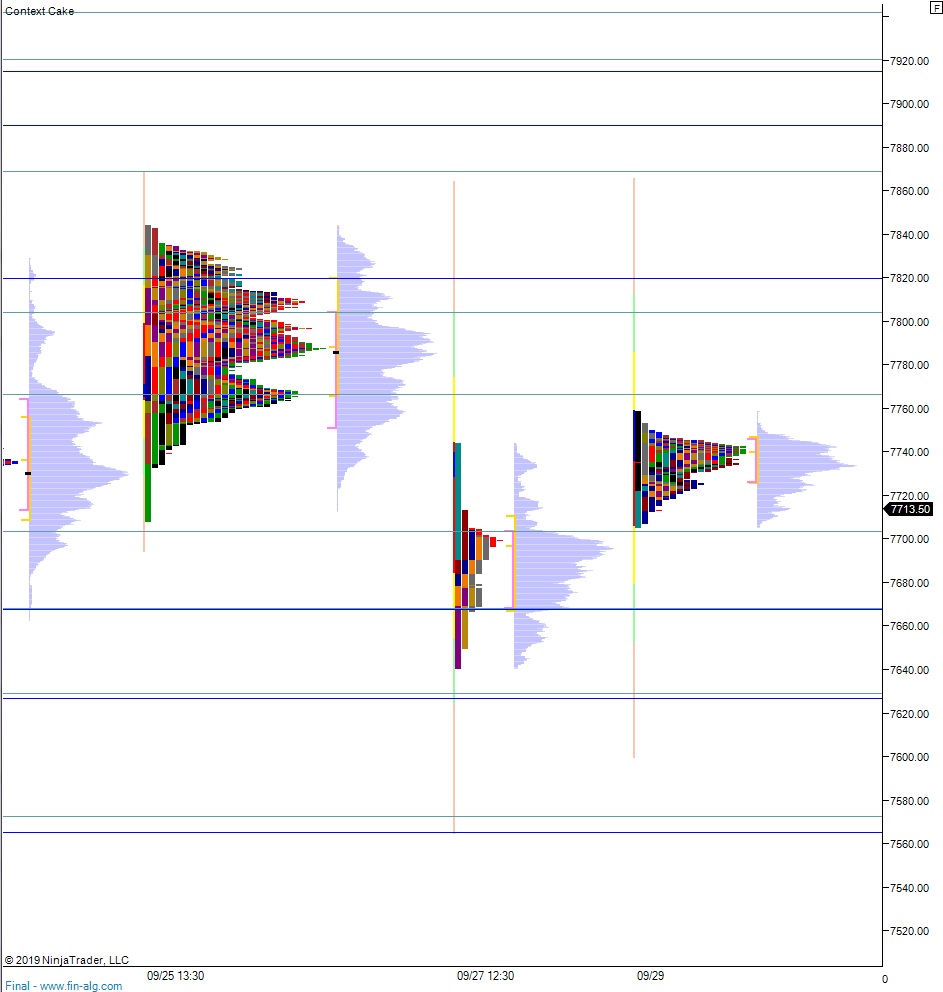

NASDAQ futures are coming into Monday with a slight gap up after an overnight session featuring extreme volume on elevated range. Price was choppy overnight, balancing around last Friday’s midpoint. As we approach cash open, price is hovering about ten points above the 7700 century mark.

On the economic calendar today we have 3- and 6-mont T-bill auctions at 11:30am.

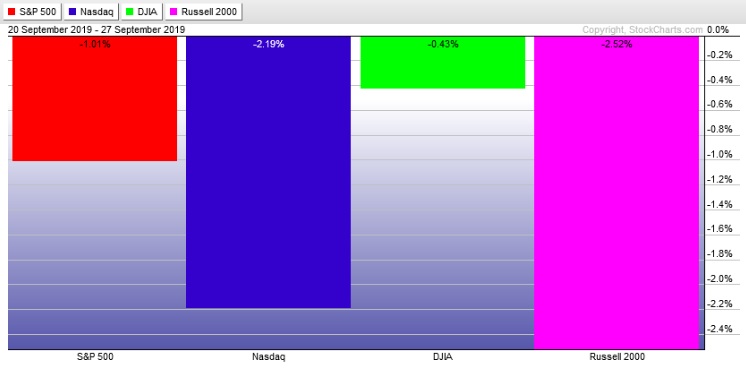

Last week markets worked lower. Monday began with chop, Tuesday went trend down. Wednesday morning we found a strong responsive bid at the pivot and reversed much of Tuesday. Thursday was choppy before sellers stepped back in Friday and worked us back near the lows. The last week performance of each major U.S. index is shown below:

On Friday the NASDAQ printed a double distribution down. The day began with a slight gap up then a drive lower. Sellers worked down near Thursday low before discovering a responsive bid ahead of it. Said buyers worked price back near the opening print before being overrun by sellers who accelerated price range extension down. After some chop along the Thursday low, sellers became initiate and worked price to a new weekly low. There was a slight ramp higher into the close. Price ended in the lower quadrant of the DD down.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 7699.50. From here we continue lower, down to 7668 before two way trade ensues.

Hypo 2 stronger sellers trade price down to 7629.25 before two way trade ensues.

Hypo 3 buyers press up through overnight high 7759 on their way up to 7766.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: