market range extension up, trading up near Monday’s high before discovering responsive sellers and trading back to the daily mid. Price chopped along the mid for a bit before sellers made a try lower. Their attempt was thwarted, and before they could make a new low-of-day (nLOD) a sharp excess low formed and we rallied up into the upper quadrant of the session before day’s end.

Heading into today my primary expectation is for a gap-and-go higher, trading up to 7890.75 before two way trade ensues.

Hypo 2 stronger buyers sustain trade above 7890.75 and tag the 7900 century mark. A battle ensues here with buyers ultimately prevailing and continuing higher. Stretch targets are 7914.25, 7920 and then 7942.25.

Hypo 3 sellers defend their 09/24 conviction selling, pressing into the overnight inventory and reclaiming Thursday high 7786.25. This sets up a gap fill down to 7761.25. Look for buyers down at 7730.25 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: