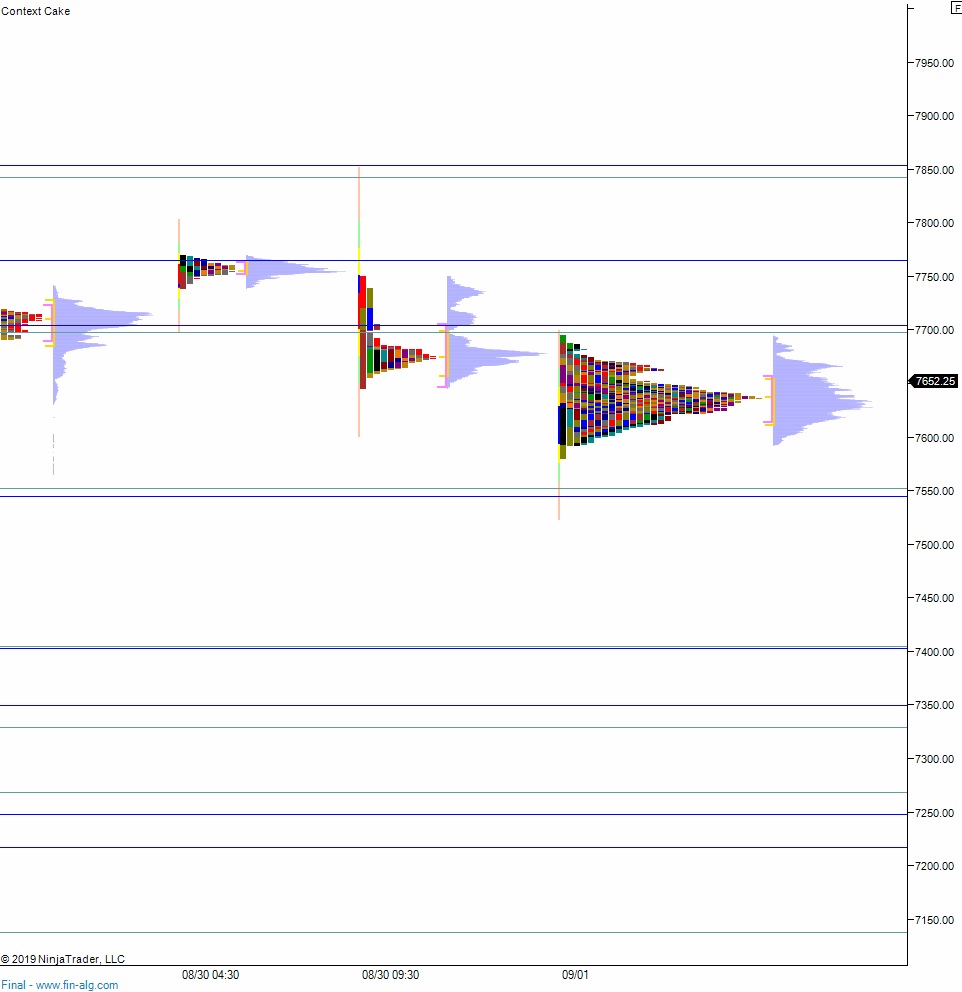

NASDAQ futures are coming into Tuesday gap down after an overnight session featuring extreme range and volume. Price was balanced overnight, chopping along the gap zone left behind last Thursday. As we approach cash open, price is hovering inside of last Friday’s low-end of the range.

On the economic calendar today we have ISM manufacturing at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

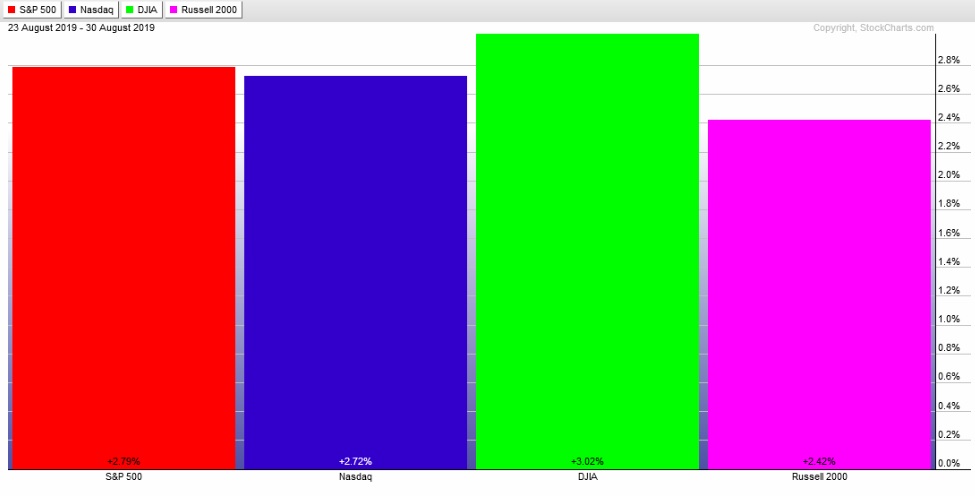

Last week began with a slight gap up into Monday then we marked time through Wednesday. A big gap up Thursday was bought into, and we spent Friday accepting those higher prices. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation down, nearly a double distribution trend down. The day began with a gap up to a new 5-day high. Sellers stepped in and drove price lower off the open, continuing to drive lower until about 11:30am when we briefly traded below the Thursday low. This move discovered responsive buyers and we spent the rest of the session marking time, eventually ramping back up to the daily midpoint near the close.

On Monday U.S. markets were closed in observation of Labor Day.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7675.75. From here we continue higher, up to 7697.50 before two way trade ensues.

Hypo 2 stronger buyers sustain trade above 7700 setting up a move to target 7764.75 before two way trade ensues.

Hypo 3 sellers work down through overnight low 7593.25 setting up a move to tag 7552 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: